Revenue

$390.00M

2024

Valuation

$13.40B

2021

Growth Rate (y/y)

27%

2024

Funding

$764.82M

2021

Revenue

Sacra estimates Plaid hit $390M in ARR in 2024, growing 27% YoY from 2023, up from a 12% growth rate the previous year. The company is projecting projects $430M ARR for 2025.

Plaid operates on a usage-based pricing model with three core revenue streams: per-account connection fees, usage-based API call charges, and subscription fees for certain products like Liabilities and Investments APIs. The company serves over 8,000 customers, with more than 50% of new deals since 2022 coming from outside traditional consumer fintech.

While not yet profitable, Plaid has significantly reduced losses from $70M in 2022 to an expected $50M or less in 2023. The company maintains approximately $140M in cash and has 80% gross margins, exceeding typical B2B software margins.

Valuation

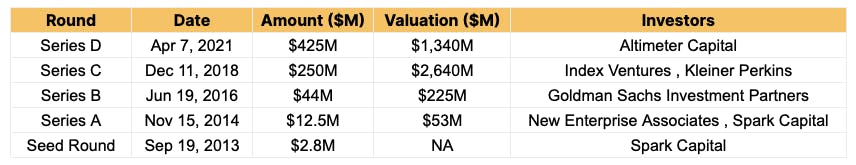

Plaid was last valued at $13.4 billion during its Series D funding round in April 2021, led by Altimeter Capital. The fintech infrastructure company has raised a total of $734.3 million across multiple funding rounds since its founding in 2012.

Based on reported 2021 revenue of $250 million, this implies a revenue multiple of approximately 53.6x at the time of its last valuation. Notable investors include Goldman Sachs, American Express, Mastercard, and J.P. Morgan, alongside venture capital firms Index Ventures and Kleiner Perkins.

Product

While aggregators like Yodlee ($660M) pre-existed Plaid, Plaid’s Stripe-like pay-as-you-go pricing, and easy-to-use documentation, compared to Yodlee’s annual fixed fee contracts and clunky documentation got immediate traction with young fintechs like Venmo, Cash App, and Chime. Venmo was Plaid’s first large customer that used Plaid to check the balance in customers’ accounts before forwarding them cash in their Venmo wallets.

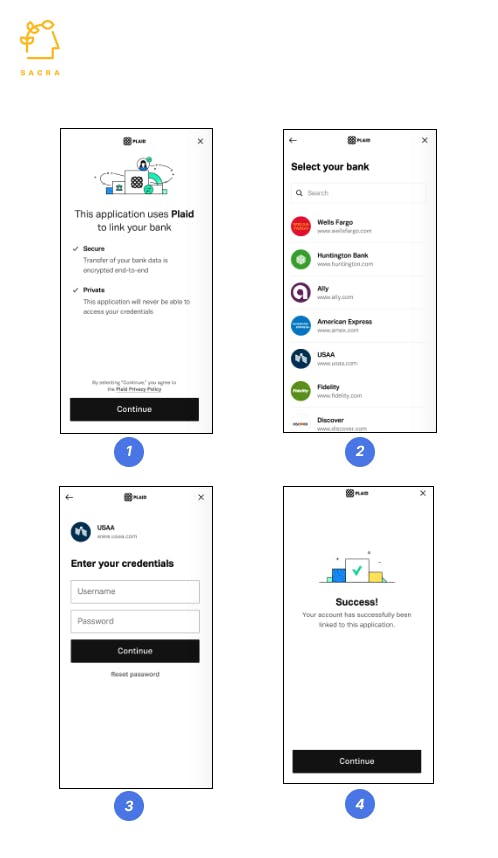

Plaid’s core product is a screen scraper that asks customers for their login credentials, uses it to log into their bank account, scrapes the data, and puts it into a data layer for fintechs to query through APIs. Its products can be categorized into 5 buckets:

- Onboarding: The most-used Plaid products that are core to onboarding a new user onto a fintech app, such as Auth for fetching customer’s account information, Identity to verify account ownership, and Balance to get real-time balance information.

- Information: Getting historical data from different types of accounts such as savings, checking, investments, credit cards, loans, and mortgages.

- Money movement: Moving money to and from customers’ bank accounts to the fintech app natively inside the app using payment initiation product and Transfer product to move money from one bank account to another through ACH.

- Payroll: Income verification by connecting to payroll providers and switching direct deposits programmatically inside the app rather than through manual paperwork.

- Fraud: Mitigating fraud in various Plaid workflows through document-based identity verification, KYC/AML compliance, and reducing the return risk of an ACH transaction.

Fintech developers connect to these products in two ways: Links, which is how they connect their app to the customer’s bank account for the first time, and APIs, which let them view account balances and move money once connected to the account. Plaid does all the heavy lifting of aggregating and cleaning data coming in multiple formats from thousands of banks to give developers a single end-point irrespective of which bank they want to connect to and maintain the connections when they break.

Note: Plaid's bank linking process.

Business Model

Plaid acts as a middleware for fintechs like Venmo, Cash App, and Robinhood to connect to their customers’ bank accounts. With only one-third of US banks opening up APIs to pull data outside the bank, fearing competition from fintechs, Plaid screen scrapes data and gives fintechs APIs to ping that data for use cases like moving money to their wallets or fast-tracking customer onboarding. Plaid charges fintechs usage-based fee and a flat monthly fee for maintaining these connections. Screen scraping-based connections break often when banks change their templates, put up pop-ups, or introduce multi-factor authentication.

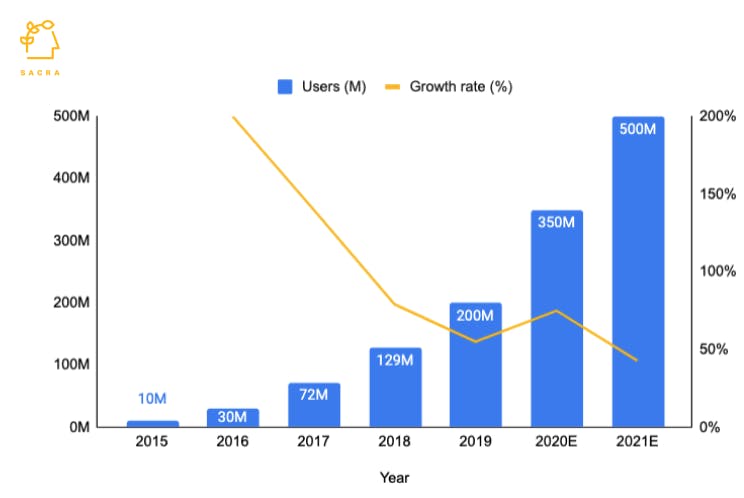

Starting as a white-label account linking service, Plaid transitioned to a consumer brand by putting its logo on the bank linking experience inside fintech apps, creating a Visa-like 3-sided network of 500M customers, 11,000 banks, and 2600 fintechs. As more customers see Plaid’s logo, they become more comfortable with sharing their login credentials with it, improving sign-ups, even though the underlying process is somewhat hacky.

Plaid indexed on the rapid growth of consumer fintechs and added 500M bank accounts in the last 6 years, growing 90% annually, which attracted other fintechs who could easily onboard these large numbers of customers by using Plaid, rather than competing services.

Competition

Data aggregation is getting commoditized with Plaid, Yodlee, and MX ($1.9B) building proprietary connections with only top 500 - 1000 banks while outsourcing development to offshore software companies or reselling connections from other data aggregators for the long tail of 11,000+ banks. That’s why there’s a huge overlap between the banks supported by data aggregators, and even if a fintech uses two or more aggregators, they don’t get massive net new coverage.

New startups offer alternative ways to get bank data. For instance, Venice is building a Segment-like aggregator of aggregators, pulling data from Plaid, Yodlee, MX, and others that fintechs integrate through a single API, saving them from building individual connections with multiple data aggregators. Another startup, Front (raised $6M), is building APIs to pull real-time investment data from brokers, exchanges, crypto-wallets, and custodians.

Plaid faces other headwinds – Large banks like Capital One, JP Morgan, and Wells Fargo force Plaid to pull data through APIs but surface bare minimum information like 90 days transaction history without any metadata, eroding Plaid’s flexibility of pulling whatever it wants through screen scraping. Another headwind is the rise of payroll API companies like Pinwheel ($500M), Argyle (raised $77M), and Atomic (raised $68M), which Plaid’s customers like Cash App are using to pull money directly from customer’s payroll accounts rather than their bank accounts, reducing their usage of Plaid.

TAM Expansion

With growth from its core data aggregation product saturating, Plaid’s future upside comes from selling new products to its 2600 fintech customers and 500 million linked bank accounts, representing 40% of US bank account holders. Plaid launched new products in two key categories - income and payroll verification, and ACH payments.

Income and payroll verification

Plaid is making a push into connecting fintechs with their customers’ payroll accounts by plugging into payroll providers like ADP and Paylocity. By bundling employment history and income details from payroll providers with the banking history of the 500M linked accounts, Plaid can get an edge over the other income verification API startups. Fintechs get the income and spend data from Plaid, making it more useful for underwriting loans, credit cards, or BNPL products.

ACH payments

Plaid’s big bet is to become a Visa-like mediator of a modern Account to Account (A2A) payment network by making ACH payments faster and safer through new products like Signal (fraud risk assessment) and Guarantee (100% promised funds), allowing fintechs to give merchants immediate cash instead of the typical 3-5 day wait for ACH transactions. Plaid aims to attract merchants from its fintech clients like Block (2M+ merchants) to its ACH network with lower processing fees than cards and make money by charging transaction fees.

Risks

Alternative ACH-based payment networks

FedNow from the Fed and The Clearing House’s Real-time Payments (RTP) aim to provide fast ACH-based account to account payment just like Plaid. RTP is already live with large banks like US Bank and Chase, and FedNow is expected to launch in 2023, covering all US banks and can become the dominant network for fast ACH payments rather than Plaid.

Bank and customer relationships

Fundraising

Funding Rounds

|

|

||||||||||||

|

||||||||||||

|

|

||||||||||||

|

||||||||||||

|

|

||||||||||||

|

||||||||||||

|

|

||||||||||||

|

||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.