ShipBob: TikTok's $500M/year fulfillment arm

Jan-Erik Asplund

Jan-Erik Asplund

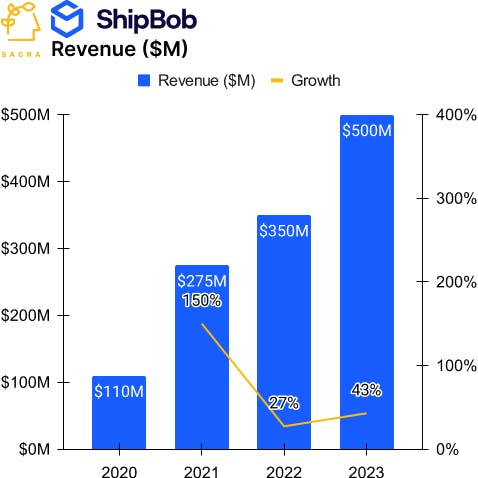

TL;DR: ShipBob hit $500M in revenue in 2023 as the fulfillment arm both of SMB ecommerce merchants and high-growth businesses like TikTok Shop. Now, they’re targeting the entire $3.2T market of non-Amazon ecommerce GMV. For more, check out our dataset and report on ShipBob.

Key points from our research:

- In 2013, Shyp hit 50-100% month-over-month growth for its service that picked up your packages within 20 minutes and shipped them for a flat $5 fee—but it failed to scale because consumers ship irregularly and in low volumes. Shyp partnered with eBay in 2016 as part of a pivot to B2B, with revenue per transaction increasing by 150% as a result, but the lack of runway left from their first ~3 years losing money on every B2C order meant they had to shut their doors in 2018.

- That pattern of product-market fit emerged again with ShipBob, which launched in 2015 to bring scheduled package pickup and shipping to SMBs selling across eBay, Shopify and Etsy, monetizing by charging $5 per package and hitting $1M of revenue, growing 35-40% MoM, after 9 months. By focusing on businesses with predictable shipping needs and relying on scheduled pickups, ShipBob gained control over their unit economics, paving the way for their expansion from a few urban centers to the entire country.

- Sacra estimates that ShipBob generated $500M of revenue in 2023, up 43% from $350M in 2022, largely off the growth in gross merchandise value (GMV) via their deal with TikTok Shop U.S., which is projecting sales of $17.5B for 2024. As ShipBob expanded from 4 warehouses in 2017 to 50 as of 2024, they went from a B2B Shyp to the fulfillment arm of Shopify, helping merchants launch next- and 2-day shipping to go up against Amazon, benefiting massively as Shopify grew revenue 15x from 2015 to 2020, from $200M to $3B.

- Across third-party logistics (3PL), a new competitive set is emerging as freight providers like Flexport, multicarrier fulfillment companies like ShipBob, ShipMonk and Red Stag, shipping APIs like EasyPost and Shippo and carriers like DHL and FedEx converge on the vision of end-to-end ecommerce logistics. ShipBob has expanded from charging $5 per pickup to monetizing the entire lifecycle of fulfillment, with fees on each pallet received and stored at its warehouses, on the human labor of picking & packing, and on per-package shipping.

- The upside case for ShipBob lies in indexing on and facilitating the growth of non-Amazon ecommerce GMV—across ecommerce platforms like Shopify, social superplatforms like TikTok and big box retailers like Target—which hit $3.2T in 2023, up nearly 4%, with ecommerce as a whole going from 14.7% of all retail sales to 15.4%. What ShipBob is building is the counterpoint to Supply Chain by Amazon, the new home of Amazon's $34B/year third-party seller services business as they look to eat up all of ecommerce, from discovery to distribution to delivery.

For more, check out our other research here:

- Shipbob (dataset)

- Klaviyo: the $665M/year HubSpot for ecommerce

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit

- Jordan Gal, CEO of Rally, on building the Switzerland of checkout

- Maju Kuruvilla, CEO of Bolt, on the NASCARification of checkout

- C-suite at creator economy company on the competitive dynamics of checkout

- Peter Zhou, CEO of Rutter, on building the Plaid for ecommerce

- Bolt (dataset)

- Klaviyo (dataset)

- Intercom (dataset)

- Attentive (dataset)

- Postscript (dataset)

- Drift (dataset)

- Customer.io (dataset)