Fanvue at $65M ARR

Jan-Erik Asplund

Jan-Erik Asplund

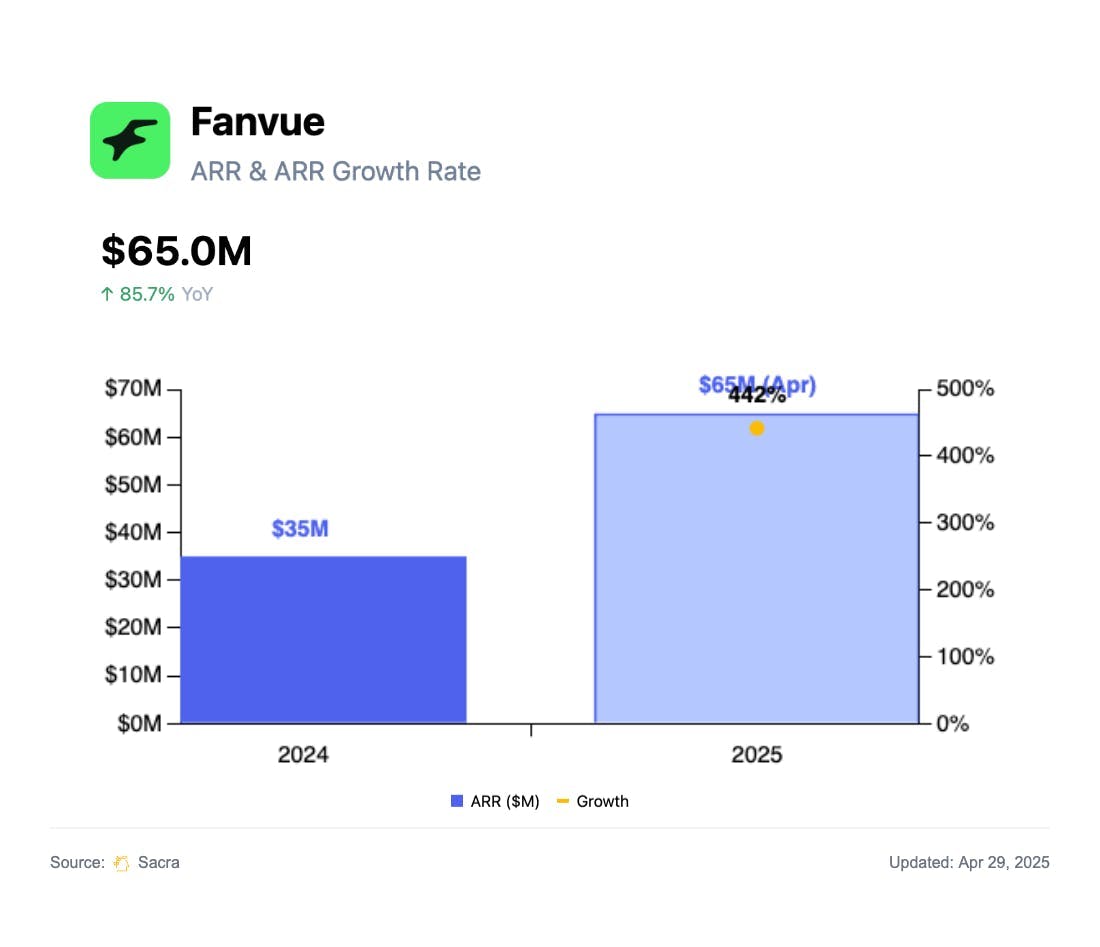

TL;DR: After OnlyFans took off, Fanvue (founded 2020) launched as a fast-follower promising quicker payouts and faster onboarding. Growth took off in 2024 as Fanvue embraced the rise of AI avatar generation and voice cloning tools, with Sacra estimating that Fanvue hit $65M ARR in April 2025, up 450% year-over-year. For more, check out our full report and dataset on Fanvue.

In September 2024, we covered OnlyFans, the Coinbase of amateur porn, and its growth to $1.3B in revenue, up 20% YoY.

That inspired us to take a look at one of OnlyFans’s early fast-followers, Fanvue, which has differentiated through its looser content policy around AI-generated content.

Key points via Sacra AI:

- OnlyFans’ rapid growth from $56M in revenue in 2019 to $1.1B in 2021 catalyzed a wave of like-for-like NSFW platforms—most notably Fansly (2020) and Fanvue (2020)—that courted creators with faster onboarding, looser content rules, and 7-day payouts vs. up to 21 days on OnlyFans. Creators use social platforms like Instagram or TikTok to post SFW content and drive fans through their link-in-bio to Fanvue, where they monetize via subscriptions, tips, locked posts, and paid DMs—with Fanvue taking a ~20% cut on gross revenue, the same as OnlyFans.

- Growth took off in 2024 as LLM text generation met the rise of realistic image (Flux, Stable Diffusion XL), video (Kling, Hailuo) and voice (ElevenLabs, Cartesia) generation, driving the creation of “synthetic” creators, with Sacra estimating that Fanvue hit $65M ARR in April 2025, up from $40M ARR at the end of 2024. Compare to creator storefront Stan at $14.7M ARR in 2023 (up 765% YoY), AI video platform Synthesia at $100M ARR in March 2025 (up 14% YoY), and OnlyFans at $1.3B gross revenue in 2024 (up 20% YoY).

- Fanvue’s decision to allow fully AI-generated content unlocks two distinct creator pathways: (1) entrepreneurs and digital artists can spin up entirely synthetic characters with open source, ComfyUI-orchestrated models or via SaaS off-the-shelf tools like Heygen ($35M ARR in June 2024) and Creatify ($9M ARR), and (2) human models can clone their own image, voice, and chat persona to automate DMs, voice notes, and off-hours engagement, cutting burnout while earning around the clock. Together, fully-AI generated influencers already make up ~15% of Fanvue’s GMV—top AI models like “Aitana” and “Emily Pellegrini” now generate $10K–$20K+ per month—with OnlyFans and Fansly permitting AI content only if it resembles the verified human creator—making Fanvue the only major platform to fully embrace synthetic, from-scratch AI models that take the marginal cost of new content to zero.

For more, check out this other research from our platform:

- Fanvue (dataset)

- OnlyFans (dataset)

- Creatify (dataset)

- Whop (dataset)

- OpenArt (dataset)

- Photoroom (dataset)

- Synthesia (dataset)

- ElevenLabs (dataset)

- Passes (dataset)

- Hassaan Raza, CEO of Tavus, on building the AI avatar developer platform

- Chris Savage, CEO of Wistia, on the economics of AI avatars

- Passes: the $9.5M/year softcore OnlyFans growing 1166% year-over-year

- Linktree: the $33M ARR About.me for Gen Z

- Neal Jean, CEO of Beacons, on building vertical SaaS for creators

- Stan: from $15M to $27M ARR in 3 months

- Stan (dataset)

- Gumroad (dataset)

- Linktree (dataset)