Revenue

$570.00M

2025

Funding

$956.34M

2024

Revenue

Sacra estimates that Rippling reached $570 million in annualized revenue in February 2025, up from approximately $532 million at the end of 2024 and $350 million in 2023.

Rippling serves over 20,000 customers as of May 2025, with its PEO business maintaining a 99.5% year-over-year client retention rate as of fall 2024. The company has built 10+ product lines each generating over $1 million in ARR, with new products typically reaching this milestone within 5 to 6 months of launch.

Rippling's revenue model benefits from multiple entry points into customer organizations, allowing the company to land with one product and expand into others through its integrated HR, IT, and payroll platform. The bundled approach enables Rippling to spread R&D and operational costs across multiple products while providing customers with unified workflows and data management across previously siloed business functions.

Valuation

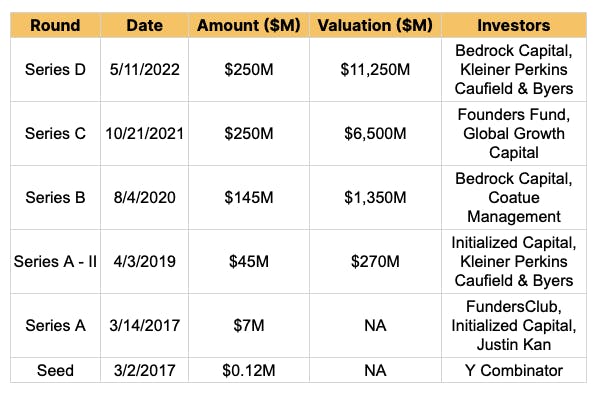

Rippling is valued at $13.5 billion following its 2024 Series F round, led by Coatue Management.

Based on their 2023 valuation of $11.25B and 2023 ARR of $350M, Rippling commanded a 32.1x revenue multiple.

The company has raised a total of $1.397 billion across multiple funding rounds. The latest Series F round included participation from Greenoaks Capital, which previously led a $500M round, as well as Founders Fund and new investor Dragoneer.

Business Model

Rippling sells HR, payroll, IT security, and device management SaaS as a subscription to SMB and mid-market companies. Unlike most other SaaS companies with point solutions, Rippling is built as a multi-product company, giving it multiple entry points into a company. For instance, companies that don’t want to use it for device management can use it for payroll, and companies that are happy with their existing payroll can use it for single sign-on and device management. Rippling then cross-sells its other products to these customers through two key value propositions.

Firstly, Rippling’s bundle is more affordable to a company than paying for each point solution SaaS separately. Every point SaaS company can only spread their R&D and marketing costs across one product, which means a customer is paying a premium, while Rippling spreads these costs across multiple products in its bundle.

Secondly, like Microsoft, its products work better when used as a bundle with common UX, 3rd-party integrations, and analytics.

Rippling has 10+ product lines that are doing over $1M in ARR and plans to launch one new product every quarter for the next 12 months. It expects its new products to reach $1M ARR in 5 to 6 months.

It aims to leverage the middleware to eat into all the heavy administrative load use cases in a company centered on employee data such as procurement, corporate spend management, and communication/collaboration. This approach is similar to how Salesforce started as a CRM, connecting all business systems through customer identity and then layered products on top of it, with the core CRM product now less than half of Salesforce’s revenue.

Product

The employee data in organizations are spread across multiple business systems and needs to be maintained and updated manually when an employee’s status changes, such as they leave, get promoted or someone new joins, creating significant administrative overhead. Rippling solves this by acting as a system of record for employee identities and the single place to make all such changes. Rippling then propagates this to all other apps through its third-party integrations with hundreds of apps.

Rippling uses its middleware as a common infrastructure to build features such as permissions, reporting, approvals, and automation faster than point solutions, which have to develop them from scratch for every new product. The middleware also pulls data from third-party apps, such as Zendesk tickets, GitHub pull requests, and Slack messages, so companies can create workflows and reports within Rippling rather than tinkering with each point solution separately.

Rippling is made up of four components:

HR SaaS: Consists of payroll, benefits and insurance, time & attendance, talent management, learning and development, and PEO.

IT SaaS: Includes app management and device management. App management enables app installation, single sign-on, password management, and access control. Device management provides remote/on-prem device setup, security, device onboarding and retrieval, and device ordering, shipping, and storage.

App exchange: Rippling integrates with hundreds of apps across procurement, design, collaboration, HR, IT & security, and office management categories.

Middleware: Rippling’s middleware, Unity, sits between the application layer and data layer to provide a common infrastructure of analytics, automation, permissioning, and policies that can be used by all Rippling products and by third-party apps.

Stack of point solutions SaaS companies

Rippling's stack

Competition

While Rippling is taking a vertically integrated approach to developing apps, Gusto is taking a platform approach where it connects with third-party apps and insurance providers without aiming to build all the features in-house. Justworks is a PEO that sells HR SaaS and insurance plans to SMBs without an option to use the HR SaaS as a standalone product. Rippling’s modular product bundle lets an SMB switch off PEO and still use the HR SaaS tools.

Also, Justworks generates 90% of its revenue from low-margin insurance sales, while for Rippling, this is less than 10%. Compared to its peers, Rippling is investing a lot more into building its product with a much higher percentage of engineering employees, which enables it to ship new products and features much faster.

Percentage of workforce in engineering for HR/payroll companies

TAM Expansion

Rippling started with HR and IT SaaS, but its ambition is to expand to other categories that need heavy lifting, and employee data are a natural fit for Rippling.

As Rippling wants to bundle everything in one subscription, one of the ways to think about the bundle expansion is for Rippling to build the features it provides through third-party integrations in-house. Its multi-product approach makes Rippling a candidate to become the Microsoft Office for startups, a business operating system where everyone plugs in for all administrative, communication, and productivity needs rather than firing up separate applications.

Risks

Enterprise sales motion

Rippling mainly sells to SMBs and mid-market companies, which can replace existing software with lesser difficulties than enterprises. Once it starts targeting enterprises, moving them to its all-in-one bundle may be challenging. Enterprises will find it difficult to rip out an expense management SaaS or a device management SaaS, part of their core workflow.

Ambition vs. delivery

Many of Rippling’s products are highly ambitious and work in progress rather than 100% finished. Rippling has invested heavily in R&D and will now want to monetize this effort by selling the SaaS to as many customers as possible. However, it needs to deliver on its ambition through customer support, without which it may struggle to maintain its early traction.

Fundraising

Funding Rounds

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.