Revenue

$616.00M

2023

Valuation

$12.60B

2023

Growth Rate (y/y)

74%

2023

Funding

$1.40B

2023

Revenue

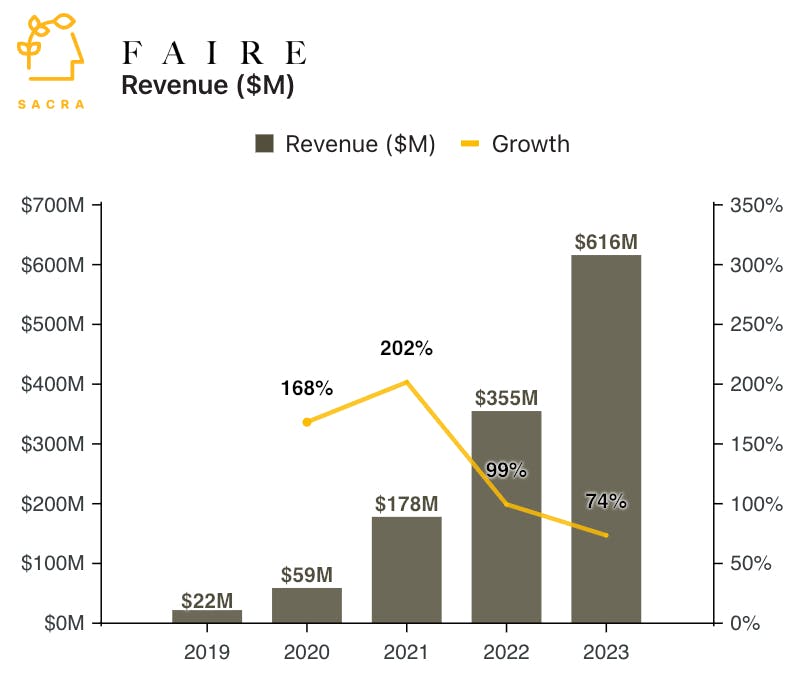

Sacra estimates that Faire generated $616M in revenue in 2023, up 73% year-over-year from an estimated $355M in 2022. This puts Faire's revenue at a 35x multiple of their $12.59B valuation from their Series G extension in May 2022.

Faire's revenue is driven by its gross merchandise volume (GMV), which hit $1B+ annually by November 2021 after tripling year-over-year as pandemic recovery boosted growth. However, GMV growth slowed to ~2x in 2022, with further deceleration in 2023 coinciding with a slowdown in retailer acquisition and layoffs at the company.

Despite this GMV growth slowdown, Faire still achieved strong 73% revenue growth in 2023 due in part to an increase in its effective take rate from ~16.5% to ~19% after implementing changes to its commission and fee structure.

Product

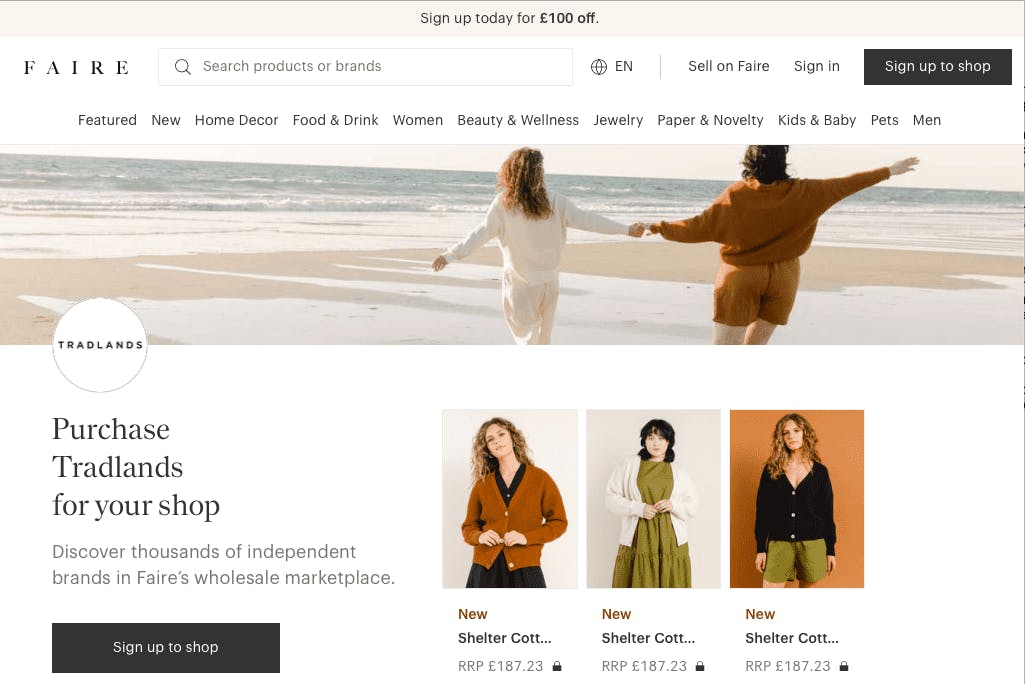

Faire is a two-sided B2B marketplace that connects independent brands with retailers looking to source unique inventory. Brands use Faire to get distribution and working capital, while retailers use it for wholesale purchasing and discovery of differentiated products.

To make its marketplace appealing for both sides, Faire has developed a range of features and service offerings:

60-day net terms: Retailers get 60 days to pay for their orders, providing them with working capital flexibility compared to the typical upfront payments required when ordering wholesale.

Free returns: Faire allows retailers to return unsold inventory for free within 60 days, reducing the risk of trying out new products.

Faire Direct: Brands can send custom links to retailers to place their first order on Faire. These orders are commission-free for brands, incentivizing them to drive demand to the marketplace.

Brand Portal: Brands get access to a dashboard with real-time data on their sales, orders, and account balance. They can also create custom linesheet links and order forms to share with retailers.

Faire Showrooms: Faire operates physical showrooms in major cities where retailers can discover and order products from brands on the platform. This blends the online and offline wholesale experience.

Faire Payments: Faire offers a checkout system for retailers to pay for their orders. Brands can choose to receive payouts in as fast as a day or up to 60 days, with lower payment processing fees for longer payout terms.

Faire is also investing in machine learning-driven product recommendations and search functionality to help retailers discover relevant brands and products as the marketplace scales. The company is exploring an expansion into software tools that would power various aspects of retailers' operations, such as inventory management, opening up new opportunities beyond its core marketplace offering.

Business Model

Faire makes money by taking a commission on each transaction between brands and retailers on its platform.

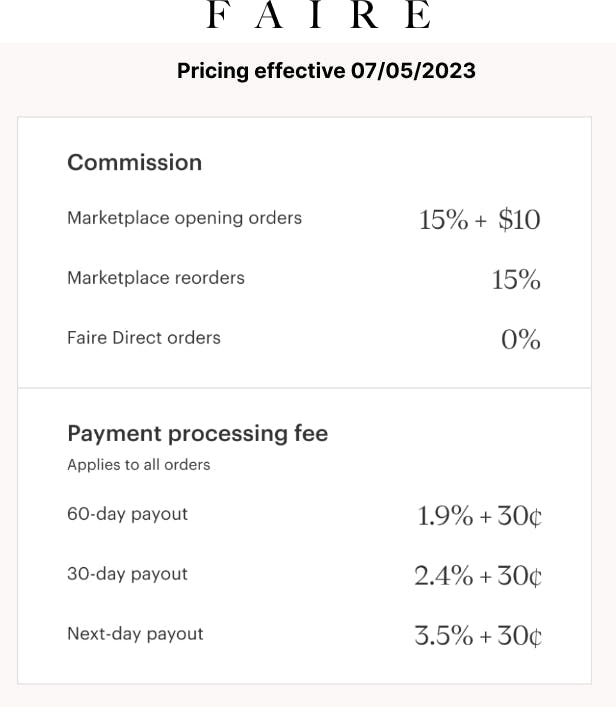

Faire's commission structure incentivizes brands to join and drive demand to the marketplace. When brands get retailers to place their first order through a custom Faire Direct link, Faire takes 0% commission on those orders.

For other orders, Faire charges brands a base commission of 15% plus payment processing fees ranging from 1.9% to 3.5% depending on the payout terms (e.g., 60-day vs. next-day). There are also flat fees of $10 for opening orders from new customers and 30 cents per payment.

This commission structure allows Faire to offer retailers appealing terms like 60-day net terms and free returns. Retailers sourcing inventory through Faire get working capital flexibility compared to the typical upfront payments required when ordering wholesale. Faire pays out brands quickly, within a day or a month, helping them manage cash flow.

As Faire has scaled to over 800K retailers, it has focused heavily on tactics to retain them and increase their purchasing.

Competition

Faire's key competitors in the B2B wholesale marketplace space are European startups Ankorstore and Qogita, as well as Etsy, which has its own wholesale business.

While Faire has rapidly expanded its international presence, entering the UK in 2021 and subsequently launching in 16 other European countries and Australia, Ankorstore and Qogita have a strong foothold in the European market.

However, Faire's revenue scale and geographic reach is at least twice as large as these competitors, with a presence in over 100 countries worldwide.

Ankorstore, based in France and founded by former Etsy employees, has been growing quickly, with GMV increasing by over 900% in 2021. However, Faire's large base of 800K+ retailers creates strong network effects and makes it difficult for competitors to catch up, even with aggressive discounting.

Etsy, known primarily for its consumer-facing marketplace, also has a wholesale offering that connects small batch manufacturers with retailers. While Etsy Wholesale can be considered a competitor, its B2C roots mean it has a different focus and business model than Faire.

TAM Expansion

With Faire's ongoing emphasis on expanding and monetizing its retailer base of 800K+ stores, the company has multiple levers it can pull to continue driving revenue growth even if GMV growth moderates further.

Expanding retailer growth and wallet share

Faire's primary focus has been on attracting and retaining a large base of retailers, which it considers its core competitive moat. With 800K+ retailers on the platform as of 2023, Faire is now seeking to grow revenue and expand its total addressable market (TAM) by increasing wallet share among these existing customers.

One key lever for driving increased purchasing is improving product discovery and matching. By leveraging machine learning to serve highly relevant brand and product recommendations to retailers, Faire aims to boost order frequency and volume. The company is also exploring offering net-60 payment terms and local exclusivity deals to further incentivize retailer loyalty and spending.

SaaS for retail operations

A significant TAM expansion opportunity for Faire lies in moving beyond its core marketplace offering and into software tools for retailers' operations. By providing solutions for wholesale purchasing, inventory management, and other backend needs, Faire can capture a larger share of retailers' overall spending.

This shift towards a more comprehensive platform offering mirrors the "all-in-one" trend seen across various SaaS verticals. For Faire, this could involve building or acquiring tools that automate various aspects of running an independent retail business.

Geographic expansion and new verticals

Faire has aggressively expanded its geographic footprint, entering 17 countries across Europe and Australia within two years of its UK launch in 2021. The company now hosts brands from over 100 countries worldwide. Continued international growth, particularly in large markets like Asia and Latin America, represents a significant opportunity to expand Faire's TAM.

In addition to geographic expansion, Faire may also explore entering new retail verticals beyond its current focus on independent brands in categories like home goods, apparel, and beauty. By catering to a wider range of product categories and store types, Faire can increase its total market size and diversify its revenue streams.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.