Luminance at $30M ARR

Jan-Erik Asplund

Jan-Erik Asplund

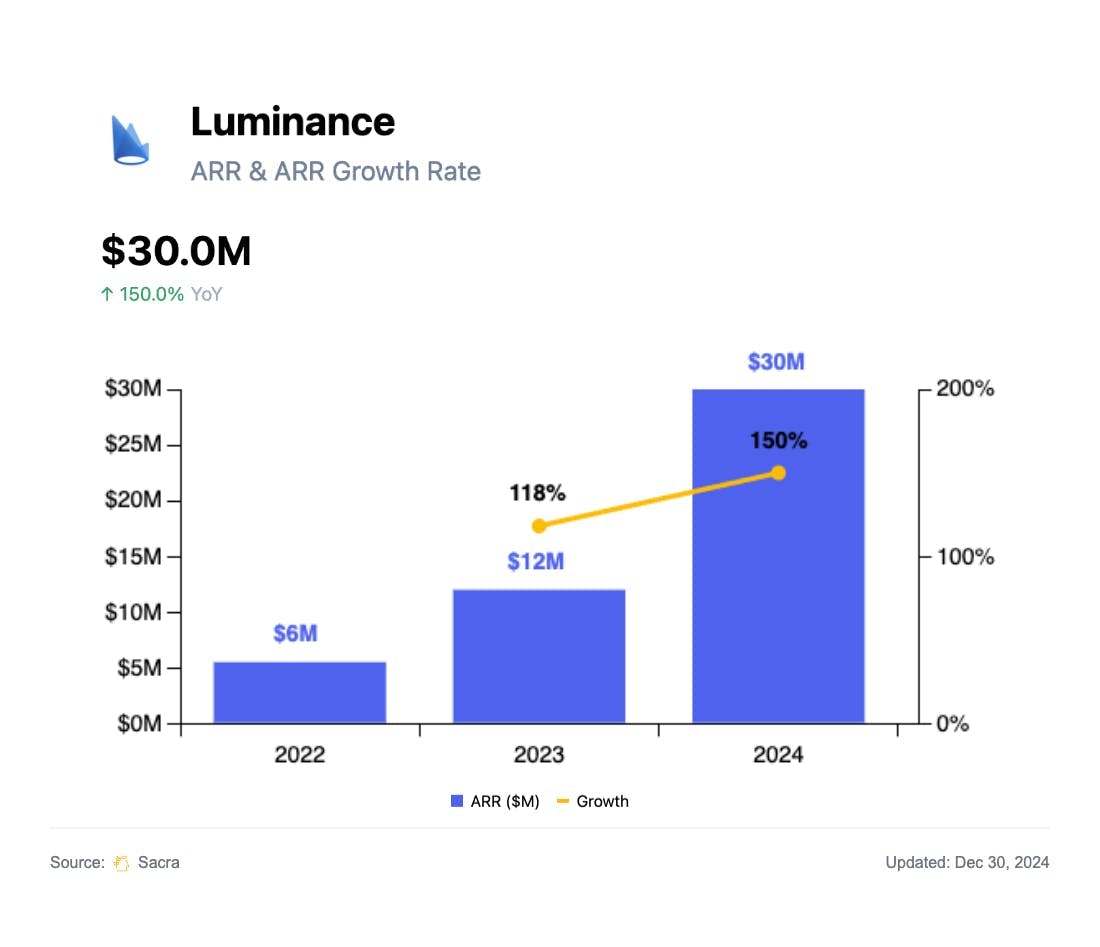

TL;DR: AI-native contract review and negotiation platforms are rapidly replacing manual red-lining, and Luminance is pushing furthest into fully autonomous “AI-to-AI” deal-making. Sacra estimates that Luminance hit $30M in ARR in 2024, up 150% year-over-year. more, read our full report and dataset on Luminance.

We first covered the legal tech space in January 2025, analyzing Harvey’s push to displace Westlaw and LexisNexis with GPT-native legal copilots—and noting how tools like Ironclad were beginning to compete with Harvey at the edges of contract creation, negotiation, and analytics.

We followed up in April 2025 by mapping the broader digital procurement stack, highlighting the emergence of “little P” platforms like Ramp, Brex, and BRM—and Ironclad’s positioning as the core CLM infrastructure layer for both legal and business teams.

Key points via Sacra AI:

- Founded in 2015 by Cambridge mathematicians, Luminance started as a tool for M&A due diligence and evolved into a full-stack legal AI platform that now auto-drafts, redlines, and even negotiates contracts end-to-end via its proprietary "Panel of Judges" model. Through products like Diligence, Discovery, and Corporate, Luminance monetizes via enterprise subscriptions and usage-based pricing—selling into both law firms and in-house teams with a fast-deploying, low-friction workflow that integrates directly with Microsoft Word.

- Growth accelerated in 2024 as Luminance introduced Lumi Go and Auto-Markup for AI-led negotiation, growing to a Sacra-estimated $30M ARR at the end of 2024, up 150% YoY, with 700 customers across 70 countries and 40% of revenue now U.S.-based. Compare to competing CLM platform Icertis at $250M ARR as of February 2024, up from roughly $240M at the end of 2023, AI legal platform Harvey at $50M ARR at the end of 2024, up 400% YoY from $10M at the end of 2023, and Clio at $250M ARR in February 2025, up from $235M at the end of 2024.

- With vertical integration across its model stack, document ingestion, clause flagging, and negotiation workflow, Luminance is positioning to own every high-volume, high-risk document flow across legal, compliance, procurement, and sales—effectively becoming a system of record for AI-native document intelligence. By training on over 150M legal docs and maintaining on-prem-friendly deployments, Luminance offers both defensibility and differentiation in a market where competitors like Spellbook, DraftWise, and Robin AI face rising infra costs and model commoditization.

For more, check out this other research from our platform:

- James McGillicuddy, CEO of BRM, on the problem with “little P” procurement

- Harvey at $50M ARR

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Ameet Shah, partner at Golden Ventures, on the economics of vertical SaaS marketplace

- Gaurav Baheti, CEO of Procol, on bringing procurement online in India