OpenEvidence at $50M/year growing 30% MoM

Jan-Erik Asplund

Jan-Erik Asplund

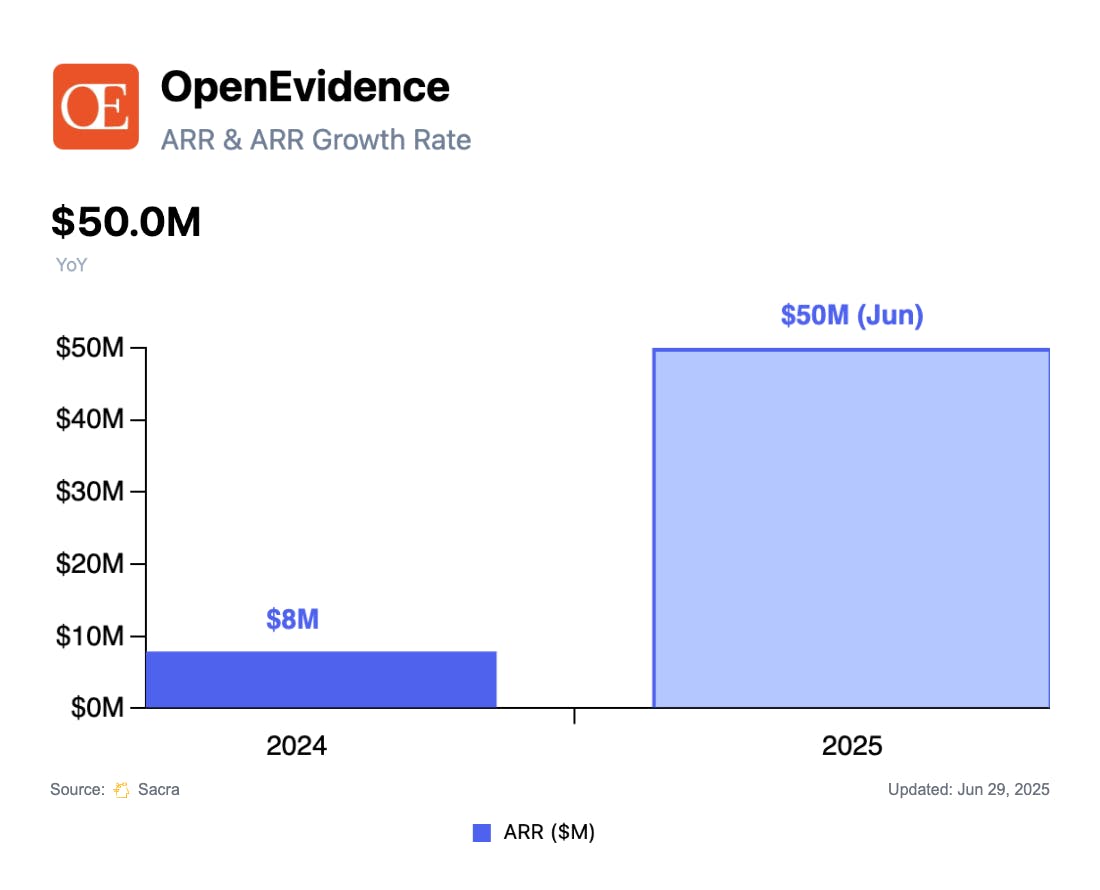

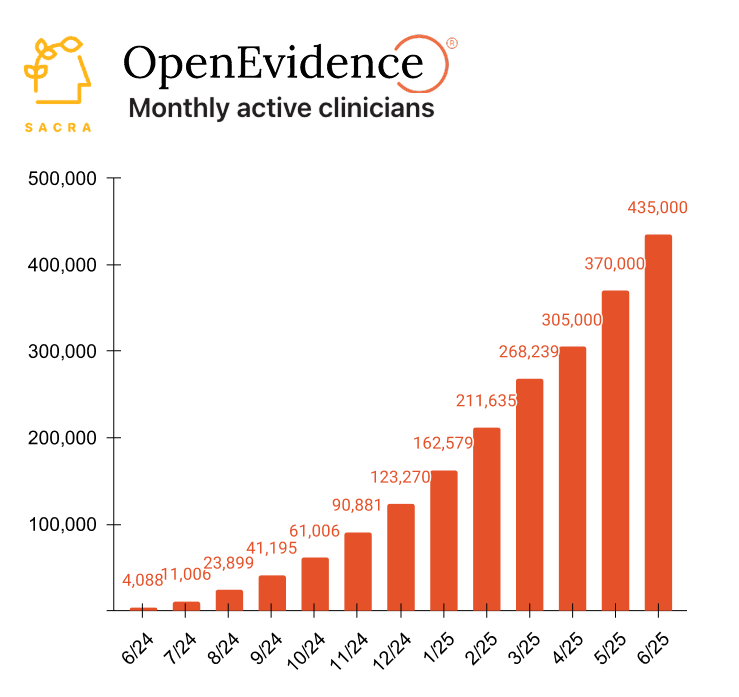

TL;DR: With doctors overwhelmed by the medical literature—which doubles in size every 5 years—OpenEvidence built a free AI-powered search engine that monetizes through pharma ads at $70-150 CPM instead of charging hospitals $500/seat like incumbent UpToDate. Sacra estimates OpenEvidence grew to $50M annualized revenue in June 2025, growing 30% MoM from $7.9M in December 2024, securing a $210M Series A from Sequoia at a $3.5B valuation for a 70x revenue multiple. For more, check out our full report and dataset on OpenEvidence.

Key points from our research:

- With 1.5M new medical papers published every year, 2x’ing the sum total of the literature every 5 years, doctors struggle to ingest the data needed to create up-to-date treatment plans—which combined with the 2017 development of large language models—inspired the founding of OpenEvidence (2021) as a search engine & chatbot trained on open-sourced medical papers & textbooks so doctors can ask complex clinical questions like “what antibiotic is best for a trach dependent pneumonia patient with cerebral palsy” and get answers with citations to the latest research. Where UpToDate (EURONEXT: WKL) charges hospitals $500/seat for their expert-curated, Encyclopedia Britannica-style compendium of reviews of the recent medical literature, OpenEvidence gives its chatbot away for free, using pharma & med‑device advertisements to monetize its audience of high-intent physicians to the tune of $70–$150+ CPM (~$124 ARPU) vs. $5-15 for the average ad on Facebook or Instagram.

- OpenEvidence's rapid word-of-mouth growth among doctors led to back-to-back exclusive content partnerships with top medical journals in The New England Journal of Medicine (Feb ‘25) and JAMA (Jun ‘25), further driving its credibility & data moat and helping OpenEvidence to a Sacra-estimated $50M in annualized revenue in June 2025, growing 30% MoM from $7.9M at the end of December 2024, announcing a $210M Series B (Sequoia) earlier this week at a $3.5B valuation for a ~70x revenue multiple. Compare to “LinkedIn for physicians” Doximity (NYSE: DOCS) which makes 80% of its revenue from ads (~$228 ARPU) at $570M in trailing twelve months (TTM) revenue, up 20% YoY, valued at $11.8B for a 20.7x revenue multiple, and competing clinical decision-making tool UpToDate (EURONEXT: WKL) at roughly $595M in revenue, up 40% YoY, with its parent company Wolters Kluwer valued at $38.7B with a 6.3x revenue multiple.

- By making their product (1) free, and (2) touching no patient records, OpenEvidence bypassed the ~18-month sales cycles in healthcare en route to capturing 40% of U.S. physicians—creating the bottom-up leverage necessary to now go upmarket, plug into the EHR, and sell into hospitals on enterprise contracts as they build agents with the capacity to extend into the rest of the diagnosis & treatment workflow, from auto-drafting clinical notes (Abridge, Ambience) and prior authorizations (Cohere Health) to checking drug interactions in real time (Lexicomp, EURONEXT: WKL). Along with other vertical AI companies like Harvey (law) and Hebbia (finance), OpenEvidence in medicine is part of the next wave of LLM applications that win by on the basis of their proprietary data from (1) partnerships, (2) users, and (3) integration into workflows—rather than competing with OpenAI, Anthropic, and Google on general-purpose model capabilities.

For more, check out this other research from our platform:

- OpenEvidence (dataset)

- Brendan Keeler, interoperability lead at HTD Health, on GTM for AI medical scribes

- Function Health at $100M/year

- Freed (dataset)

- Freed at $13M ARR

- Virta Health at $175M revenue

- Commure at $105M ARR

- Noom at $1B ARR

- BillionToOne at $153M/yr

- Maven Clinic at $268M ARR

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth