Revenue

Sacra estimates Zapier hit $310M in annually recurring revenue at the end of 2023, up about 35% year-over-year from $230M in 2022.

Zapier demonstrated impressive capital efficiency, reaching $100M ARR in just under 10 years while only raising $1.4M in venture capital. This puts Zapier in an elite category with a 100x ratio of ARR to funding, comparable to bootstrapped successes like Atlassian (128x) and Cloudinary (80x).

The company has been profitable since 2014, maintaining a healthy balance sheet alongside its rapid growth. Zapier's low customer acquisition costs, driven by its SEO-optimized landing pages and organic growth engine, contribute to its strong financial performance.

Zapier's revenue is primarily generated through subscription fees for its integration platform, with pricing tiers based on usage and features. The company's ability to continually add new app integrations (now over 3,000) has been a key driver of its sustained growth and expanding user base.

Valuation

Zapier was valued at $5 billion as of 2021, with Sequoia Capital leading its funding efforts. Based on 2021 ARR of $165 million and a $5 billion valuation, Zapier operated at a 30.3x revenue multiple. The company has raised a total of $1.4 million across three funding rounds, with backing from prominent investors including Sequoia Capital and Y Combinator.

Product

Zapier was founded in 2011 by Wade Foster, Bryan Helmig, and Mike Knoop in Columbia, Missouri. The idea stemmed from their experience building integrations for clients. They created Zapier to automate connections between web applications without coding, with the initial prototype built at a Startup Weekend event.

Zapier allows you to create automated workflows where events in one app trigger actions in another app, or multiple other apps via chained steps.

In 2012, Zapier was accepted into Y Combinator and raised a $1.3 million seed round. That same year, they launched a developer platform, enabling third-party apps to build Zapier integrations. By 2014, the company reached profitability and remained bootstrapped after the seed round.

Zapier found initial traction with small business owners and solopreneurs seeking to automate repetitive tasks between SaaS tools. The company's SEO-driven growth engine, generating 6 million monthly visitors by 2021, allowed for near-zero customer acquisition costs. This strategy, combined with their developer platform, fueled rapid integration growth.

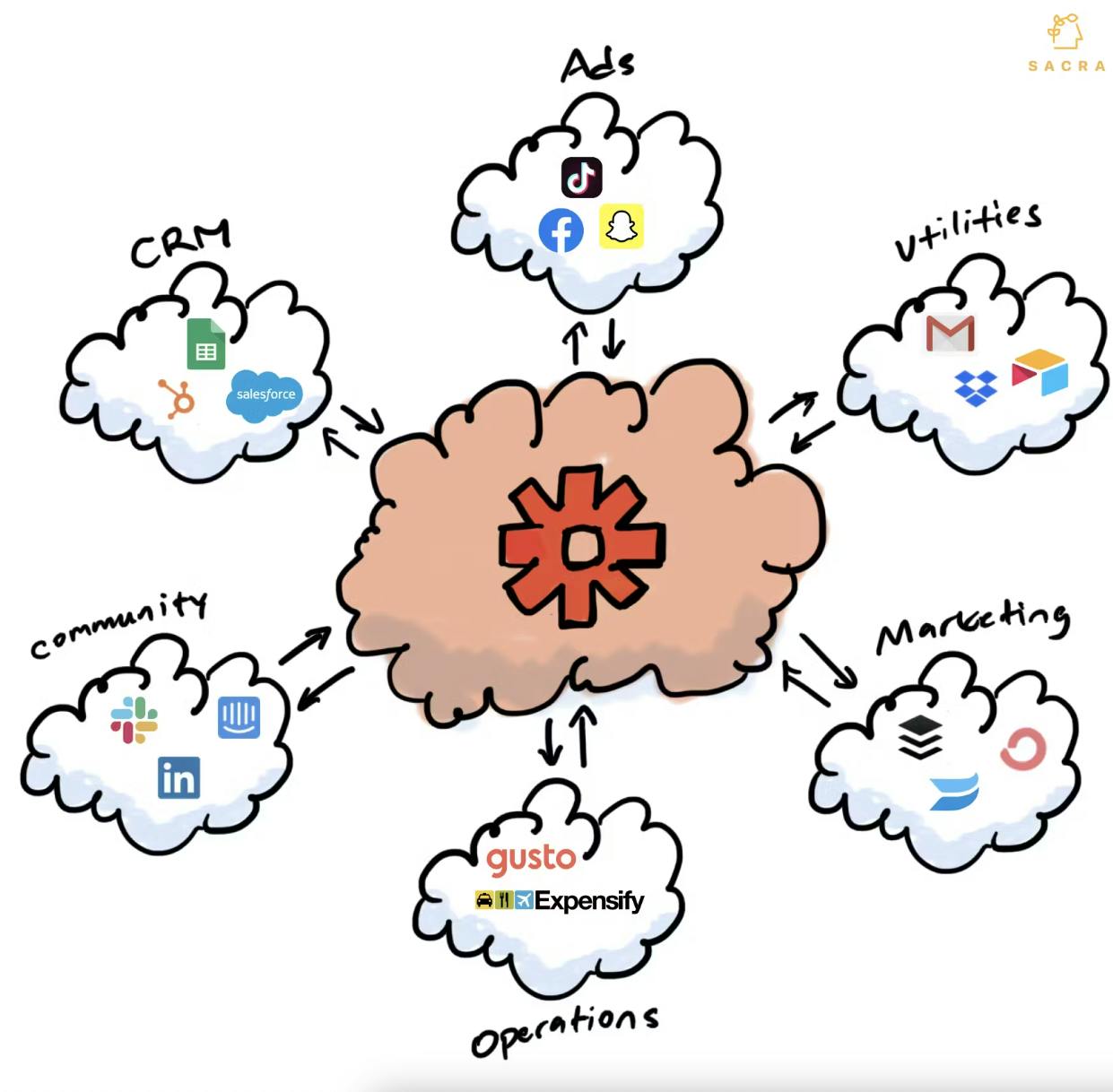

Today, Zapier is an integration platform and marketplace that lets non-technical end-users connect and transfer data between the different SaaS applications they use. When a product joins the Zapier marketplace, it becomes interoperable with hundreds of other applications.

Their core product is a web-based automation tool that connects over 5,000 apps, allowing users to create automated workflows called "Zaps." Key features include:

1. Multi-step Zaps: Users can create complex workflows with multiple steps and conditional logic.

2. Zapier for Teams: Collaboration features for businesses to share and manage Zaps.

3. Zapier Interface Designer: A tool for creating custom interfaces for Zaps.

4. AI-powered automation: Recent integration of AI to simplify Zap creation and enhance functionality.

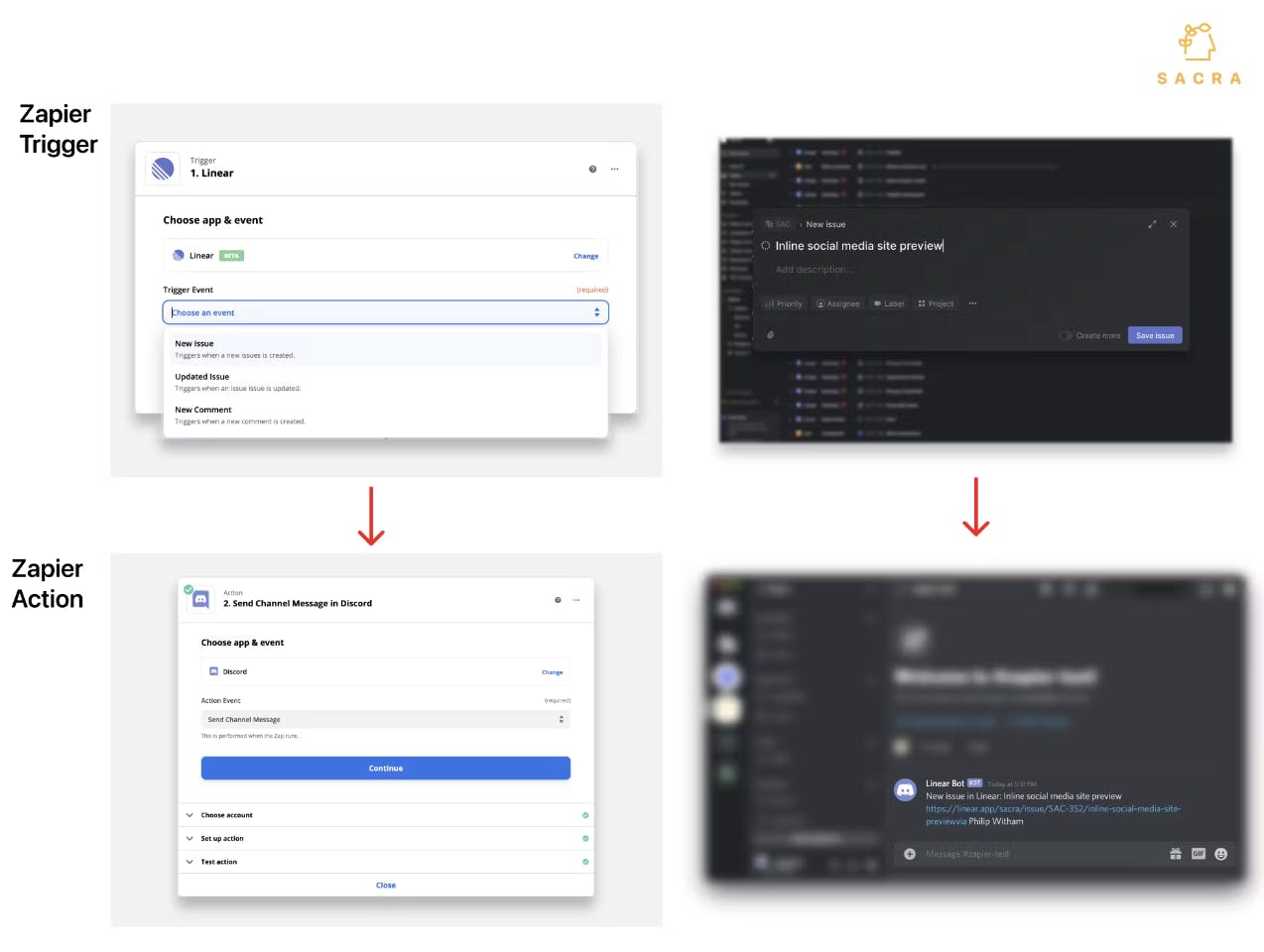

The core design paradigm of the product is the trigger-and-action:

1. User chooses an action in one of their apps they would like to serve as a “trigger”

2. Whenever that trigger event takes place, it sets into motion a “zap”

3. The zap performs one or more “actions” which can create, read, update or delete information in that same app or another app

A basic Zap might trigger upon the receipt of an email in a particular inbox, ingest the subject line and text, and pipe the results into a Slack channel. But with multi-step automations, conditional logic, looping, and native transformations, Zaps have the potential to be highly complex.

Companies can build a ‘stack’ out of tools that wouldn’t otherwise talk to each other using nothing more than Zapier.

With native Zapier actions, Zapier users can also manipulate the data that they pull out of their connected apps in various ways without having to sign up for another tool: they can parse text, set up a delay, pull in the weather or the status of an app, translate text, and more.

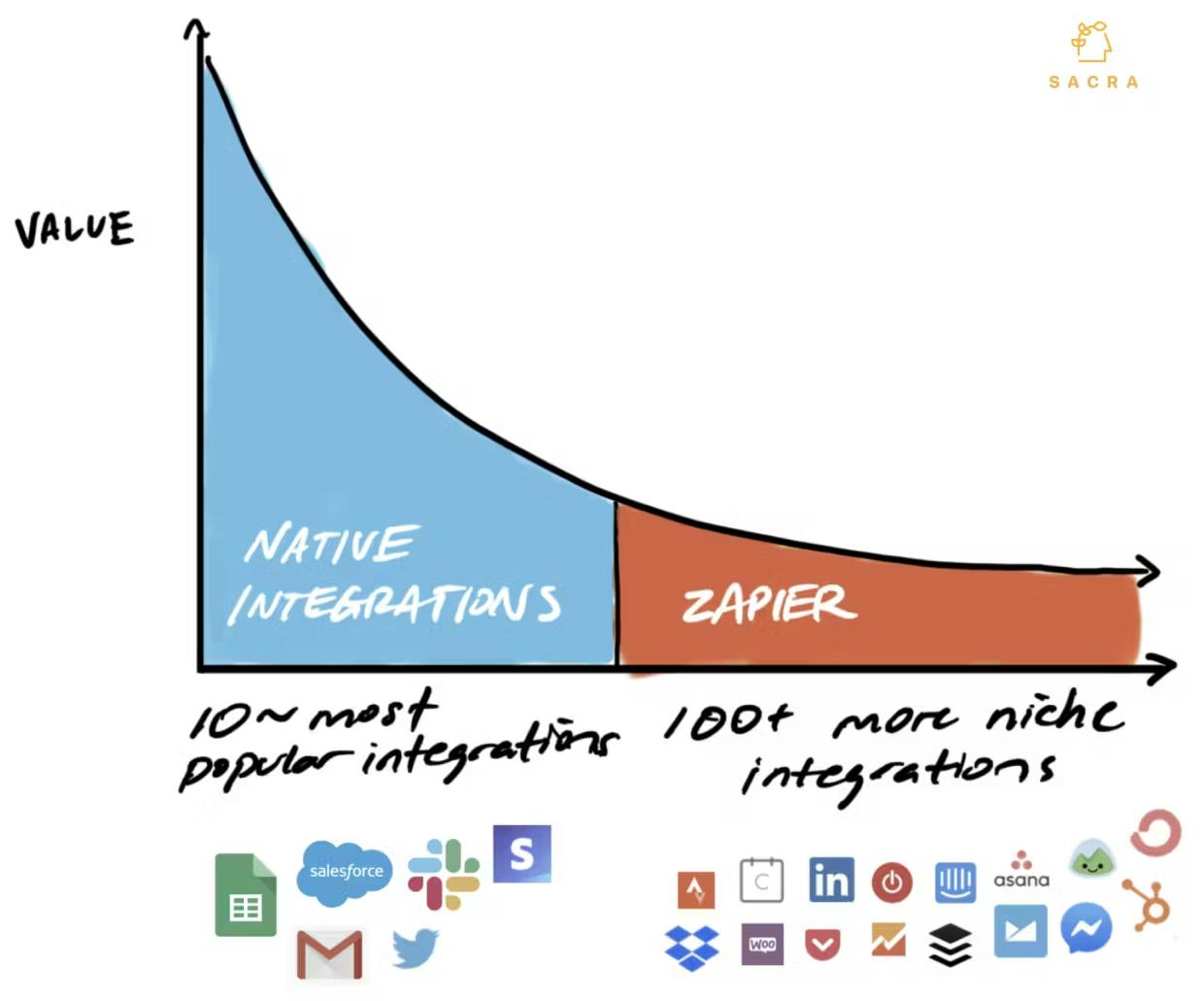

For end-users, Zapier covers a long tail of integrations between SaaS applications that aren’t handled natively—a list that was long when Zapier first launched and has only grown with the expansion of the SaaS world itself. Sales teams use it to populate lists of leads, marketing teams use it to funnel social mentions or create scheduled posts, operations teams use it to maintain internal tools.

Business Model

Zapier is a subscription SaaS company that provides an automation platform connecting over 6,000 different apps, enabling users to create custom workflows without coding. The company's core revenue stream comes from tiered subscription plans based on the number of tasks automated per month and the complexity of integrations required.

Zapier's pricing model is designed to capture value across various customer segments. They offer a free tier with limited functionality to attract users and showcase the platform's capabilities. Paid plans range from $19.99 to $599+ per month, with pricing based on the number of "zaps" (automated workflows) and tasks executed. This usage-based model allows Zapier to monetize effectively as customers grow their automation needs.

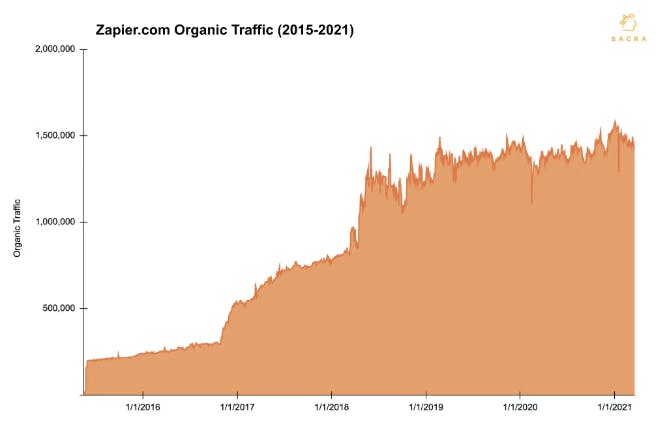

Taking $1.4M in venture capital and turning it into a $140M ARR business is a remarkable feat of capital efficiency. Core to Zapier’s ability to do this without spending millions of dollars in other people’s money—while competing with VC-funded IFTTT—was building one of the most impressive SEO machines in SaaS ever.

Zapier gets about 50% of its overall traffic from search, a channel which they have tripled the size of overall over the last four years.

Between 2016 and 2021, Zapier’s traffic grew by more than 7x to 6M+ unique visitors per month, and the number of unique terms for which Zapier ranks between #1 and #3 has grown from 2,000 to more than 30,000. The secret to Zapier’s success here is simple: new landing pages are published automatically as new apps join the platform, meaning they can be pushed out at huge scale with virtually no human effort required, and their content is almost entirely user-generated.

Programmatically generating these landing pages turned SEO from a marketing tactic to Zapier’s main growth engine.

All of this organic growth put Zapier closer and closer to the forefront of the customer experience. Bottom-up demand for the product began growing, with customers of other SaaS tools going to Zapier, realizing the integrations with other tools they could be using, and then asking the companies who built the products they use to get on Zapier.

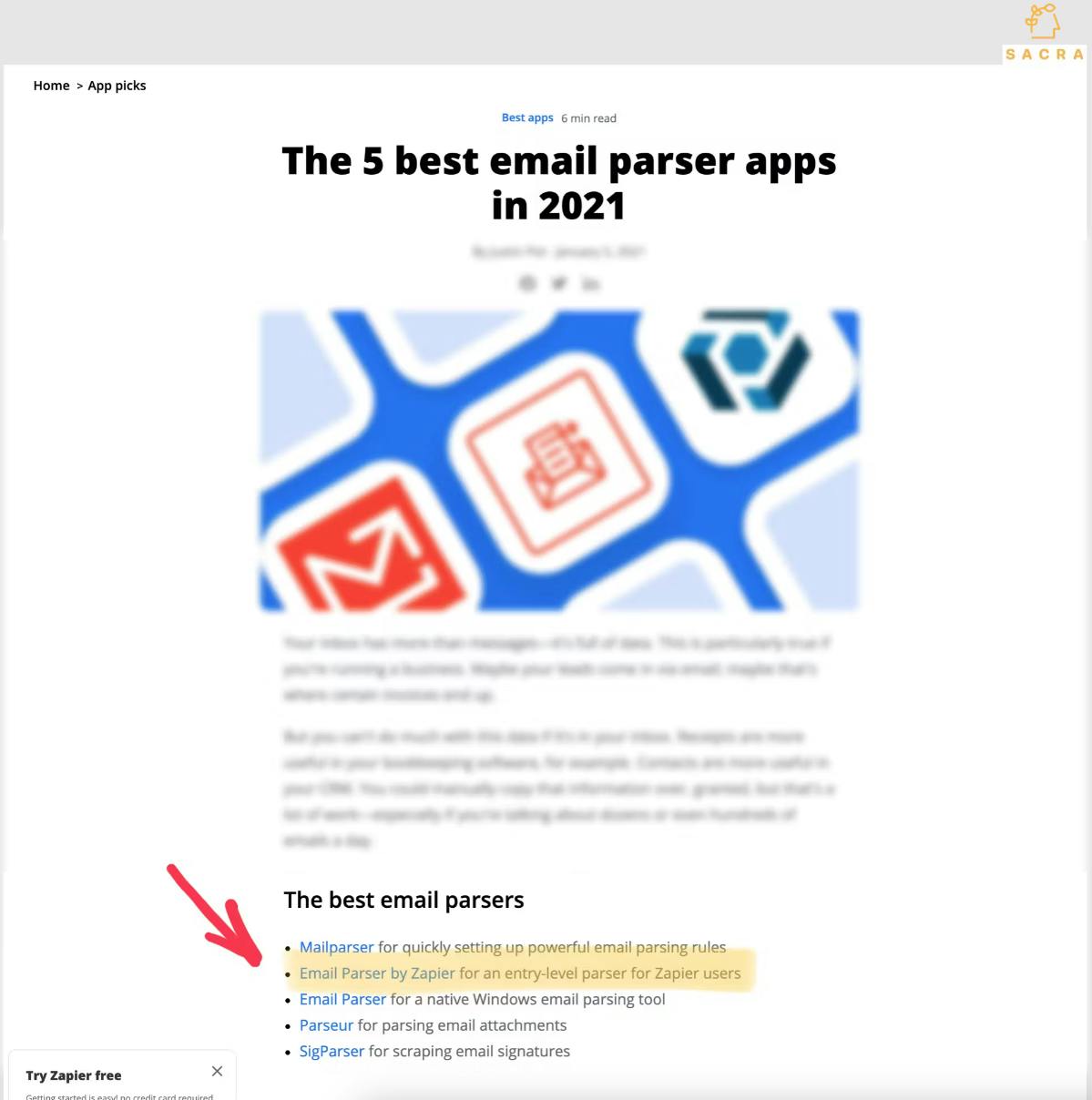

Zapier using its top position in search to advertise Zapier-integrated products—and its own native actions.

At the same time, Zapier was becoming more and more an opinionated aggregator of applications rather than simply a form of connective tissue between them.

Zapier advertises the competition on the landing pages that they build for their integration partners.

Realizing that users would occasionally run into issues with one of the products they were using or thinking of using in an integration, Zapier started offering recommendations for alternative tools to use on their various product landing pages.

Rather than simply a piece of glue between products, Zapier was becoming an ecosystem unto itself—a marketplace for applications driving discoverability and setting standards versus merely a utility you might use to connect them.

This growth strategy would help propel Zapier to $100M+ in ARR in nine years. It would also come to test the relationships between Zapier and its partners.

Zapier had an incentive to be as helpful as possible to its partners early on when they had to attract more of them to the platform to make the product useful, but over time, partners began writing integrations themselves. Zapier became a destination and an onramp to these various tools.

Partners began to realize that Zapier now had the power to treat them as commodities: interchangeable parts that could be swapped out with any other similar product. (See our expert interviews for more on this)

Working with Zapier still made (and makes) sense for many SaaS platforms, and that’s especially true when thinking about the ‘long-tail’ of integrations that will never make sense to write in-house. But Zapier’s rapid growth and proximity to customers would eventually come to present a potential conflict for some partners—and help motivate them to start looking for ways to reduce the need for Zapier on the part of their customers.

Competition

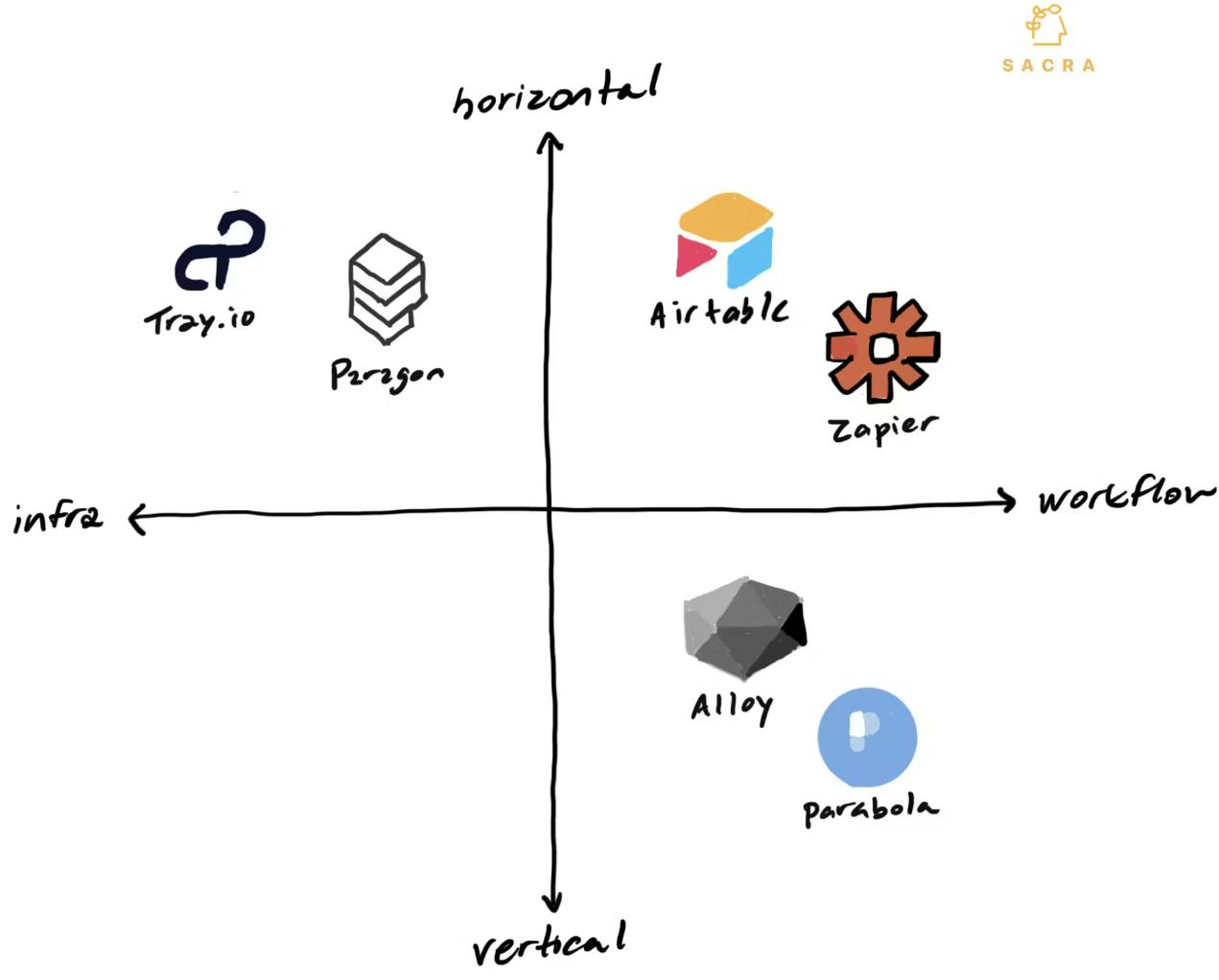

Zapier is a horizontal product—designed for no specific automation use case.

Zapier competes in the automation and integration platform market, facing competition from both established players and emerging startups across several categories:

No-code integration platforms

Zapier's primary competition comes from other no-code integration platforms that allow users to connect different apps and automate workflows without coding. Key players include:

1. Make: Offers a more visual, flowchart-style interface for creating complex workflows. While Zapier had about 125,000 paying customers in 2020, Integromat had only about 5,000, highlighting Zapier's dominant market position.

2. Automate.io: Provides similar functionality to Zapier but with a focus on marketing and sales automations.

3. IFTTT (If This Then That): Originally focused on consumer automations but has expanded into business offerings. IFTTT's simpler interface makes it more accessible for basic automations, while Zapier caters to more complex business workflows.

Zapier differentiates itself in this category through its extensive library of over 3,000 app integrations, significantly more than most competitors. This breadth of integrations, combined with Zapier's strong SEO presence and content marketing strategy, has helped it maintain a leading position in the market.

Native integrations

There’s a future where companies natively integrate with their 10~ most popular partners and relegate the rest (which represent 5-10% of usage) to Zapier.

A growing threat to Zapier comes from companies offering native integration APIs that allow SaaS products to build their own integrations:

1. Tray.io: Provides both a visual workflow builder and an API for developers to create custom integrations.

2. Paragon: Offers a platform for SaaS companies to build native integrations quickly.

If more Zapier partners start building their own native integrations with the help of APIs like Tray.io or Paragon, it will cut into the number of tasks being completed in Zapier, which will cut into the revenue that they generate.

Companies like Tray.io and Paragon make it as easy as possible for SaaS companies to spin up a range of integrations that look and feel completely native. That’s important because companies want to keep barriers to activation as low as possible. Forcing their users off-platform to set up an integration with another tool risks churn and it keeps them from learning what kinds of features their users might need in the core product.

Verticalized integration APIs

Zapier also faces competition from platforms that focus on automations for specific industries or use cases:

1. Alloy: Specializes in e-commerce automations

2. Parabola: Focuses on data workflow automations

3. Rutter: Specializes in e-commerce automations

4. Finch: Specializes in payroll/HRIS automation

These vertical-specific tools are valuable because they index on functionalities underdeveloped inside Zapier, like looping an action over a large dataset, which an ecommerce store owner might use to mass-alter a group of products or run their delivery process.

TAM Expansion

Zapier has tailwinds from the growing no-code movement and increasing demand for workplace automation, and has the opportunity to grow and expand into adjacent markets like AI-powered workflow automation and enterprise-level integration platforms.

No-Code Movement and Workplace Automation

Zapier's core business of connecting disparate SaaS applications through no-code integrations is well-positioned to capitalize on the growing trend of citizen developers and the democratization of software development. As more businesses adopt a wide array of SaaS tools, the need for seamless integration between these tools becomes increasingly critical. Zapier's extensive library of over 5,000 app integrations and its user-friendly interface make it an attractive solution for small to medium-sized businesses looking to automate their workflows without dedicated IT resources.

The company can further expand its market share by developing more complex, multi-step automations and targeting larger enterprises that require more sophisticated integration solutions. By leveraging its existing user base and brand recognition, Zapier could introduce premium features and consulting services to capture a larger portion of the enterprise market, competing more directly with established players like MuleSoft and Dell Boomi.

AI-Powered Workflow Automation

Zapier's recent focus on incorporating AI into its platform presents a significant growth opportunity. By integrating large language models (LLMs) and other AI technologies, Zapier can enhance its offering in several ways:

1. Natural language processing for easier automation creation

2. Intelligent workflow suggestions based on user behavior and industry trends

3. Predictive analytics to optimize existing automations

This AI-driven approach could dramatically expand Zapier's total addressable market by making automation accessible to an even broader audience and providing more value to existing users. The company's vast dataset of user-created automations could be leveraged to train AI models, creating a powerful network effect and further solidifying Zapier's market position.

Data Integration and Analytics Platform

As Zapier continues to facilitate data flow between applications, there's an opportunity to evolve into a comprehensive data integration and analytics platform. By expanding its capabilities to include data warehousing, business intelligence, and advanced analytics features, Zapier could position itself as a central hub for not just automating workflows, but also for deriving actionable insights from the data flowing through its platform.

This expansion would allow Zapier to tap into the rapidly growing business intelligence and analytics market, estimated to reach $43.03 billion by 2028. By leveraging its existing integrations and user base, Zapier could provide a unique value proposition that combines ease of use with powerful data analysis capabilities, potentially disrupting established players in the space and significantly increasing its revenue per user.

Risks

1. Disintermediation by native integrations: As SaaS companies increasingly build native integrations, Zapier risks being relegated to handling only long-tail, niche integrations. This could significantly reduce Zapier's value proposition and market share, especially if major players like Salesforce or HubSpot expand their native integration offerings. Zapier's revenue could be impacted as users migrate to these native solutions for their most critical workflows. To mitigate this, Zapier may need to focus on providing unique value through advanced features or by becoming a super-aggregator of no-code tools.

2. Commoditization of the integration layer: The proliferation of no-code tools and integration platforms could lead to commoditization of Zapier's core offering. Vertical-specific automation solutions like Alloy Automation or Parabola may provide more tailored experiences for certain industries, potentially eroding Zapier's user base. This could pressure Zapier's pricing power and growth. To counter this, Zapier may need to expand its product offering beyond simple integrations, possibly by developing its own data store or more advanced workflow capabilities.

3. Dependency on SEO-driven growth: Zapier's growth has been heavily reliant on its SEO strategy, generating landing pages for integration combinations. As the integration space becomes more crowded, this strategy may become less effective, potentially slowing Zapier's customer acquisition. Additionally, changes to search engine algorithms could significantly impact Zapier's visibility and growth. To mitigate this risk, Zapier may need to diversify its acquisition channels and focus on retention and expansion within its existing customer base.

Funding Rounds

|

|

||||||

|

||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.