Revenue

$600.00M

2023

Valuation

$15.20B

2023

Growth Rate (y/y)

35%

2023

Funding

$1.00B

2023

Revenue

By the end of 2023, Discord hit $600M in annually recurring revenue (ARR), growing 35% year-over-year, last valued at $15.2B or a 25x multiple on their current revenue.

Compare to Reddit (NYSE: RDDT) at $804M in revenue in 2023, growing 20% year-over-year, valued at $8.87B for a 11x multiple on revenue and with $1.87 ARPU, and Snapchat (NYSE: SNAP, $14B) at $4.60B in revenue, growing 0.09% year-over-year, valued at $24.65B for a 5.4x multiple on revenue, with ARPU of $5.75.

Valuation

Discord reached a valuation of $15.20B as of 2023. The company's current revenue multiple is 25.3x, based on 2023 revenue of $600M against its $15.20B valuation.

The company has raised approximately $1B in total funding across multiple rounds. Key investors include Tencent Holdings, Sony, and major venture capital firms like Greylock Partners and Accel.

Other strategic investors include Dragoneer Investment Group, Fidelity Investments, and Franklin Templeton, demonstrating strong institutional backing from both technology and financial sectors.

Product

Launched in 2015, Discord is a communications platform that combined the elements of group text chat, VoIP (Voice over Internet Protocol) group calls, and video calls to give League of Legends/Dota 2/CS gamers a room to hang out in, plus low-latency voice channels to jump into and communicate for live game play.

As COVID forced lockdowns from 2020 to 2021, moving concerts, corporations and companies into digital worlds instead of physical spaces, Discord launched new features like Stages (audio-only communication spaces akin to Clubhouse), Server Video (group video calls similar to Zoom), Scheduled Events (event organization similar to Hopin), and Threads (threaded conversations similar to Slack) to eat up many of those adjacent use cases.

Lastly, Discord integrates with many other platforms and services, including gaming platforms (e.g., Steam), streaming services (e.g., Twitch), and productivity tools (e.g., Trello, GitHub), enhancing its value proposition for different user groups. For example, integration with gaming platforms allows users to display what game they're playing, while integration with productivity tools enables teams to receive updates and notifications directly within Discord.

Business Model

Discord's core services—including text, voice, and video communication, for communities of unlimited size—are offered free of charge. This freemium approach has allowed Discord to attract a large user base, especially among gamers and communities who can create and manage their own servers without any cost.

Where Slack charged companies $7-$13 per-seat subscription SaaS for every team member, killing its economic viability for communities, Discord flipped that model by making servers free and charging end users a $3-$10 per/mo subscription to unlock features in the chat—enabling large communities with a model that could scale to millions of members.

Those additional premium features are unlocked through Discord Nitro, which offers additional features to subscribers. These include enhanced customization options such as custom emojis and a boosted upload limit, high-quality video for screen sharing, priority support, and global access to custom emojis from all the servers a user is part of.

Furthermore, Nitro subscribers can "boost" their favorite servers (a certain number of boosts grants the server access to exclusive perks and customizations), demonstrating a model that promotes both individual and community benefits.

While Discord ultimately has low ARPU ($2.54) that’s comparable to other pseudonymous social products like Reddit (~$1.30) versus what Facebook (~$45) or Instagram (~$35) can achieve via real identity and targeted ads, Discord’s user-supported subscription model enables them to build for their customers and avoid the perils inherent to an ads-based model endemic to large social media sites.

Discord embodies what Elon Musk is trying to build with Twitter (~$10) as a user supported subscription product immune to the pressures of big advertisers to moderate their content.

In addition to the Nitro subscriptions and server boosts, Discord has recently started allowing creators to monetize their servers through ticketed events and member subscriptions, charging a 10% fee on these transactions. This approach allows creators to monetize their content and communities, thus incentivizing them to stay and grow on the platform.

Competition

By virtue of its product expansion over the last several years, Discord competes, directly or indirectly, with numerous companies focused on B2B and B2C communication and collaboration.

Slack is a workplace communication tool offering chat rooms organized by topic, as well as private groups and direct messaging.

Acquired by Salesforce for $27.7B in 2021, Slack launched in 2013 as a Discord-like mashup of business chat functionality and integrations with the playfulness of modern messaging apps including emojis and animated gifs, growing from 0 to 2.3M DAU in 2 years with intercompany communication core to its thesis of replacing email.

Slack originated as a startup-friendly chat tool but has gradually moved upmarket. Today, Discord is competing with Slack to own corporate chat for startups, particularly in cases where startups are building communities around them—owing to Slack’s per-seat SaaS model, Discord allows startups to build these kinds of communities for free where doing so on Slack will cost them at least $7 per seat.

Telegram is a cloud-based instant messaging, videotelephony and voice over IP service with end-to-end encrypted chat.

TAM Expansion

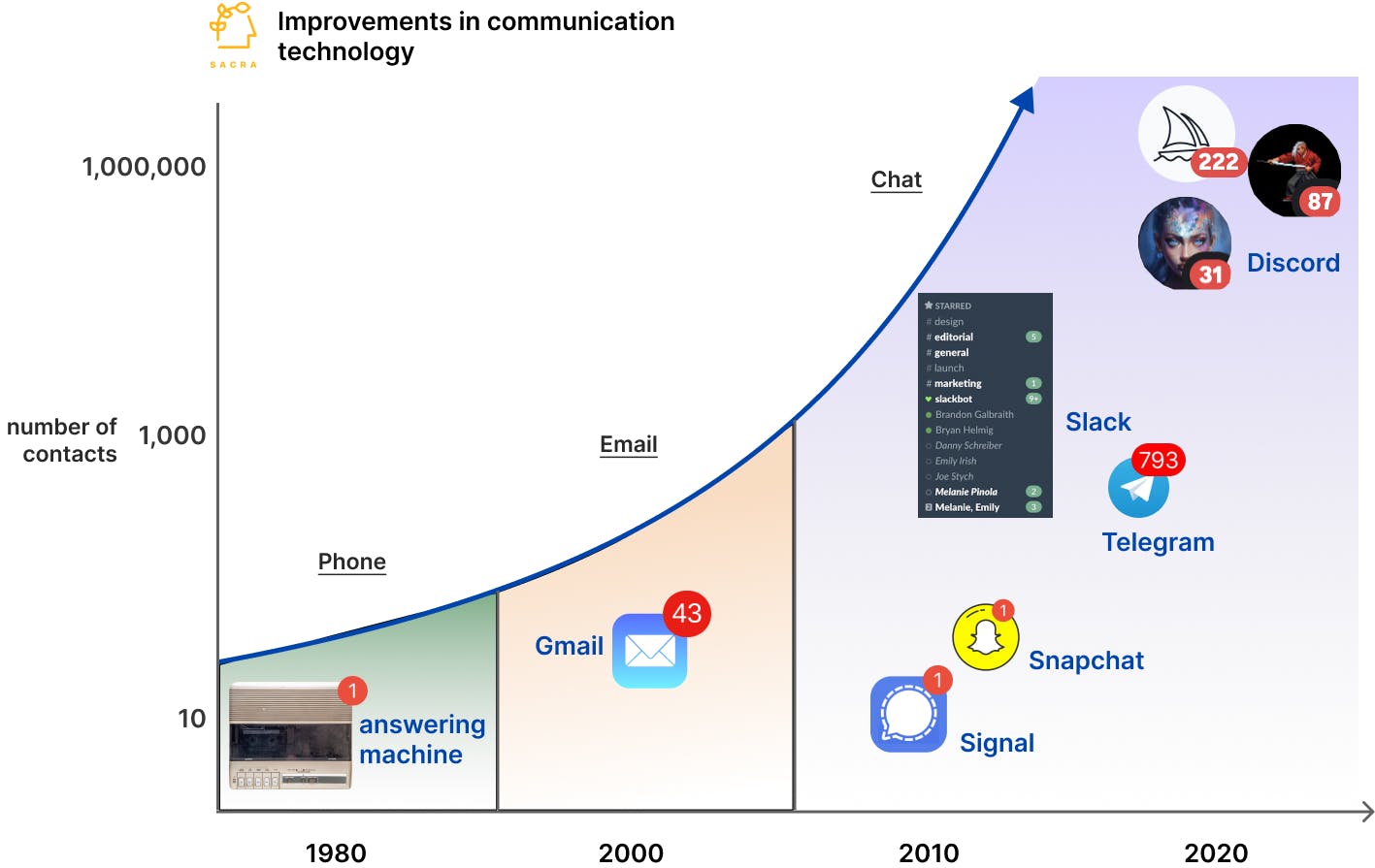

In the early 2010s, text messaging shifted from SMS to rich messaging apps that proved extremely sticky with built-in virality—seeing the launch of WhatsApp (2009), Kik (2010), GroupMe (2010), Signal (2010), Snapchat (2011), MessageMe (2013), Telegram (2013) and Facebook Messenger (2014).

Asian chat apps WeChat (2011, China), Line (2011, Japan) and Kakao (2010, South Korea) featuring stickers and emoticons provided the example for how rich group chat’s engagement and growth could serve as a powerful wedge into building superapps.

During the COVID boom across crypto, Discord built a chat superapp for crypto. The shift from in-person to metaverse served as a huge tailwind for pseudonymous group chat apps like Discord (growing 587% from 2019 to 2021), Telegram (~700M MAUs, growing 47% YoY) and Signal (~50M MAUs, growing 25% YoY) with Discord in the best position to monetize via its subscription SaaS model, as Telegram and Signal only made money from donations.

Having proven its model durable across industries and trends including gaming and crypto, Discord is currently indexing on the upside of its next big tailwind, AI, with AI art generator Midjourney (~$750K in monthly sales) hosted on Discord, as is its 15.6M-strong community (the largest of any Discord server).

The entire Midjourney app experience is baked into Discord, from creating art via DM’ing the Midjourney Discord bot using the “/imagine” command, to payments via subscribing to the Discord server, to consumption of the through the channel feed.

With OpenAI’s ChatGPT reviving the notion of chat as a platform and a wedge into building a superapp, the upside case for Discord and Telegram lies in building a WeChat for the metaverse—the destination app for virtual socializing, gaming, AI apps and more, with payments and apps built into the conversational interface.

Risks

Key risks for Discord from our research:

Monetization and profitability: Even as Discord hit $445M in revenue in 2022, the company lost $66M in earnings before interest. Discord’s losses in Q1’23 were $11M, up from $6M in Q1’22. Discord has shown an ability to monetize its MAUs, but the risk remains that Discord could struggle to monetize them profitably at scale, while layering on additional monetization via advertising could hurt the user experience to the point that users start to leave for other platforms like Telegram.

Content moderation: Discord has value today as a largely-private, unmoderated platform vs. the more heavily moderated spaces of sites like Twitter and Reddit. That said, the platform has been criticized in the past for hosting communities that engage in harassment, hate speech, and other harmful behaviors. Failing to manage these issues could be a problem for Discord from the perspective of regulators, especially with an IPO looming, while managing them could be a problem for Discord from the perspective of its loyal users.

Funding Rounds

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.