Apple vs. Limitless vs. Gong

Jan-Erik Asplund

Jan-Erik Asplund

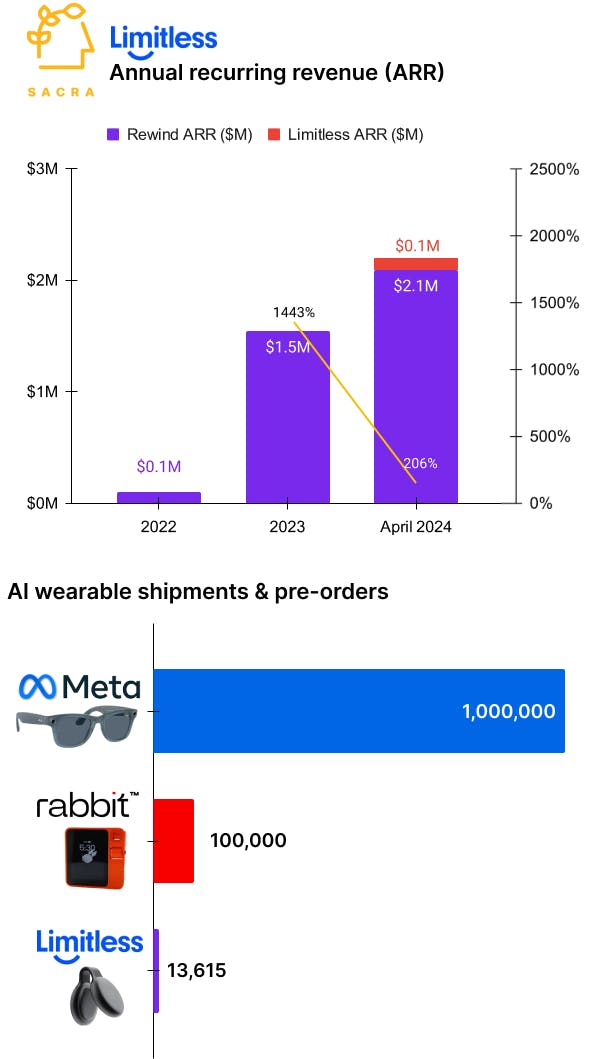

TL;DR: Last month, Rewind AI (valued at $350M) hit $2.2M in annual recurring revenue (ARR) rebranded as Limitless and announced the AI wearable Pendant that gives you full-text search over all your on- and offline conversations. With the AI wearable land grab in full swing, Limitless is effectively starting over to try to win the prosumer workplace segment. For more, check out our full Limitless dataset.

Key points from our research:

- Rewind launched in November 2022 as an always-on screen and audio recorder that uses optical character recognition (OCR) and local LLMs to give you full text search and chat-based retrieval over everything you’ve seen, said, or heard on your computer—in May 2023, it raised $15M at a $350M valuation (a 495x multiple on their $707K in ARR). Rewind pivoted from its previous product, Scribe.ai—a Zoom bot that recorded meetings and turned them into searchable transcripts—as the AI-powered call recording app category got crowded with competitors like Otter.ai, Grain, Fathom, Fireflies.ai, and Multi and as every B2B SaaS app got “Gong-ified,” tacking on call recordings as a feature.

- Last month, Rewind launched the AI wearable Pendant to capture both on- and offline conversations, announced it was returning its focus back to meeting recordings and split meeting recordings into a separate platform from Rewind branded as Limitless. Rewind’s ambitious product concept had a key technical limitation—running locally, it relied on users’ CPUs to run its voice-to-text models, preventing it from using the best-available LLMs to process the ~11GB of data it collected per user per month.

- Today, Limitless is a multi-product company with $2.2M ARR split across two different apps—Limitless with $100K ARR and $1.3M in Pendant sales and Rewind, which is no longer receiving updates, with $2.1M ARR. Compare to call recordings juggernaut Gong at $285M ARR in 2023, up 43% from $200M ARR in 2022, and sales software that includes call recordings Outreach at $250M ARR in 2023, up 11% from $225M ARR in 2022.

- While competitors like the Humane AI pin and the Rabbit R1 aim to be general-purpose AI companions, Limitless is counter-positioning as a prosumer workplace tool with a focus on meeting productivity and collaboration. A land grab is on among AI wearables to stake claims on different parts of the human body—from the eyes for computer vision applications (Meta, Frame) to the neck (Tab, Friend) and chest (Limitless, Humane) for audio recording, as well as the pocket (Rabbit), wrist (Apple, Oppo), phone (OpenAI, Google), and even legs (Hypershell).

- With Apple—which already owns your wrist, ears, phone, and desktop—on the consumer hardware end, and Gong—which owns your Zoom bot—on the B2B software all-in-one platform end, Limitless has a tight window to execute on its AI-native, vertically integrated hardware and software vision. As in 2021, charismatic early-movers who raised money at high revenue multiples and multi-hundred million dollar valuations will live or die based on their ability to iterate quickly and turn strong initial traction into product-market fit.

For more, check out this other research from our platform:

- Gongification of SaaS

- Gong (dataset)

- Outreach (dataset)

- Lenny Bogdonoff, co-founder and CTO of Milk Video, on the video infrastructure value chain

- OpenAI (dataset)

- Anthropic (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Scale (dataset)

- David Park, CEO and co-founder of Jenni AI, on prosumer generative AI apps post-ChatGPT

- AI writing goes enterprise

- Jenni AI: the $5M/year Chegg of generative AI