ConvertKit at $43M ARR

Jan-Erik Asplund

Jan-Erik Asplund

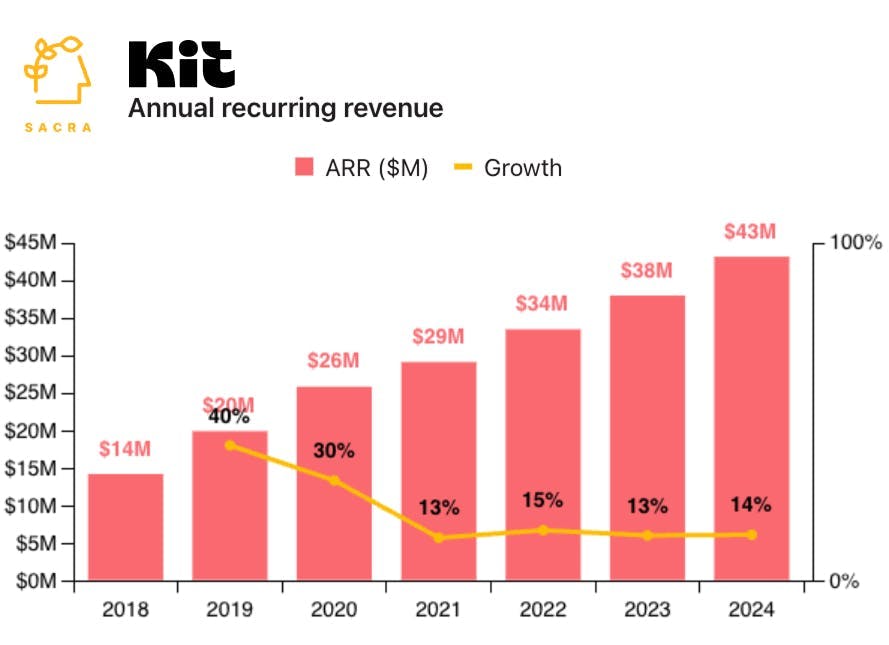

TL;DR: ConvertKit (now rebranded as Kit) has expanded beyond email infrastructure with the launch of the Kit App Store and physical Kit Studios locations, with the aim of building a full creator operating system. Sacra estimates that Kit reached $43M ARR in 2024, up 14% YoY growth from $38M in 2023. For more, check out our full report and dataset on ConvertKit.

We first covered ConvertKit at $33.5M ARR in 2022, growing 15% YoY, as one of the core players, along with Substack and Beehiiv, in the race to build the best tools for email newsletter creators. In 2023, we interviewed CEO Nathan Barry about emerging monetization trends—especially ad networks—and ConvertKit’s path to $100M in revenue.

We followed up at $41M ARR in April 2024, growing 17% YoY, as it was establishing itself beyond pure email SaaS with diversification into subscription software, creator commerce, and advertising.

Here's our Kit update with key points via Sacra AI:

- Sacra estimates that Kit (formerly ConvertKit) reached $43M ARR in 2024, up 14% year-over-year from $38M in 2023, (not including transactional revenue from its ad network business) while maintaining 99.5% net dollar retention.

- With its October rebrand and launch of the Kit App Store, Kit shifted from vertically integrated SaaS to a platform model akin to Shopify’s ecosystem strategy, enabling 15+ third-party apps to go live by year-end and creating new levers for expansion revenue and developer-led distribution—mirroring the bundling trend across creator SaaS as players like Kajabi and Stan seek to combat low ACV and high churn.

- With the launch of Kit Studios and its first physical location offering free, high-end video and podcast production space to creators, Kit is extending its product surface offline to capture more multi-channel “creator CEOs”—echoing Kajabi’s bundling strategy and positioning itself as a B2B SaaS alternative to venture-backed platforms like Substack, which continue to struggle with 50-60% annual churn and negative revenue on subsidized creator advances.

For more, check out this other research from our platform:

- Nathan Barry, CEO and founder of ConvertKit, on ConvertKit’s path to $100M in revenue

- Beehiiv (dataset)

- ConvertKit (dataset)

- Substack (dataset)

- Stan (dataset)

- OnlyFans (dataset)

- Justin Gage, founder of Technically, on how Substack earns its 10% take rate

- Neal Jean, CEO of Beacons, on building vertical SaaS for creators

- How Shaan Puri's podcast landed him a $4M rolling fund

- ConvertKit vs. Beehiiv vs. Substack

- ConvertKit at $38M ARR

- Substack: the $19M/year content LVMH

- Stan: the $14.7M/year store-in-bio

- Linktree: the $33M ARR About.me for Gen Z

- Passes: the $9.5M/year softcore OnlyFans growing 1166% year-over-year