Revenue

$43.00M

2024

Growth Rate (y/y)

231%

2025

Funding

$264.26M

2023

Revenue

Sacra estimates that Saildrone generated $43M in revenue in FY24, up 231% YoY.

Revenue growth has been primarily driven by Saildrone's success penetrating the US Navy market, capitalizing on increased defense spending and accelerating adoption of unmanned autonomous technologies across military applications. The company expects to deepen its foothold in US defense contracts throughout 2025, with plans for international expansion later in the year as global defense budgets allocate more resources toward autonomous maritime systems.

The significant gap between bookings and recognized revenue reflects the nature of Saildrone's long-duration missions and government contracting cycles, where multi-month deployments and complex procurement processes create timing differences between contract signing and revenue recognition.

Valuation

Saildrone raised a $75M Series C-1 round in 2024 at a $575M post-money valuation, representing a slight discount from their previous funding round. This followed their $100M Series C in 2021 led by Bond at a $600M post-money valuation.

The company has raised over $235M in total funding across multiple rounds. Key investors include Bond, Horizons Ventures, Tribe Capital, Lux Capital, Social Capital, and strategic partners like Crowley Maritime Corporation. The 2017 Series B was a $60M round led by Horizons Ventures at a $260M post-money valuation.

Product

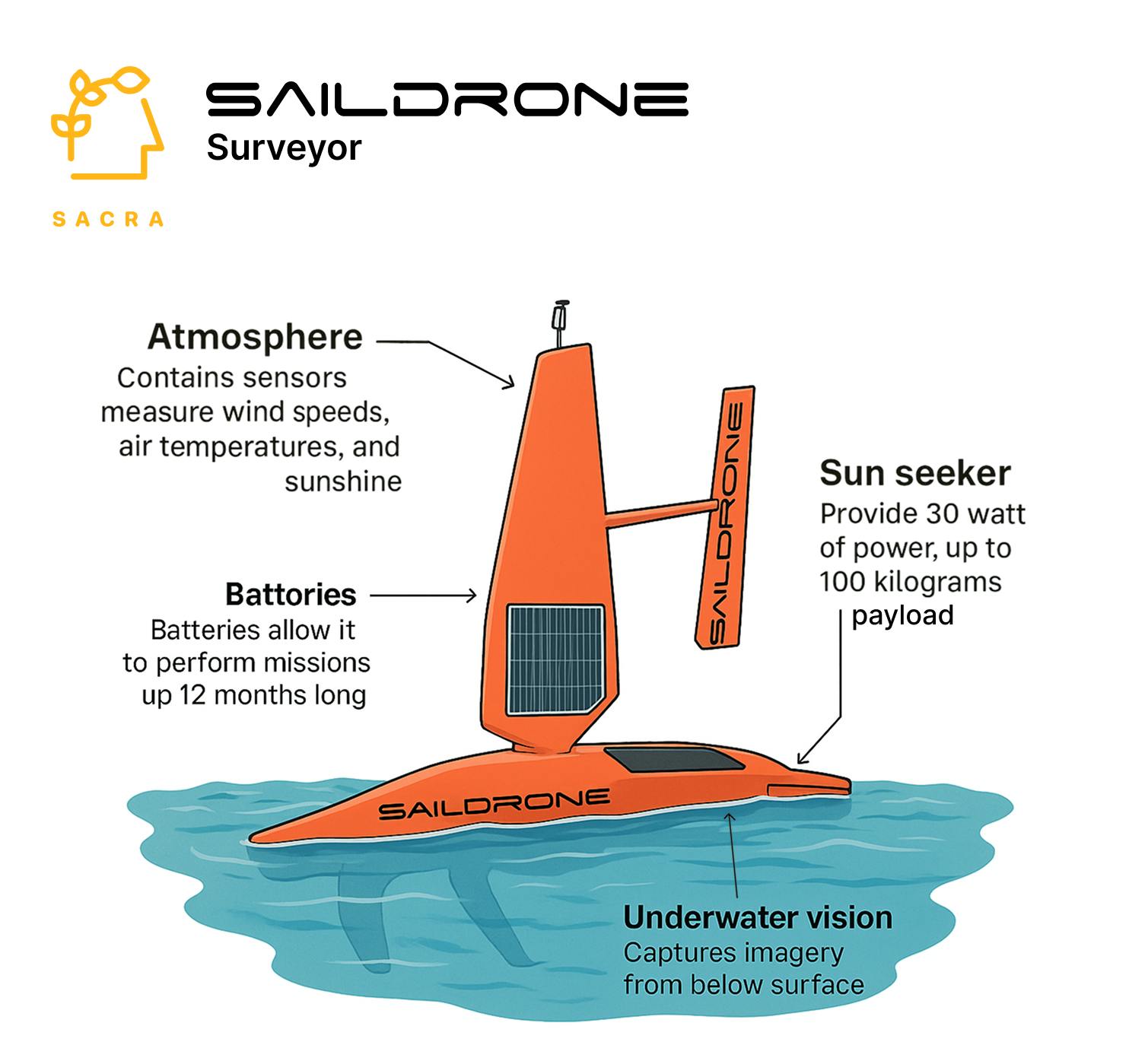

Saildrone builds wind and solar-powered autonomous surface vehicles that collect ocean data at scale for months at a time without human intervention. The company operates three main vehicle classes: the 23-foot Explorer for basic ocean monitoring, the 33-foot Voyager for mid-range missions, and the 65-foot Surveyor for deep-water operations.

Each vehicle uses a rigid wing sail for propulsion combined with solar panels and onboard computers that enable autonomous navigation for 6-12 months per deployment. The vehicles carry modular sensor packages that can include multibeam sonar for seafloor mapping, weather stations, cameras, radar systems, and specialized equipment for defense applications. All data streams back to shore via satellite in real-time.

Customers access missions through Saildrone's cloud-based Mission Portal where they can set waypoints, define survey areas, and monitor live data feeds. A 24/7 Mission Control center in Alameda oversees the global fleet but the vehicles operate autonomously, automatically adjusting course for weather and avoiding collisions using onboard AI systems.

The vehicles serve diverse use cases from climate scientists tracking hurricane formation to telecom companies surveying subsea cable routes to naval forces conducting maritime domain awareness. The same hull platform can switch between scientific and defense missions simply by swapping sensor modules.

Business Model

Saildrone operates a mission-as-a-service model where customers pay for data collection services rather than purchasing vehicles outright. This B2B approach spans both government agencies and commercial enterprises, with pricing structured around mission duration, geographic coverage, and sensor complexity.

The business model leverages significant cost advantages over traditional crewed research vessels. Saildrone's wind-powered vehicles eliminate fuel costs and crew expenses, delivering ocean data at roughly one-tenth the daily cost of conventional ships. This cost structure enables the company to offer competitive pricing while maintaining healthy margins on multi-month deployments.

Revenue streams include both one-off mission contracts and longer-term service agreements with repeat customers. The company's vertically integrated approach encompasses vehicle design, manufacturing, fleet operations, and data processing, allowing Saildrone to control the entire value chain from hardware to delivered insights.

The model creates natural expansion opportunities as customers typically start with single missions before scaling to multi-vehicle deployments across larger geographic areas. Government contracts often involve multi-year frameworks that provide revenue visibility, while commercial customers increasingly adopt Saildrone for ongoing monitoring needs.

Competition

Defense technology insurgents

Anduril represents the most prominent competitor in the autonomous defense vehicle space, with significantly more funding and a broader product portfolio spanning air, land, and sea domains. Anduril's partnership with HD Hyundai for USV development demonstrates how well-funded competitors can leverage manufacturing partnerships to scale production rapidly. Saronic has also emerged as a notable player after raising $175M from investors including Andreessen Horowitz, focusing on larger autonomous vessels for military logistics and sensor hosting.

Vertically integrated maritime players

Traditional defense contractors like L3Harris, Thales, and Kongsberg bundle autonomous vehicles with existing sensor systems and established naval procurement relationships. These companies can potentially underprice data collection services as loss leaders to win larger platform deals. Fugro poses a particular threat in the commercial market by building autonomous survey fleets that complement their existing global survey operations, offering hybrid packages that combine unmanned and crewed capabilities.

Ocean data specialists

Companies like SoFar Ocean and Open Ocean Robotics compete directly in the data-as-a-service model, operating their own autonomous fleets to collect and sell processed ocean data. These competitors focus on similar long-endurance missions but may lack Saildrone's dual-use capability across defense and commercial applications. Regional players like SEA-KIT International and Maritime Robotics offer configurable platforms for local hydrographic work, potentially capturing market share in specific geographic regions.

TAM Expansion

Defense market penetration

The global shift toward unmanned maritime systems creates substantial expansion opportunities as NATO allies and other defense partners seek alternatives to expensive patrol vessels. Saildrone's recent deployments with the Danish Armed Forces and ongoing US Navy contracts demonstrate the scalability of their platform across different military organizations. The company's GPS-denied navigation capabilities unlock contested maritime zones that were previously inaccessible to autonomous systems.

Commercial infrastructure monitoring

The sabotage of Nord Stream pipelines has created mandatory monitoring requirements for subsea cables and pipelines across Europe and other regions. This regulatory shift opens a large addressable market for continuous maritime surveillance services. Energy companies, telecommunications providers, and insurance firms increasingly need persistent monitoring of critical underwater infrastructure, creating recurring revenue opportunities that extend far beyond traditional oceanographic research.

Geographic expansion and manufacturing scale

Saildrone's European subsidiary in Copenhagen positions the company to capture Nordic, Baltic, and Arctic monitoring contracts funded by EU and NATO budgets. The partnership with Austal USA for manufacturing enables regional production strategies that could support Asia-Pacific expansion once regulatory approvals are secured. Climate monitoring requirements and offshore wind development in new geographic markets provide additional growth vectors beyond the company's current operational areas.

Risks

Manufacturing constraints: Saildrone's growth depends on scaling production of complex autonomous vehicles that require specialized components and extensive testing. Unlike software companies, each additional mission requires physical hardware deployment, creating potential bottlenecks in manufacturing capacity and supply chain management that could limit the company's ability to meet growing demand from both defense and commercial customers.

Regulatory barriers: Autonomous maritime operations face evolving international regulations around navigation rights, data collection permissions, and military applications. Changes in maritime law or restrictions on autonomous vehicles in territorial waters could significantly impact Saildrone's operational flexibility and market access, particularly for international expansion and defense applications.

Technology commoditization: As autonomous navigation and ocean sensing technologies mature, larger competitors with deeper resources may replicate Saildrone's core capabilities while leveraging superior manufacturing scale or existing customer relationships. The risk is particularly acute in defense markets where established contractors could integrate similar autonomous capabilities into broader platform offerings at competitive prices.

Funding Rounds

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.