Revenue

$108.00B

2023

Valuation

$300.00B

2022

Growth Rate (y/y)

27%

2023

Funding

$9.40B

2022

Revenue

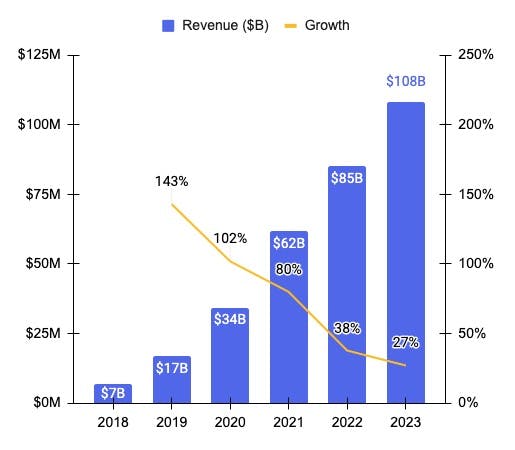

Sacra estimates ByteDance's 2023 revenue at $108B, up 27% from 2022 when they generated $85B.

~90% of ByteDance’s revenue comes from China. Two of the largest revenue components are advertising (~60%) and live broadcasting (~26%) on Douyin. TikTok's advertising and live streaming revenues are ~$5 billion, ~8% of total revenue.

Recent headwinds for ByteDance include COVID as well as significant regulatory crackdowns in China’s internet sector (Tencent’s growth in 2021 slowed to just 13% year-over-year).

By segment

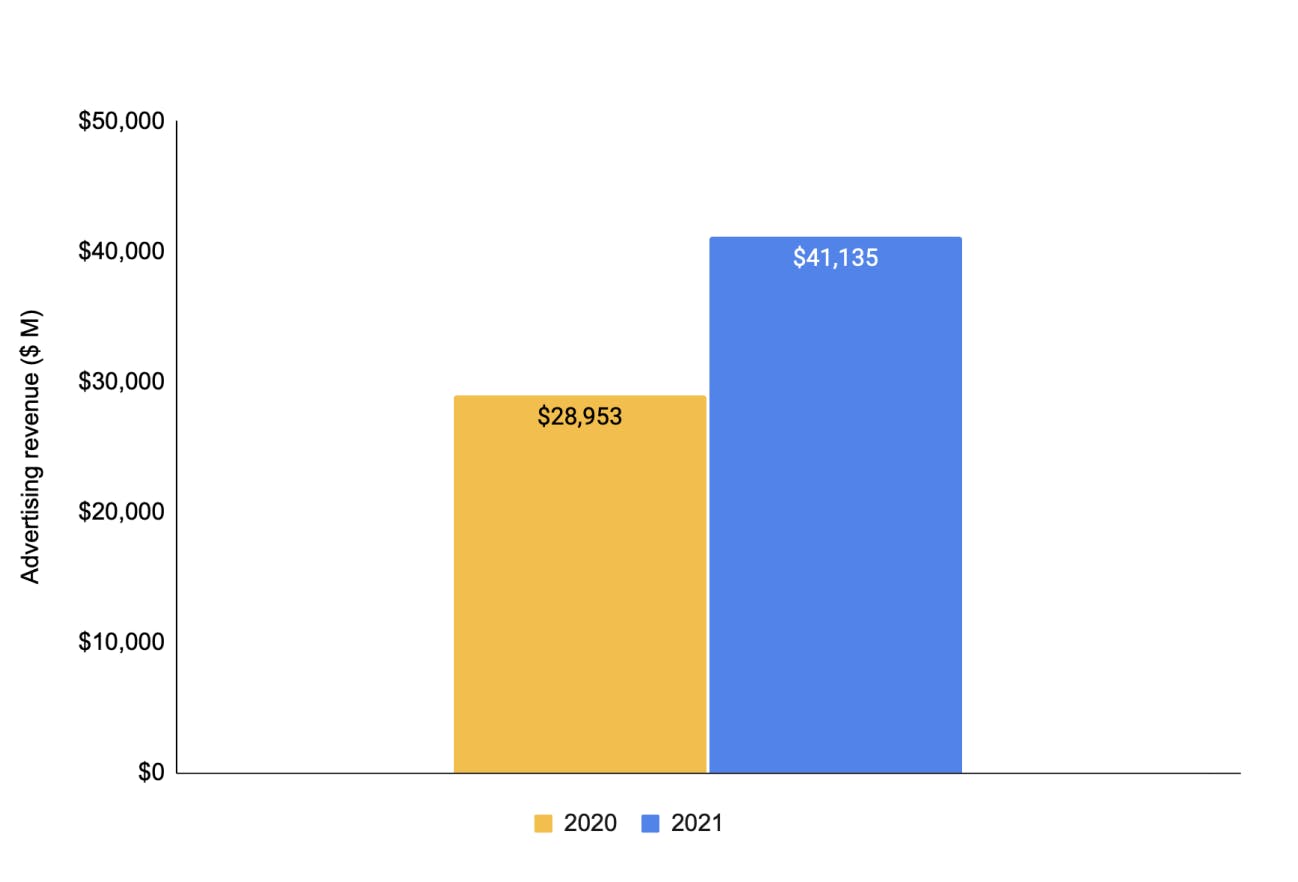

Total ByteDance advertising revenue ($M)

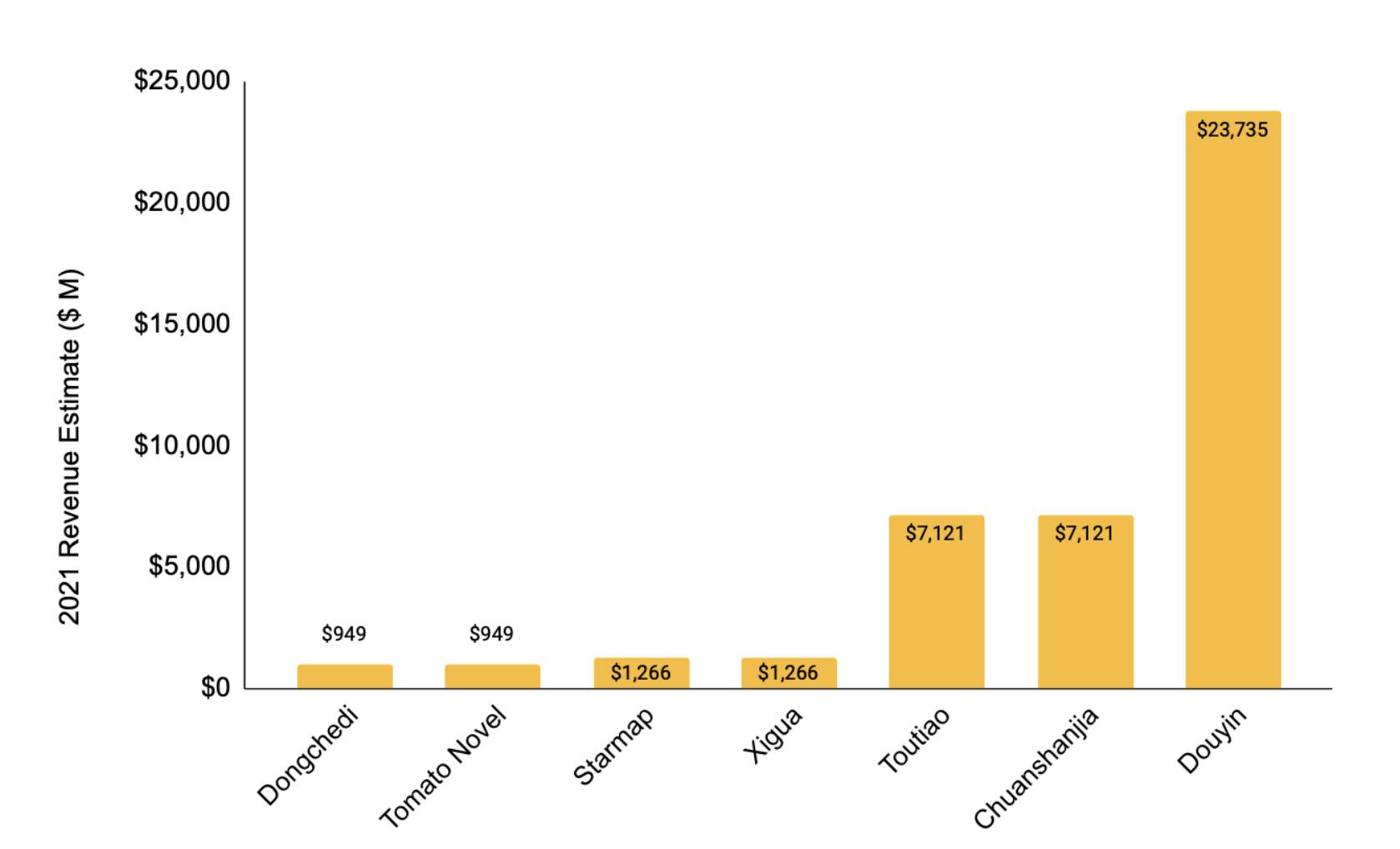

Total ByteDance 2021 advertising revenue targets by product (in $M)

ByteDance expected their advertising revenue to grow about 40% to $41 billion in 2021, with most of that growth coming from their flagship product Douyin (or the Chinese TikTok). Notable from their projections is the inclusion of Tomato Novel, a free online fiction reading app launched in mid-2019 and was already projected to drive at least $1 billion in revenue in 2021.

Other 2021 revenue estimates by segment:

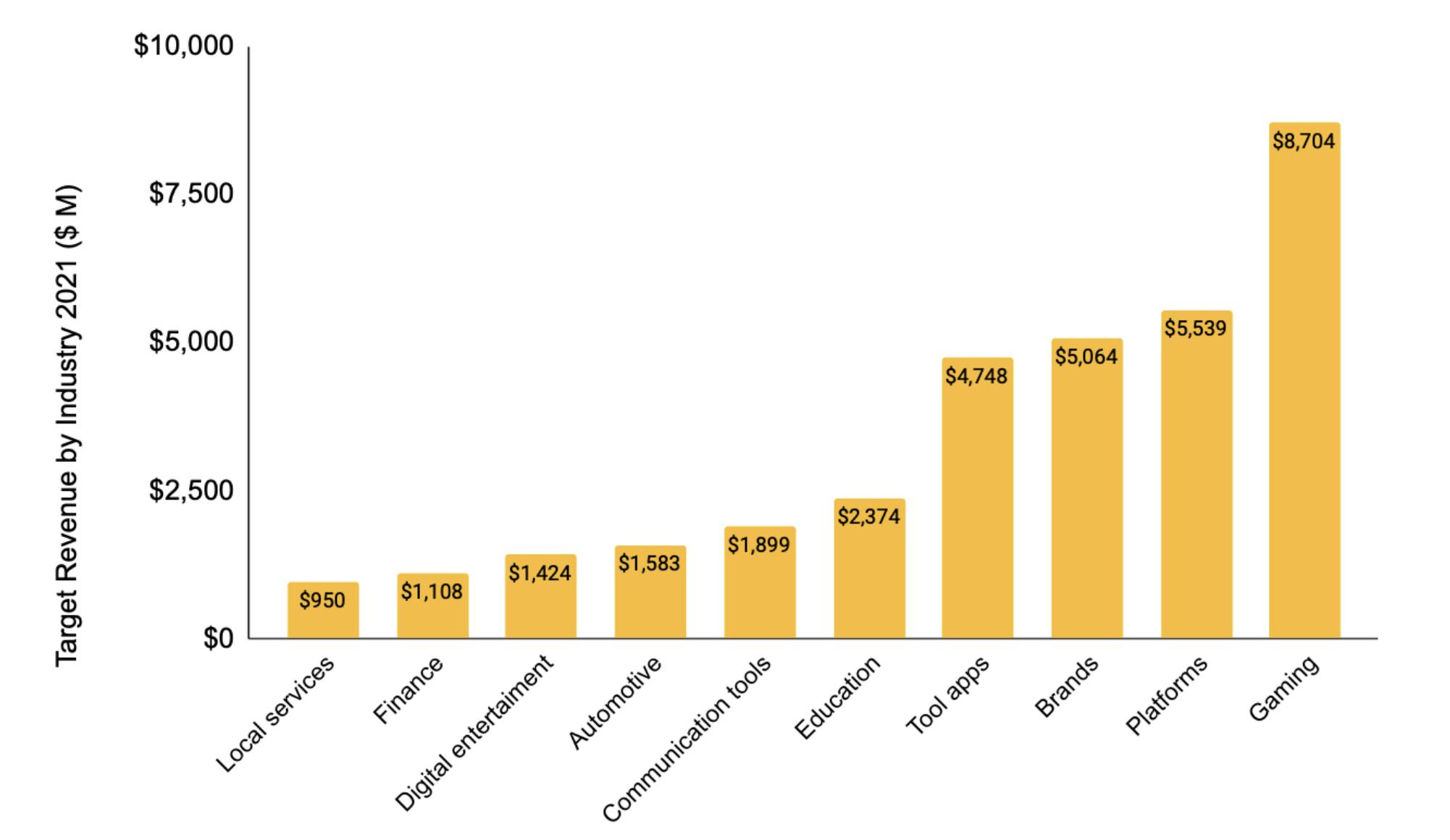

- Education at $2.4 billion, flat from 2020; expected significant negative impacts due to new legislation in China affecting the education market

- Brands at $5 billion, with most of the growth expected to come from brands advertising on Douyin to drive traffic to their stores

- Platform companies at $5.5 billion, driven mainly by growth of spending from Alibaba, up from ~$2.8 billion in 2020

- At $8.8 billion, gaming was ByteDance’s top source of revenue in 2020 as well; projection for the future was for light and mini-games to play a more important role

ByteDance 2021 target revenue by industry of advertiser (in $M)

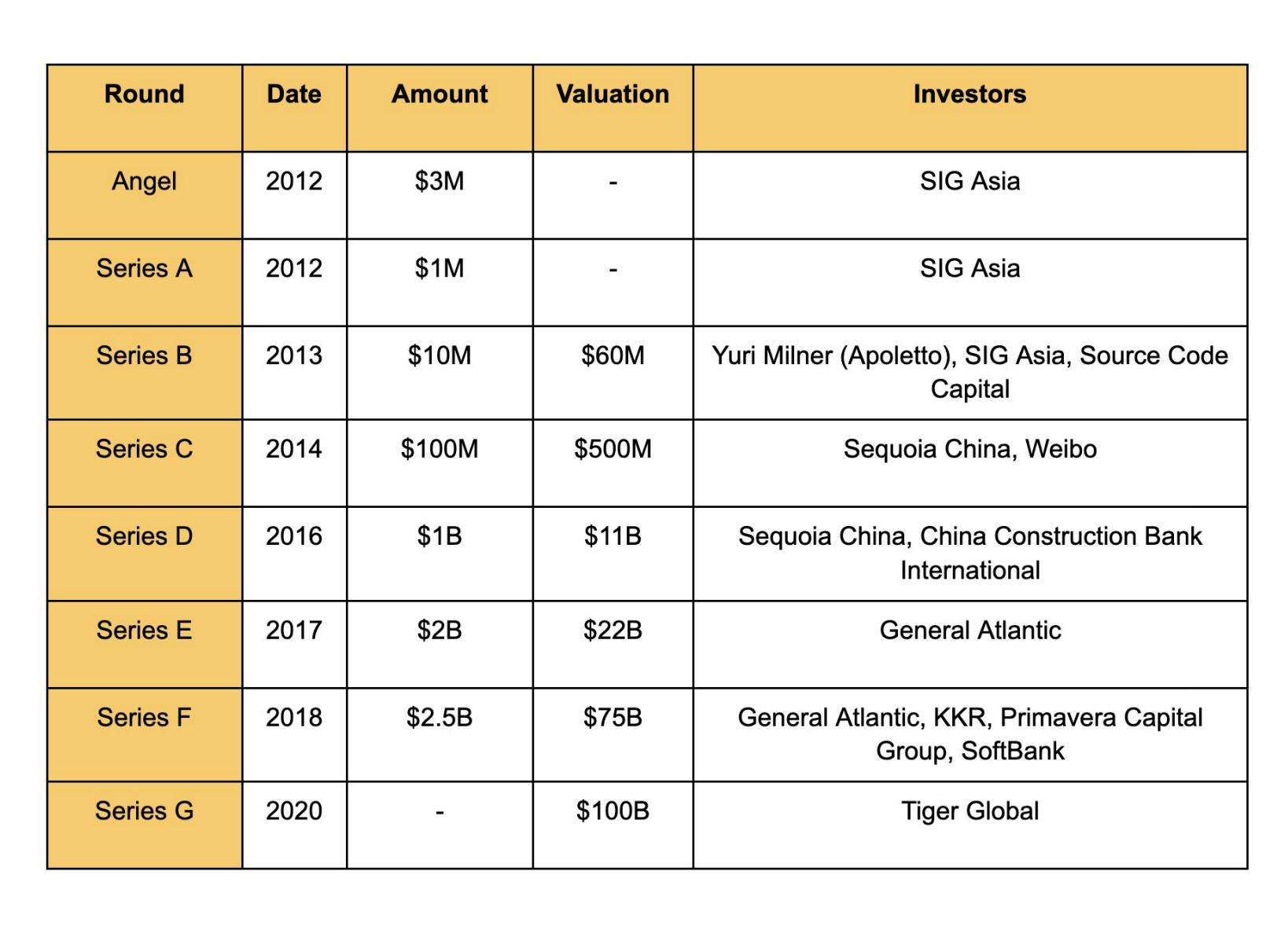

Valuation

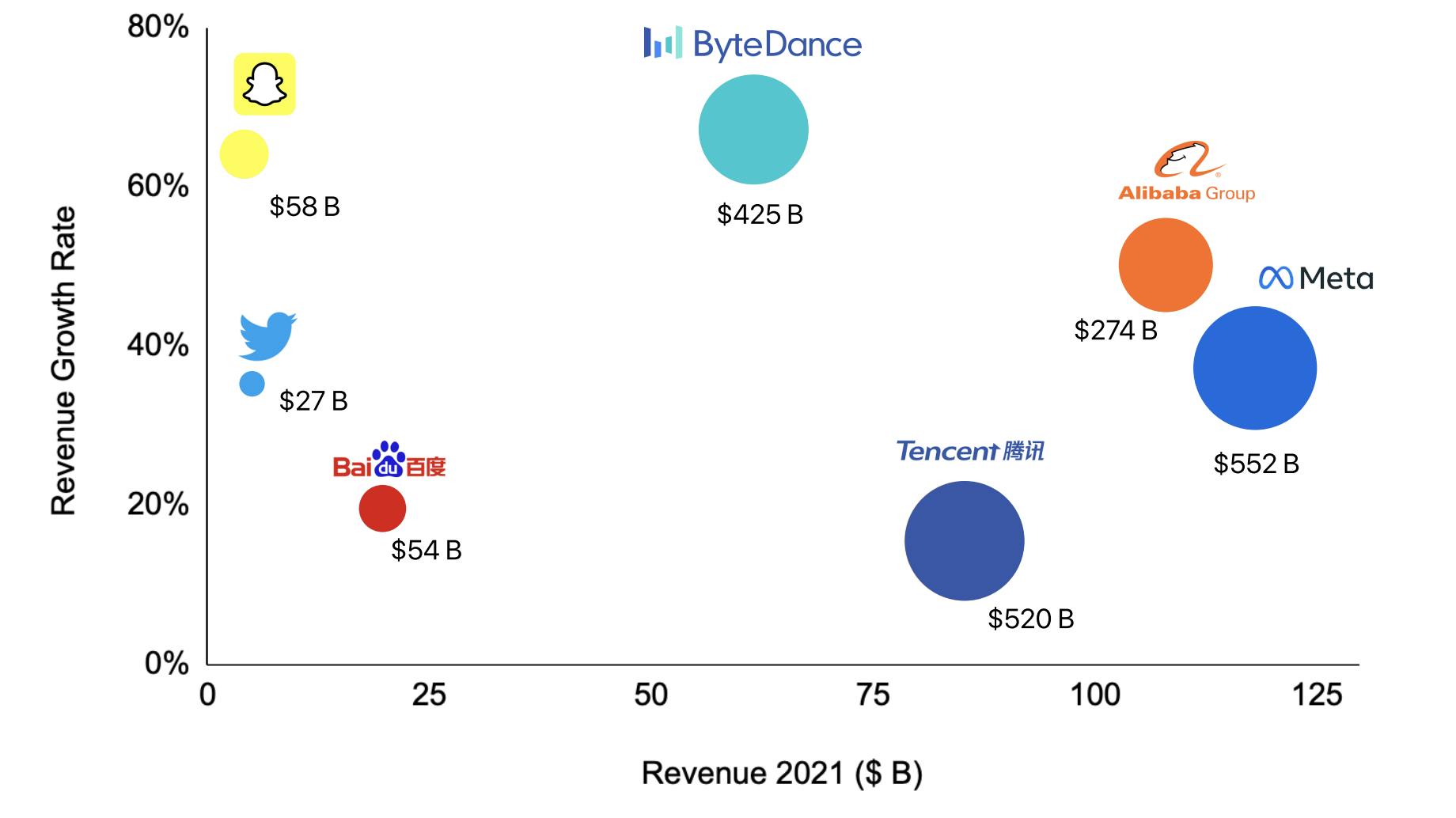

Key social media companies by revenue and revenue growth rate. Bubble size = valuation.

ByteDance was valued at $100 billion in its last funding round in 2020. However, private market transactions peg ByteDance’s valuation to ~$425 billion. Compared to its competitors in China and globally, ByteDance grew the fastest in 2021, even though its competitors, Alibaba and Tencent faced headwinds of COVID and change in regulations. Its market cap/revenue multiple is 2nd highest in this cohort at 6.9, after Snap (14.1). It is interesting to note that even though Alibaba has almost 1.75X ByteDance’s revenue, its valuation is just 2/3rds of ByteDance. One possible reason could be that the changes in Chinese regulations have impacted Alibaba much more than ByteDance thus far.

Product

ByteDance is building an AI factory: a platform of products built around and helping refine the set of machine learning models at the company's center. AI provides powerful cross-network effects, allowing user interest profiles to be built cross-apps. For instance, users' behavior in the news aggregator Toutiao can be used to hyper-target ads on short-form video services Douyin and vice versa. Thus any new app from ByteDance starts with a massive data advantage and can serve highly targeted content and ads to users without a large user base of its own.

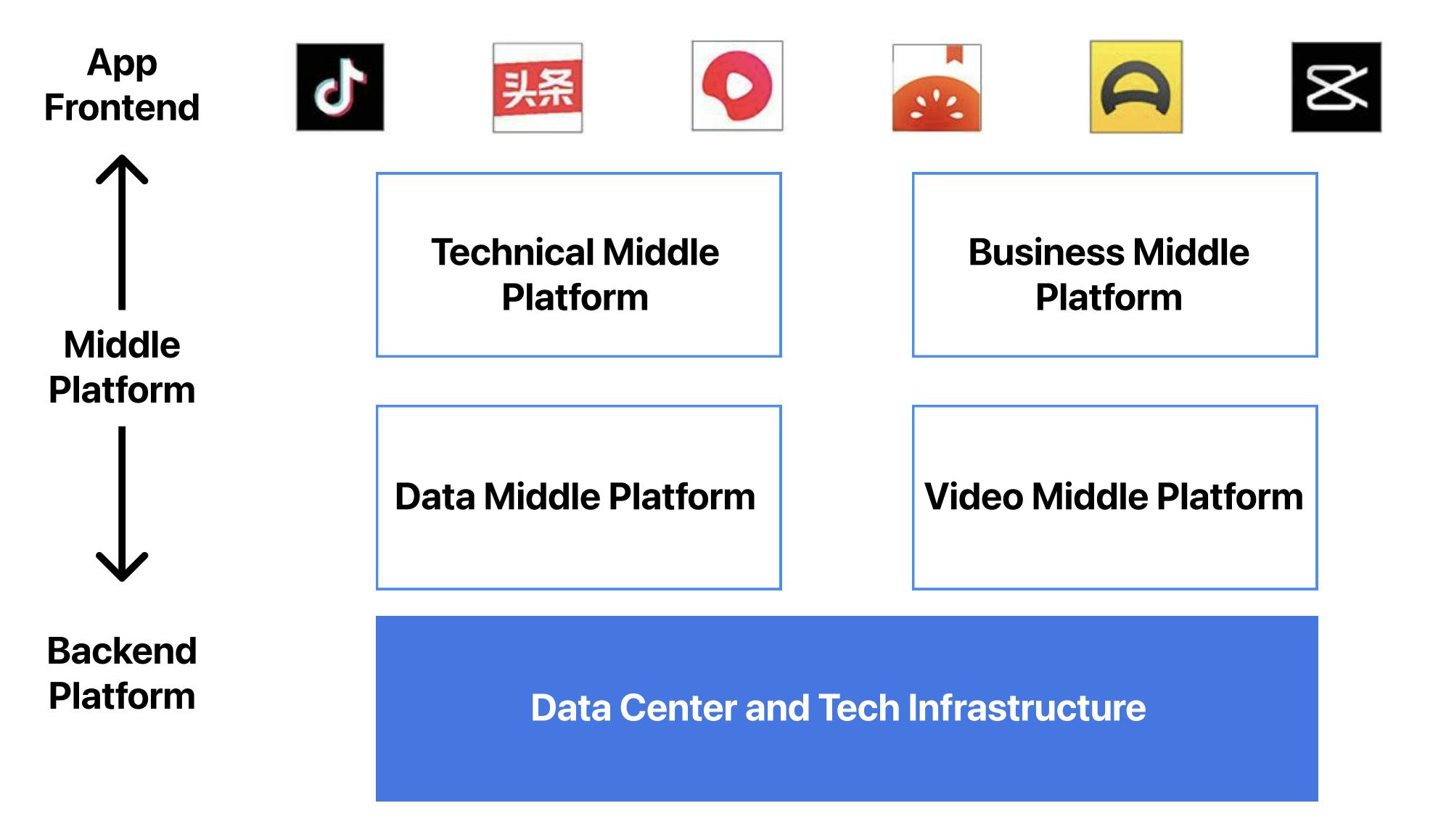

ByteDance enables this through its ‘middle platform’ between the front-end (app) and the back-end (datacenter, tech infrastructure). Middle platform is a pool of resources that includes recommendation algorithms, monetization engine, augmented reality technology, and content classification engine shared company-wide. This provides all apps access to best-in-class technologies and engineering capabilities, significantly reducing time to market and improving odds of success.

Most of ByteDance’s revenue comes from three apps - Douyin, Toutiao, and TikTok. These apps differ from their Western competitors such as Facebook, YouTube, and Snap in two fundamental ways:

- ByteDance’s apps are built grounds-up to drive exceptional mobile experiences. Thus, unlike YouTube or Facebook, it has no technical or cultural debt of desktop consumption. This allows ByteDance to build higher-quality user profiles. For instance, when a user spends 5 minutes on YouTube, they typically watch one video. However, on TikTok, they may end up swiping through 5-10 videos in this duration, providing better signals to the AI recommendation engine.

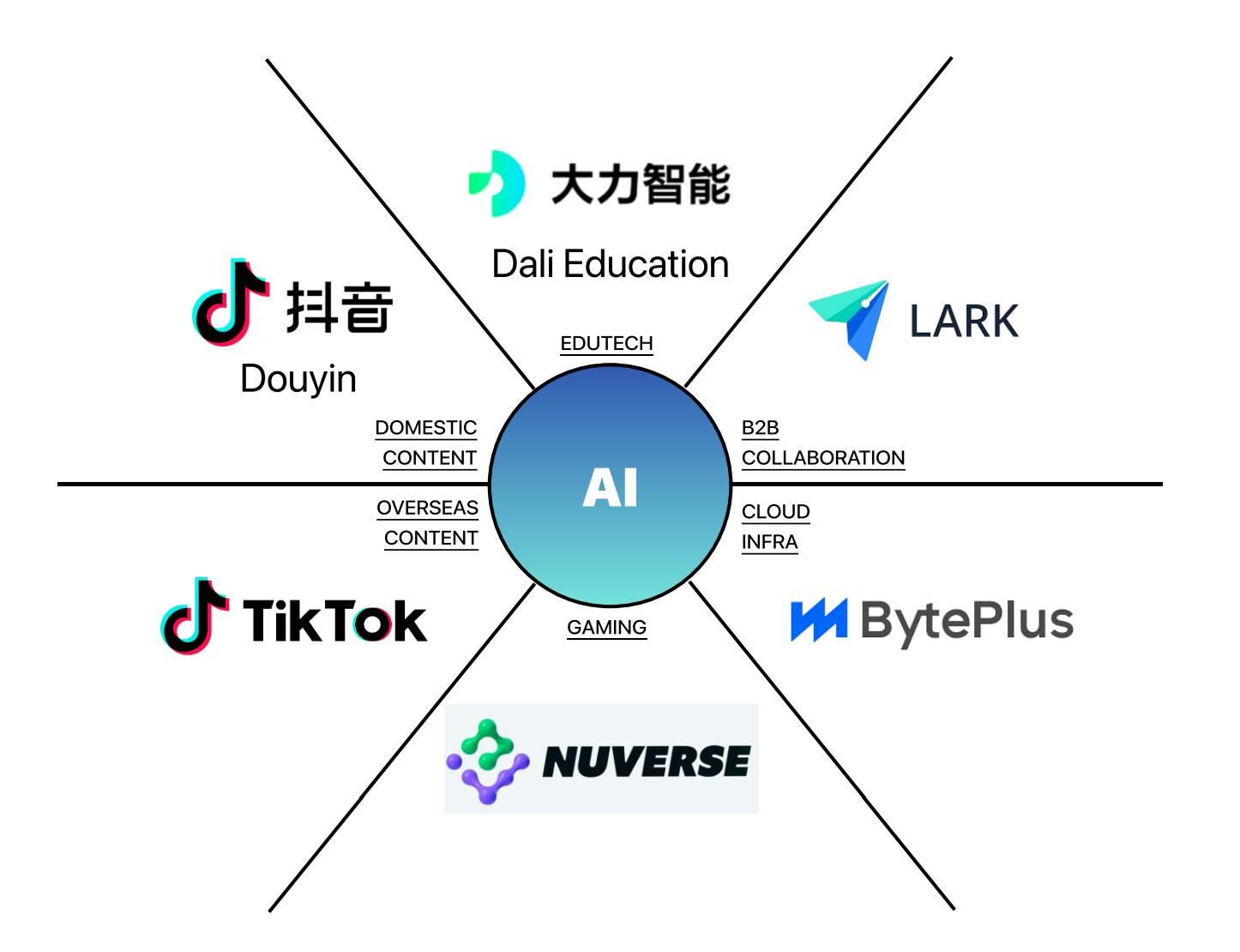

Recently ByteDance reorganized itself into six business units. Toutiao, Douyin, Xigua, and other China-focused apps are under Douyin. TikTok is a separate business unit that encapsulates all businesses outside China.

B2B collaboration app Lark, developed internally to help teams communicate better, and BytePlus, a cloud infrastructure service designed to make ByteDance’s artificial intelligence models accessible to other companies as a service, are separate business units, while ByteDance’s education initiatives such as vocational training, education hardware and campus learning initiatives fold up into Dali Education. All the game development and publishing efforts are under Nuverse.

Product-market fit

ByteDance’s first product, Jinri Toutiao, was launched in 2012. CEO and co-founder Zhang Yiming had seen firsthand the challenges faced by smartphone users trying to use search to find relevant information in China, with Baidu (China’s Google) in particular cramming search results full of ads. He launched Jinri Toutiao (“Today’s Headlines”) with the goal of using artificial intelligence to get highly-targeted content to users.

Toutiao’s growth was anchored to the rise of smartphone usage in China—mobile penetration in the country went from a few percent in 2020 to 65% by 2014. Toutiao’s initial competition was online news outlets like Sina and Sohu that were text-only and optimized for desktop, while Toutiao was one of the first to be intentionally designed for mobile. An influencer campaign and urgent CTAs to share content helped them grow the product to 10 million users in 90 days.

The product itself tracked users’ behavior to figure out what kinds of content to show them next—everything from how long they spend reading a story to where they scroll to and what time of day they’re most likely to read articles—making the platform far stickier for users. The advent of revenue-sharing for publishers, on the flip side, attracted many new creators and companies to the platform.

Over time, that recommendation algorithm and those partner relationships allowed ByteDance to begin parlaying its core competencies into other types of products—the first one being Douyin, the short-video platform that is the Chinese counterpart to TikTok.

Growth cycle

ByteDance’s growth strategy anchors on rapid feature introduction in existing products, isolating the winning feature from the rest, and scaling the feature to become an app, backed by heavy investment in marketing & promotions. This has allowed it to layer the users from different apps on top of existing users, compounding its user growth.

Another driver of ByteDance’s growth is its ability to rapidly scale beyond early adopters and move to mainstream users by constant innovation in features and positioning. For instance, Douyin (and its predecessor, A.me) started by targeting teens through lip-sync, music-based, edgy content. But ByteDance evolved Douyin’s positioning to ‘Record beautiful life’ and made the content library more diverse and neutral to appeal to a larger audience.

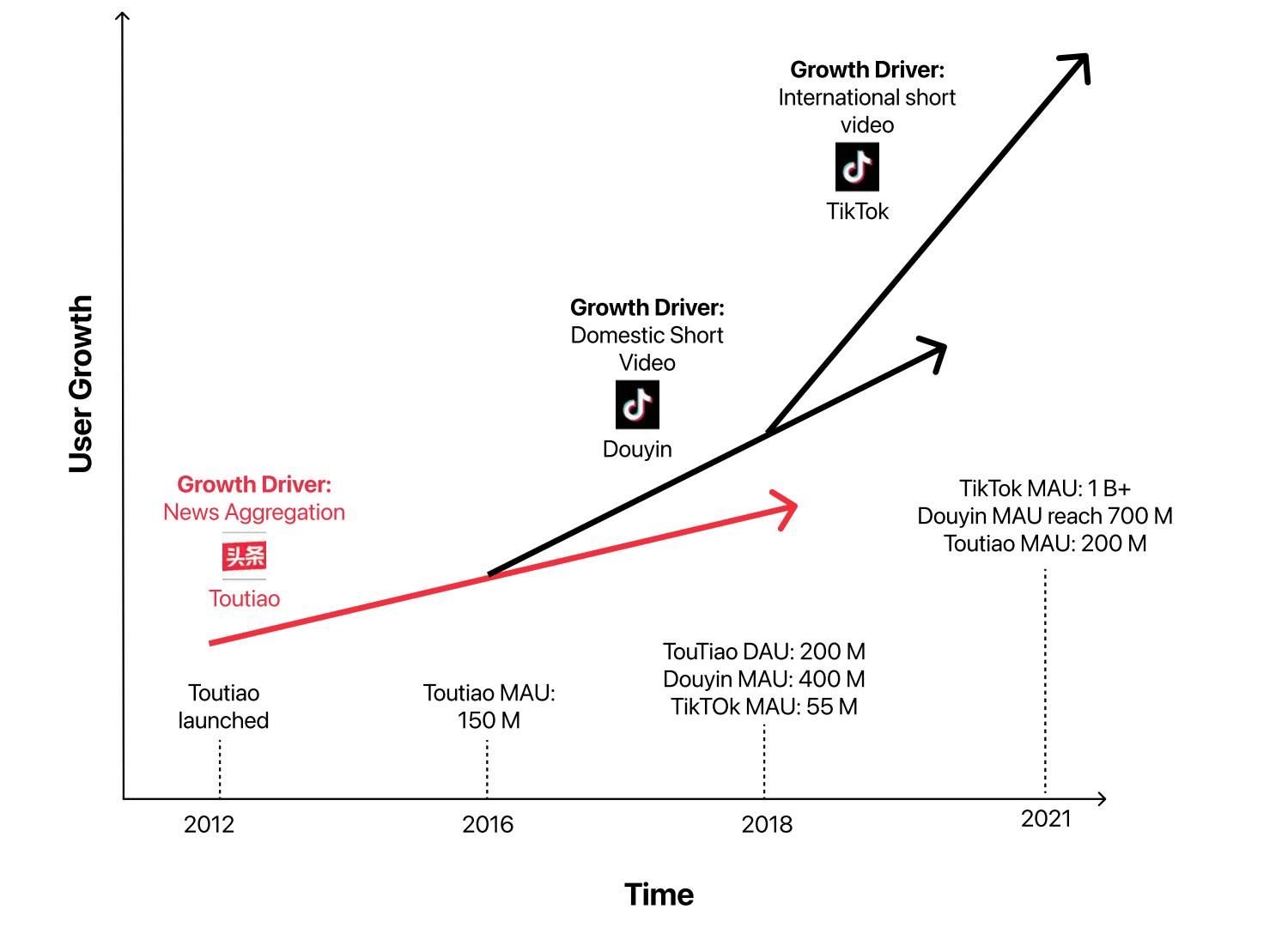

The historical key growth drivers at ByteDance

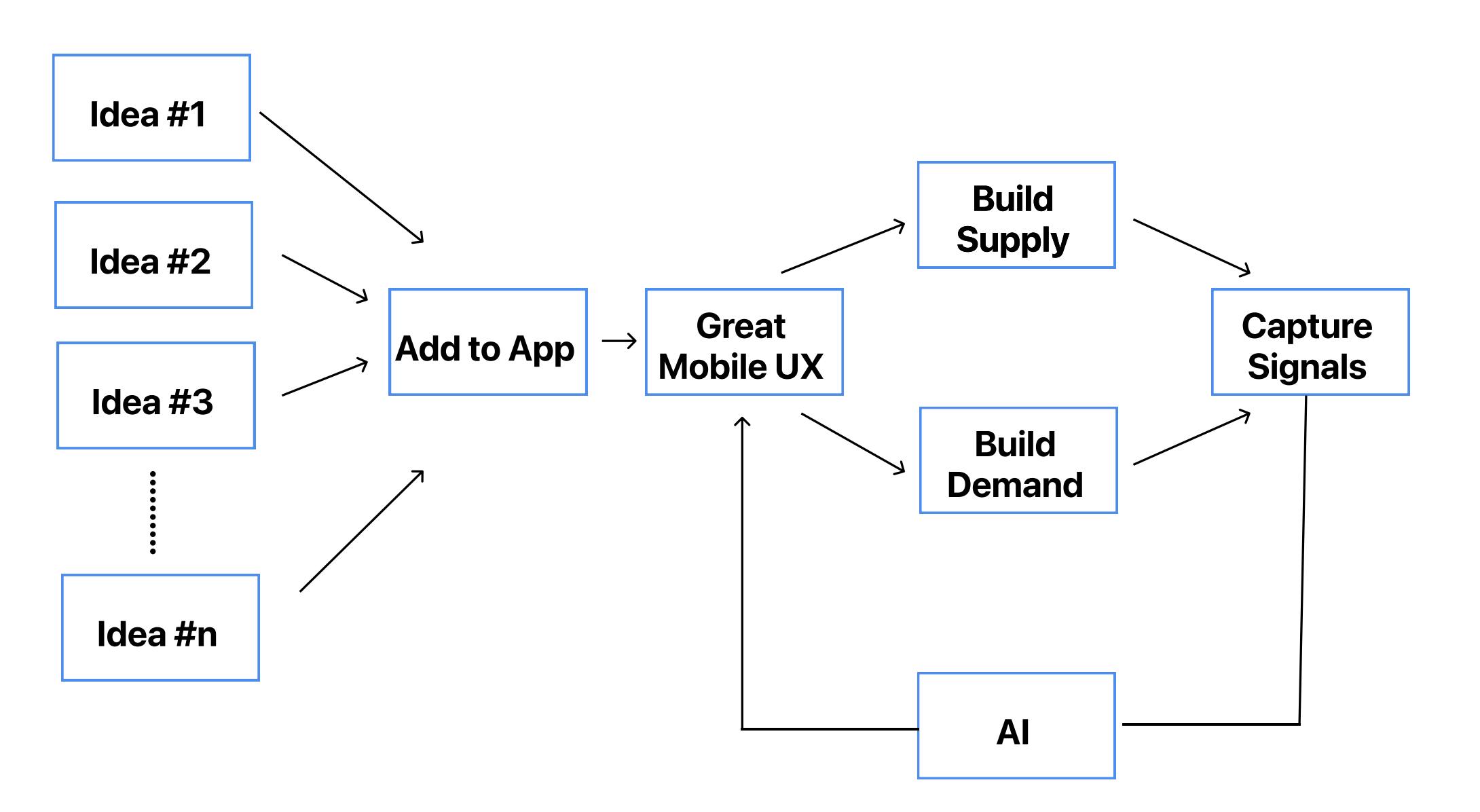

The core playbook for growth at ByteDance looks like this: Adding ideas to app as new features: ByteDance identifies potentially disruptive ideas and adds a number of them to its existing apps. The approach is to find the winner fast, scale the winner and remove the others. This is one reason why the UX of Chinese apps changes frequently. For instance, the short-form video feature was added to Toutiao’s home screen in May 2015, and in 2016, short-form videos were played over 1 billion times daily on Toutiao. This led to the launch of Douyin in September 2016. Building supply: ByteDance builds an early content supply to avoid the cold-start problem. In the case of Toutiao, it scraped web-based news websites and reformatted content for mobile screens. It also partnered with Weibo (equivalent to Twitter in China) influencers to seed the app. When it launched Douyin, its operations team ran multiple paid partnerships - the most prominent Chinese social media influencers, existing video platforms such as Baidu-backed streaming service iQIYI, and fashion events such as Michael Kors catwalk event 2017. Building demand: ByteDance builds demand parallel to supply to provide a high-quality signal to its AI recommendation engine. It uses notifications and share prompts aggressively during sessions. In the case of Toutiao, it allowed users to log in using their Weibo accounts, which it scraped to get early indicators of their interests and social graph. These aggressive tactics allow ByteDance to achieve early solid demand for its apps. Toutiao grew from 0 to 10 million users in just 90 days. Similarly, Douyin grew from 0 to ~2 million DAU in less than a year. Great mobile experience by hyper-targeting content: By building an early flywheel of supply and demand, ByteDance captures large swathes of user behavior data that its AI recommendation engine utilizes to server hyper-targeted content to existing and new users. This improves users’ experience and encourages them to spend more time on the app, providing more data to the AI recommendation engine. Douyin’s 100 minutes per day usage rate is the highest of any global social app; that breaks down further into roughly 80 minutes spent on short videos, 11 minutes spent on live streaming, and the rest on the friends' page, search, messaging, and other screens.

Distribution

Bytedance uses the product-as-distribution strategy to get early traction for its apps. TikTok is one of the best mobile-based short video editing apps that allow clipping, scrubbing, and adding music from a large library. Many early creators used TikTok as a tool than a platform. All videos exported from TikTok have a watermark that further built brand awareness about TikTok and prompted users to search for it.

ByteDance promotes its new apps aggressively in its existing apps by providing them pride of place. This means instant exposure to millions of engaged users.

ByteDance invests aggressively in marketing and partnerships to generate demand. In 2018, ByteDance spent an estimated $3 million daily promoting Douyin in China, leading to rapid scale-up and reaching 150 million DAU in June 2018. In the same year, it spent ~$300 million on Google Ads alone to promote TikTok in the international markets.

Competition

ByteDance faces substantial domestic and international competition across its six primary lines of business. Douyin, for example, competes not only with other content services like Kuaishou and Weixin but with live streaming e-commerce destinations like Alibaba’s Tmall.

Domestic

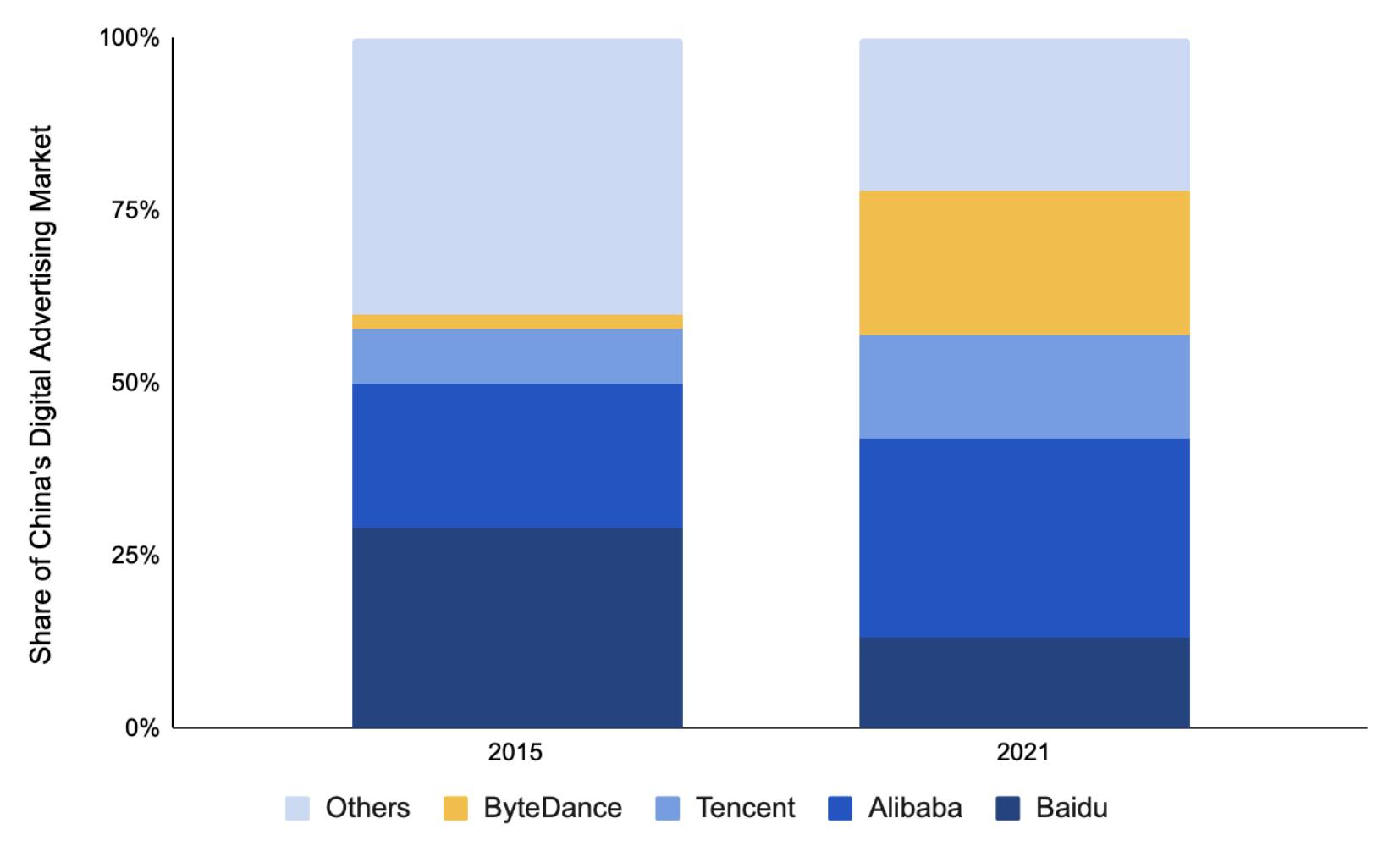

ByteDance competes for advertising dollars with other large players such as Alibaba, Tencent, and Baidu in China. Rapid growth in its user base, a shift in user behavior from search to recommendation for content consumption, and the rise of short video have enabled ByteDance to grow its share of the Chinese digital advertising market from 2% in 2015 to 21% in 2021.

The regulatory environment in China presents additional twists into the competitive landscape. So far, the Chinese government has upended two sectors ByteDance operates in via new regulations: education (where ByteDance operates Dali Education) and gaming (Nuverse). In addition, the Government in China has released draft guidelines to layer stricter rules and compliances on digital advertising platforms. As ~60% of ByteDance’s revenue comes from digital advertisements, regulatory changes could impact revenue.

Share of digital advertising in China by major tech player

Traditionally, the Chinese government has protected domestic players from foreign competition while permitting the development of internal “walled gardens” at Alibaba, ByteDance, and Tencent. In September 2021, however, Beijing ordered the dissolution of these walled gardens—a move that could be a net positive for ByteDance, which has previously sued Tencent over its links being blocked on Tencent platforms WeChat and QQ.

As we progress through the early stages of an apparent transition from semi-market economy to a planned economy in China, the implications on competition could be significant and hard to predict.

International

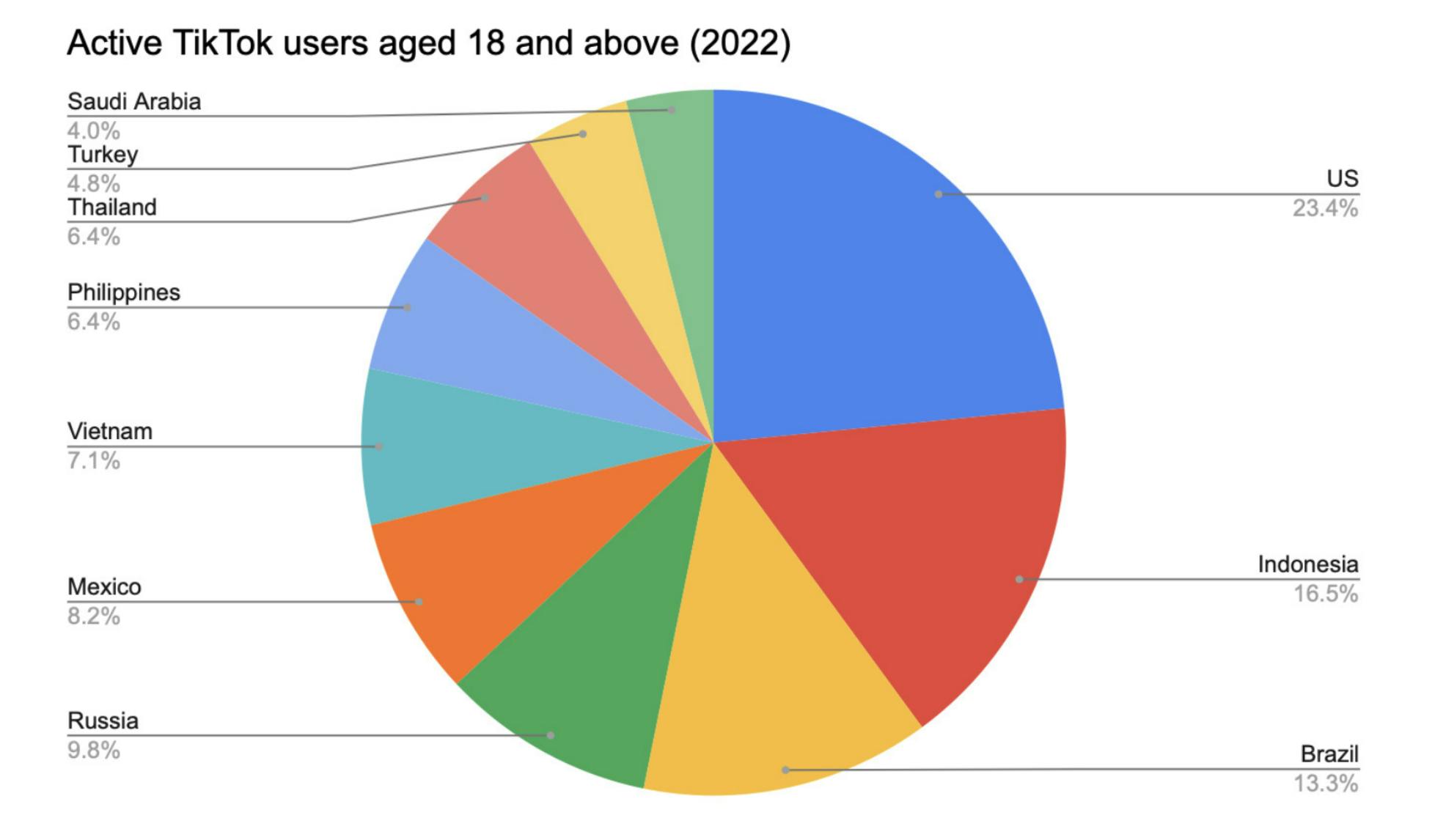

Where TikTok’s users come from

In trying to break into the international market, ByteDance’s main wedge is TikTok. TikTok’s largest markets are the US, Indonesia, and Brazil. While today driving daily usage comparable to that of Snapchat or Instagram, in the United States, TikTok faces the long-term challenge of any consumer app: dealing with upstart competitors and protecting its stranglehold on the attention of younger generations.

TikTok also faces significant regulatory challenges in international markets. It was banned in India (a huge market) last year amidst complaints about the app “stealing and surreptitiously transmitting users' data in an unauthorized manner to servers which have locations outside India." Pakistan, Japan, Indonesia, Australia, and the United States have similarly debated banning the app due to geopolitical concerns.

TAM Expansion

Gaming

ByteDance began accelerating its push into gaming and upping its competition with Tencent in 2021, acquiring game companies Moonton (with its former Tencent founder) and C-4 Games.

Moonton’s Mobile Legends generated ~$900M in revenue from 2016 to 2021, and C-4’s Houchi Shoujo has become one of the best performing mobile games from China overseas.

Tencent still owns more than half of China’s domestic gaming market as of 2020, but gaming is still a big, growing, and lucrative space—the worldwide mobile gaming market grew 25.6% year-over-year in 2020 to hit $86.3 billion.

What makes ByteDance particularly well-positioned to win in gaming is its ability to create cross-app universal interest graphs of its users. ByteDance’s existing domestic (Douyin) and international (TikTok) user base consist of young-skewing audiences who already spend considerable time on its apps. By leveraging the universal interest graphs, it can hyper-target the distribution and promotion of mobile games, increasing the odds of higher downloads and engagement.

Search

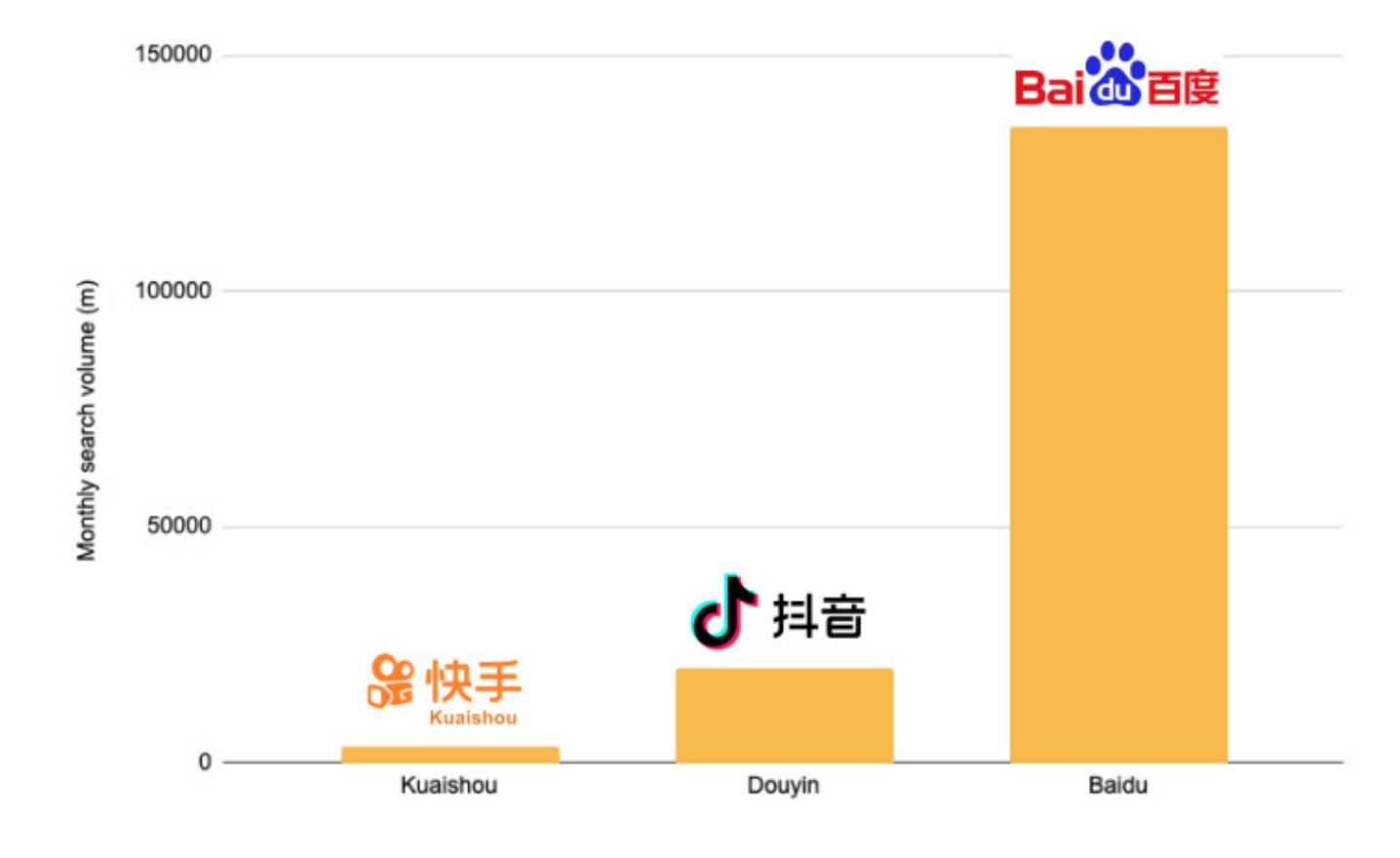

Monthly search traffic (millions of views)

Kuaishou was a fast follower of Douyin in the short video/live streaming space, but the data shows that Douyin is still much further along in driving demand and turning their content into a successful advertising business.

Douyin search traffic is at around 20 billion searches monthly, which is about 6x that of Kuaishou (and 2x in terms of the number of users) but about 1/6 of Baidu, which has about 120-150 billion searches per month.

Growing search is a strong tailwind for Douyin because it siphons traffic away from Kuaishou and allows them greater ability to monetize as the demand for content grows.

How quickly Douyin is leveraging e-commerce and brands to grow search, ultimately, is showing how Baidu (China’s Google) is potentially threatened by ByteDance’s rise.

International

Compared to other international and Chinese apps, TikTok (ByteDance’s main product outside of China) has a user base that is relatively under monetized and represents one of ByteDance’s biggest growth opportunities as a company. Its average revenue per MAU is the lowest in its peer group and much lower than Douyin and Kuaishou.

ByteDance’s focus for TikTok has been to drive user growth rather than monetization. But it has started moving in the direction of increased monetization.

In Dec 2021, rolled out Creator NEXT program to expand the way creators can be compensated for their work. It is also introducing new features such as live gifts, video gifts, and tips. ByteDance can leverage its experience of Douyin to unlock significant value from TikTok’s users.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.