GrubMarket: the $2B/year Standard Oil of food

Jan-Erik Asplund

Jan-Erik Asplund

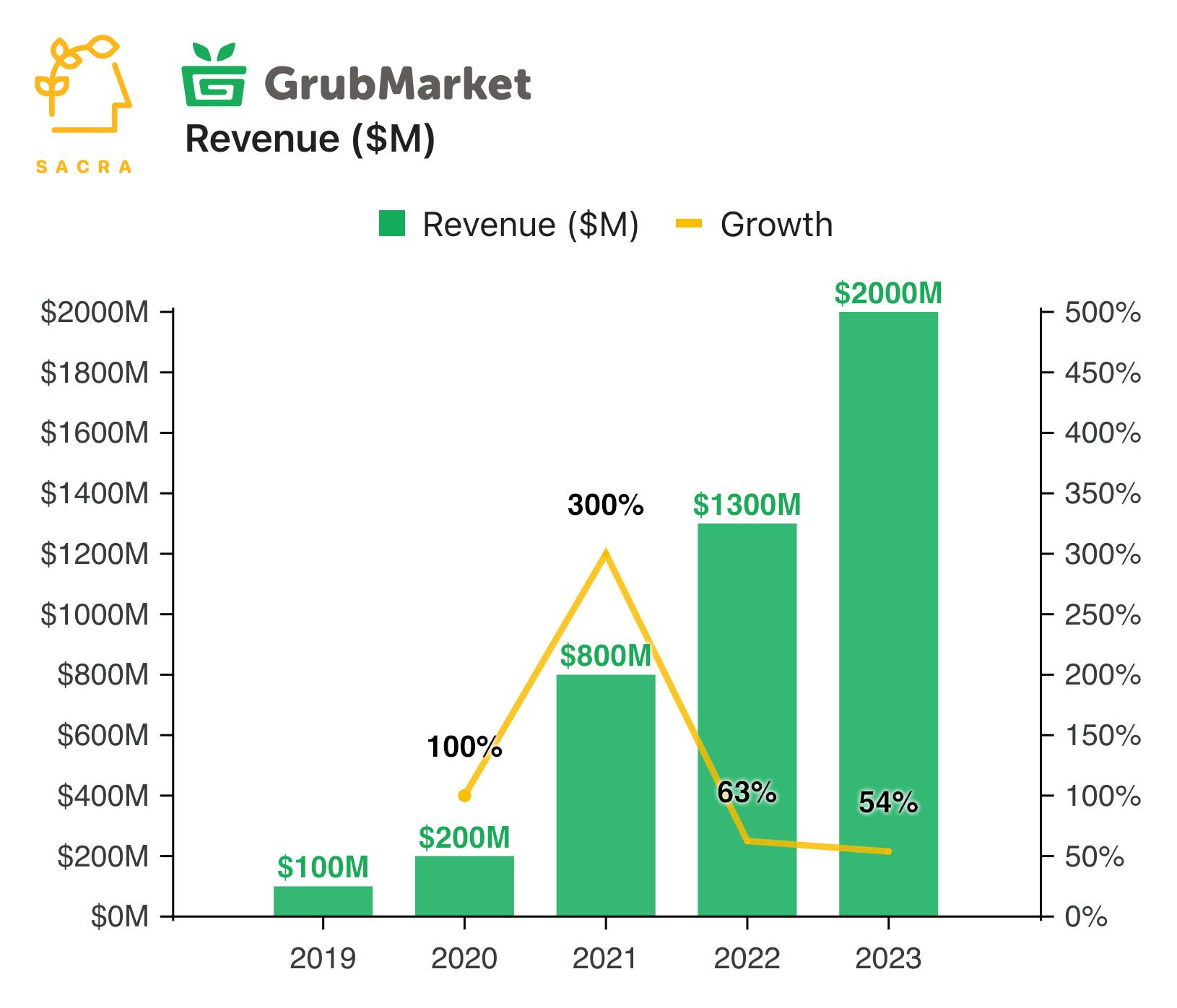

TL;DR: Sacra estimates that GrubMarket generated $2B of revenue in 2023, up 54% year-over-year and up 10x since 2020, as they build the tech-enabled anti-Sysco. For more, check out our full GrubMarket report and dataset.

Key points from our research:

- GrubMarket (launched 2014) launched as an online marketplace connecting farmers and wholesalers with consumers—today, it’s primarily a B2B marketplace supplying restaurants, grocery stores, and corporate offices. In 2023, GrubMarket layered on payments with GrubPay, echoing Shopify’s path into financial services with an offering that lets food suppliers get paid faster via credit card/ACH.

- Sacra estimates that GrubMarket generated $2B in revenue in 2023, up 54% year-over-year from $1.3B in 2023 and up 10x since 2020. Compare to Sysco Corporation (NYSE: SYY) with $78B revenue in the last twelve months, valued at approximately $35B, and US Foods (NYSE: USFD) with $36B of revenue in the last twelve months, valued at about $13B.

- GrubMarket’s Standard Oil-esque strategy of horizontal integration, with 90+ acquisitions of smaller distributors, has allowed them to bootstrap the challenging supply side of the marketplace. GrubMarket gives their acquired distributors SaaS to help them operate and a new, nationwide market for their goods—in return, GrubMarket expands their inventory and can add their revenue and gross merchandise value (GMV) as their own.

For more, check out this other research from our platform:

- GrubMarket (dataset)

- Instacart vs Amazon vs Uber

- Pradeep Elankumaran, CEO of Farmstead, on the future of online grocery

- Online Grocery Unit Economics, Sensitivity Analysis and TAM

- The Key Profitability Levers in Online Grocery

- Sebastian Mejia, co-founder of Rappi, on building for multi-verticality in on-demand