Revenue

$128.94M

2023

Valuation

$2.50B

2023

Growth Rate (y/y)

27%

2023

Funding

$992.40M

2023

Revenue

Varo generated $129M in gross revenue in 2023, growing 27% year-over-year from $101M in 2022. Varo reported a $105.2M net income loss for the year.

$19M of Varo's revenue came from interest income and $110M came from non-interest income.

Roughly 80% of their non-interest revenue would have come from interchange, while roughly 20% would have come from fees on out-of-network ATM withdrawals, deposits from 3rd party money transfer services, and OTC money withdrawals.

Valuation

Varo was valued at $1.8B as of March 2023.

Based on 2023 revenue of $129M and a valuation of $1.8B, Varo trades at a 14x revenue multiple.

The company has raised $1.04B across 9 funding rounds. Key investors include Warburg Pincus, which led investment in their Series E-II round, along with HarbourVest Partners and BlackRock. Their portfolio also includes strategic backing from Gallatin Point Capital.

Business Model

Varo was co-founded by Colin Walsh (now CEO), Assaf Guery, Mykola Klymenko, and Roger Van Duinen in 2015 to offer a mobile-based, consumer-friendly neobank.

Varo bank accounts have no monthly fees or minimum balance fees, and users can access ATMs without fee through the 55,000-strong Allpoint network.

In 2020, Varo became the first American fintech to gain approval to become a nationally chartered bank—allowing Varo to steward their users’ funds (and collect interest on them directly instead of by splitting that interest with another bank) and collect a larger share of interchange from debit and credit transactions done with their branded card.

Most fintechs that operate checking accounts for users partner with a bank like Bancorp or Cross River Bank—the bank holds all consumer deposits on its balance sheet, taking on the liability and compliance work of operating a bank, while the fintech operates as a marketing and UX front-end that brings in customers more cheaply (around ~$100 CAC). Both interchange and deposit interest are then split between the neobank and the banking partner on the back-end.

Product

- Checking account and debit card: No monthly, low-balance, or overdraft fee bank accounts with a debit card that can be used at 55,000+ ATMs.

- Credit builder account: Prepaid account funded by moving money from the checking account where Varo reports the transactions to credit bureaus to build customer’s credit history.

- Savings account: A fee-free savings account with 2% APY, compared to 0.01% offered by traditional banks.

- Money transfer: A Venmo-like fee-free facility to send or receive money from Varo/non-Varo bank account holders.

Competition

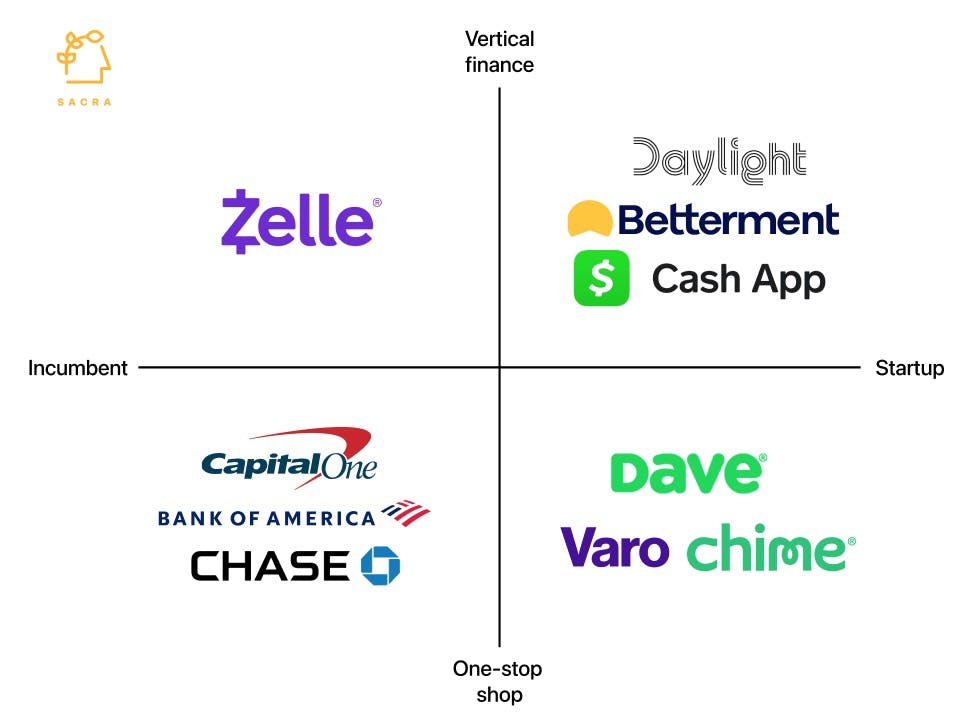

Distinctions between American neobanks tend to be minimal—in Varo’s case, it is differentiated by the fact that it is a nationally chartered bank, which allows it to collect a higher percentage of the interchange and earn more interest on its customer deposits.

At 7M users, Varo is smaller than the biggest American neobanks—see Chime with 14.5M users and Dave with 10M—but bigger than Current with 3.7M. Varo has roughly 17% share of all digital checking accounts in the United States.

Incumbent banks like Chase and Capital One are closing the gap on their neobank competitors by improving their own digital offerings—In H1 2022, Capital One’s app had 7.7M downloads, Chase’s had 6.3M, and Bank of America’s had 5M.

Varo also faces competition from fintechs that have verticalized given the proliferation of horizontal neobanks like Chime and Varo—these include apps like Daylight, which is focused on the LGBT community, Betterment, which is focused on automating investments for higher-earning consumers, and SoFi, which focused on helping students with their loans.

TAM Expansion

Lending

The biggest TAM expansion opportunity for neobanks like Varo is extending lending to their existing user base. Nubank (NYSE: NU) made $1.6B from lending in 2023 (compare to $1.2B from interchange), making up 20% of their total $8B in revenue.

A key advantage that neobanks like Varo have when it comes to lending is that with direct deposit enabled, they have a direct view into their users’ finances end-to-end—from all of their wages and what they’re getting paid to all of their expenses.

Unlike a traditional FICO score that onlys judge a user’s creditworthiness based off a limited set of payments like mortgages or car payments, neobanks like Varo can use a wider range of payments—like Netflix or Hulu subscriptions—in order to extend loans to more people.

Risks

Reduction in consumer spending

Because of Varo’s dependence on interchange revenue, Varo’s business could be hit hard as consumers scale back their spending in an uncertain economic environment. Also, its paycheck to paycheck customer base is the first to reduce excess spending as recessionary pressures grow in the economy.

Decline of primary bank account

With more and more Americans opening up multiple accounts across banks, brokerages, crypto apps, and others, the concept of one account being their ‘primary account’ from where they make most of their purchases is depreciating. Customers prefer to move their money (and apps are empowered to move their money with payroll APIs like Pinwheel) to different apps/accounts that provide them better offers/cash-backs/convenience rather than sticking with one bank account.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.