Revenue

$100.00M

2023

Valuation

$1.15B

2022

Growth Rate (y/y)

35%

2024

Funding

$339.00M

2022

Revenue

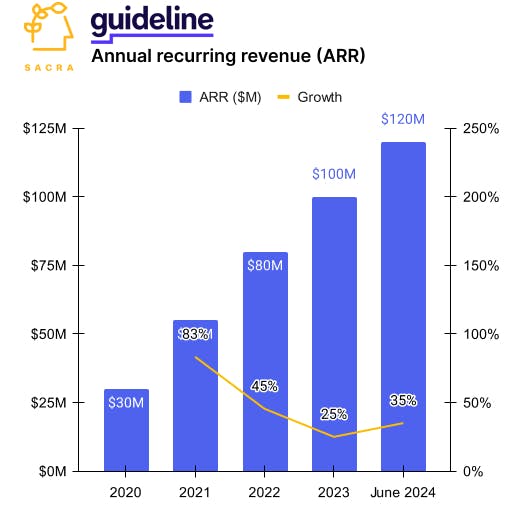

Guideline hit $120M in annual recurring revenue (ARR) in June 2024, up 35% year-over-year, after crossing $100M ARR at the end of 2023.

As of June 2024, Guideline has $13B in assets under management (AUM), up roughly 55% year-over-year.

Guideline serves more than 50,000 businesses with more than 1 million employees in total.

Valuation

Guideline has raised $356M across 6 funding rounds. Key investors in the company include General Atlantic, Tiger Global Management, and Generation Investment Management. While the company's current valuation is not publicly disclosed, Guideline has maintained consistent investor interest, with notable venture capital firms like Felicis Ventures and Greyhound Capital participating in their funding rounds.

Business Model

Guideline makes 95% of its revenue from subscriptions to its SaaS platform, for which Guideline charges businesses between $49 and $129 per/mo, plus $8 per/mo per active participant.

An additional 5% comes from charging 0.08% per year on all of the AUM they manage—significantly lower than the 1% to 2% of AUM on which traditional 401(k) providers make their money.

Guideline’s initial product-market fit came from selling into VC-backed tech startups like Plaid with large numbers of high-earner employees banking substantial amounts of money into retirement programs. These kinds of startups were inclined to adopt and pay for a new SaaS product like Guideline given the potentially great savings of switching from an AUM-driven model to a subscription-driven model.

Guideline also charges a fee for its Guideline IRA product, which allows individuals to invest in their retirement outside of their employer-sponsored plan. The fee for this product is $8 per month.

By charging a flat fee, Guideline is able to offer its services at a lower cost than traditional 401(k) providers, also making it more accessible to small businesses and individuals who may not have large amounts of assets under management.

Product

Guideline's software-as-a-service (SaaS) product is a cloud-based platform that provides small and medium-sized businesses with a 401(k) retirement plan solution, featuring easy setup, automated administration, low-cost investments, and a user-friendly interface for employees to manage their retirement accounts.

Guideline handles filing all the standard annual reports, including Form 5500 and 1099-R. They process transactions and execute trades, do all the necessary compliance testing, and act as the overall record keeper of the 401(k) plan, from deferrals to balances to transactions.

Individual employees can get access through the Guideline app to various educational resources, like investing webinars, portfolio recommendations, and live support.

Competition

Guideline operates in the 401(k) plan provider market, competing across three main categories: traditional providers, robo-advisors, and tech-enabled 401(k) startups. Within this landscape, Guideline has positioned itself as a low-cost, tech-forward solution targeting small businesses.

Traditional 401(k) Providers

The 401(k) market has long been dominated by large financial institutions like Fidelity, Charles Schwab, and John Hancock. These incumbents offer comprehensive retirement services but often struggle to serve small businesses cost-effectively. Their plans typically involve complex fee structures, including asset-based fees and additional charges for services like recordkeeping and administration.

Guideline differentiates itself from traditional providers through its transparent, flat-fee pricing model. Unlike percentage-based fees that grow with account balances, Guideline charges a fixed $500 setup fee and $8 per employee per month. This approach can result in significant cost savings, especially as assets grow over time. For example, a five-person company with $100,000 in total assets would pay just 0.53% annually with Guideline, compared to over 1.2% with many traditional providers.

However, Guideline's simplified approach may not suit larger companies with more complex needs. Traditional providers still hold advantages in offering personalized service, broader investment options, and handling intricate regulatory scenarios like mergers or acquisitions.

Robo-Advisors Entering 401(k)

Established robo-advisors like Betterment have expanded into the 401(k) space, leveraging their existing brand recognition and automated investment technology. These players bring a tech-forward approach similar to Guideline's but with the added benefit of integration with their individual investment platforms.

Betterment for Business, for instance, charges about 1.1% for a plan similar to Guideline's offering. While higher than Guideline's fees, Betterment argues its value proposition includes broader financial wellness tools and the ability for employees to seamlessly manage both individual and 401(k) investments on one platform.

Guideline counters this by focusing solely on employer-sponsored plans, allowing for a more specialized product. Its lower fees and purpose-built 401(k) platform may appeal to cost-conscious small businesses that prioritize simplicity over a full-service financial wellness suite.

Tech-Enabled 401(k) Startups

Guideline faces direct competition from other venture-backed startups aiming to modernize small business 401(k) plans. Companies like Captain401 (now Human Interest) and Honest Dollar (acquired by Goldman Sachs) share Guideline's mission of making retirement plans more accessible to small businesses through technology.

In this category, Guideline stands out for its fully vertically integrated approach. By building its entire technology stack in-house, from recordkeeping to administration, Guideline can offer lower fees and maintain greater control over the user experience. This contrasts with some competitors who may rely on third-party providers for certain functions, potentially leading to higher costs or less seamless integration.

Guideline's growth strategy heavily leverages partnerships with payroll providers and HR platforms. Its exclusive integration with Gusto, a popular small business payroll service, provides a significant distribution advantage. Similarly, partnerships with Square and ADP expand Guideline's reach to a broad small business customer base.

However, competitors are also pursuing similar strategies. For example, Human Interest has partnered with Rippling, an HR platform, to offer integrated 401(k) services. The effectiveness of these partnerships in driving customer acquisition and retention will be a key factor in determining market share among tech-enabled providers.

TAM Expansion

Guideline is well-positioned to capitalize on several key tailwinds in the 401(k) and retirement savings market:

Horizontal expansion

Guideline has line of sight into all kinds of tax-advantaged retirement savings vehicles that do not require a mandated middleman—like the IRA, SEP, and HSA markets.

There are various markets where the government’s involvement in regulating it—like the market for 529 college savings plans—means that the economics are unfavorable for a company like Guideline to get involved. If Guideline were to get into the 529 market, for example, they would have to pay each state 25-50 basis points for nothing.

They’ve also expressed interest in exploring adjacent opportunities in wealth management, estate planning, and retirement events where they can help people further protect their earnings. For now, however, their primary focus remains on the 401(k) market.

Catching up to Fidelity & Vanguard

Guideline today is at about $120M ARR serving 1M individual plan participants. That said, Fidelity 401(k) serves 22,000 employers representing 32M+ individual employees. All in all, when it comes to how many individual people’s retirement accounts they serve, Guideline is just 1.5% the size of Fidelity.

The distinction between Guideline’s traction and the total 401(k) market is even more striking when comparing AUM.

In total, as of June 2021, 401(k) plans held $7.3 trillion in assets—about 20% of the overall $37.2 trillion US retirement market. Guideline has roughly $13B on the platform, or about 0.1% of that 401(k) total.

Risks

Reliance on payroll providers: Guideline relies heavily on partnerships with payroll providers for customer acquisition because Guideline needs the kind of clean data that comes from a pay stub in order to do the data-intensive work of managing a 401(k) plan.

If those payroll providers were to their offer 401(k) plans, it might put payroll providers at odds with 401(k) providers like Guideline and shut that distribution channel down.

Funding Rounds

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.