Handshake vs Mercor

Jan-Erik Asplund

Jan-Erik Asplund

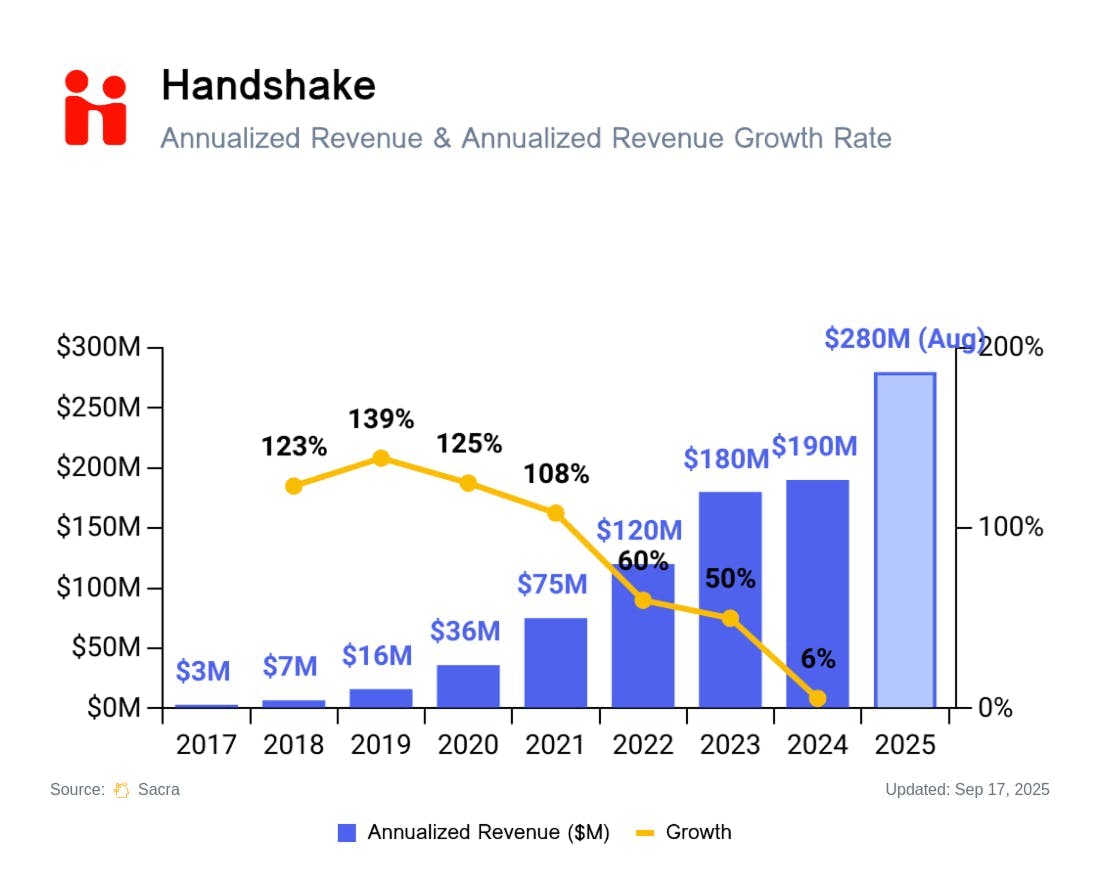

TL;DR: Handshake (2013) grew its campus recruiting portal & job marketplace to 18M students, ending 2024 at ~$190M in revenue (up 6% YoY) but with growth decelerating. Since launching its AI data labeling platform, growth has taken off, with Sacra estimating that Handshake hit $280M in annualized revenue as of August 2025, with Handshake AI going from $0 to $80M in 8 months. For more, check out our full report and dataset on Handshake.

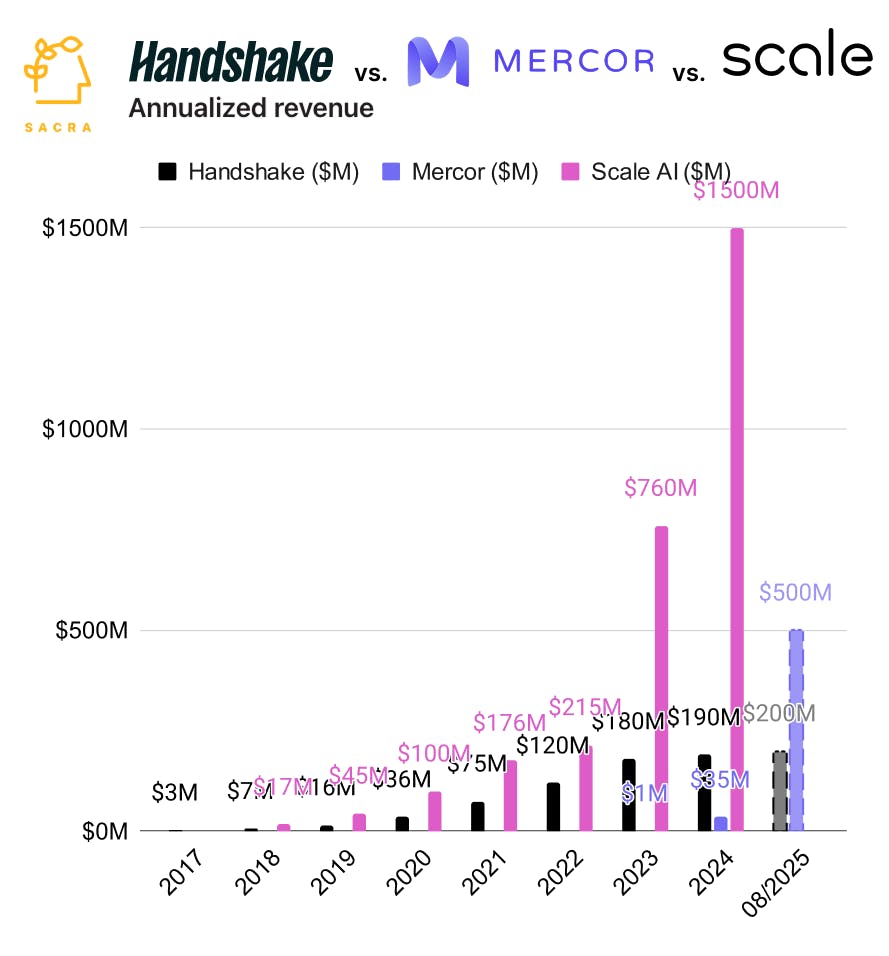

We've been tracking the rapid growth of a new cohort of data labeling companies like Mercor ($100M annualized revenue in February 2025), Invisible ($134M in 2024), and Prolific fueled by frontier labs' transition to reasoning models requiring expert human feedback.

With that in mind, we looked at how campus job board Handshake (founded 2013, $10.5M Series A, Kleiner Perkins) has reinvented itself as an expert data provider.

Key points via Sacra AI:

- In the 2000s, campus recruiting was dominated by the PE-owned Symplicity (founded 1997, acquired by H.I.G. Capital in 2016) with 70% market share—Handshake (founded 2013) launched a career-center SaaS & recruiting portal for colleges that undercut Symplicity’s pricing (sub-$10K/year) and offered a modern UX that students wanted to use. Following Facebook's playbook, Handshake targeted elite schools first (Stanford, Michigan, Cornell, University of Chicago, and Princeton were among its first 10 customers) to attract top employers, driving a network effect where the long-tail of schools then signed up for Handshake to get their students access to those same opportunities, scaling to 1,400 colleges representing 92% of the top 500 universities.

- COVID dramatically accelerated Handshake's growth as remote recruiting exploded and in-person career fairs disappeared, driving revenue from $36M in 2020 to $75M in 2021 (108% YoY) and $120M in 2022 (60% YoY) while scaling to 18 million students/alumni & 1 million companies. After years of doubling revenue, the U.S. job board market cratered in late 2023 with mass layoffs and hiring freezes evaporating recruiting budgets, causing Handshake's revenue to decelerate sharply, hitting ~$190M in 2024 (6% YoY).

- In 2023, frontier model companies drove massive demand for academically credentialed data labelers to power reasoning models and benchmarks in math, law & physics—driving the growth of companies like Mercor ($500M annualized revenue in August 2025)—with Handshake specifically well positioned to capitalize, launching Handshake AI and leveraging its network of PhDs & graduates & postdocs with Sacra estimating Handshake hit $280M in annualized revenue as of August 2025, with $200M from the core job board business and $80M from Handshake AI. Because gig data labeling companies report top-line revenue figures that include the value of contractor payouts (akin to GMV), we estimate 60-70% of payouts go directly to contractors, yielding 25-40% gross margins for Handshake AI and ~80% gross margins for its job board business.

For more, check out this other research from our platform:

- Handshake (dataset)

- Invisible (dataset)

- Mercor (dataset)

- Scale AI (dataset)

- Joe Kim, CEO of Office Hours, on the end of crowdwork

- Jemma White, COO of Prolific, on why humans ensure AI safety

- LinkedIn for data labelers

- Scale at $760M ARR

- Scale: the $290M/year Mechanical Turk of machine learning

- Contractor Payroll: The $1.4T Market to Build the Cash App for the Global Labor Market

- Wingspan's 992x growth in contractor payroll

- Ved Sinha, Former VP of Product at Upwork, on gig marketplaces

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- OpenAI (dataset)

- Anthropic (dataset)

- Cursor (dataset)