Revenue

$27.00M

2023

Valuation

$11.00B

2021

Growth Rate (y/y)

4%

2023

Funding

$963.00M

2021

Revenue

Sacra estimates that Bolt generated about $27M in revenue in 2023, up 4% from $26M in 2022.

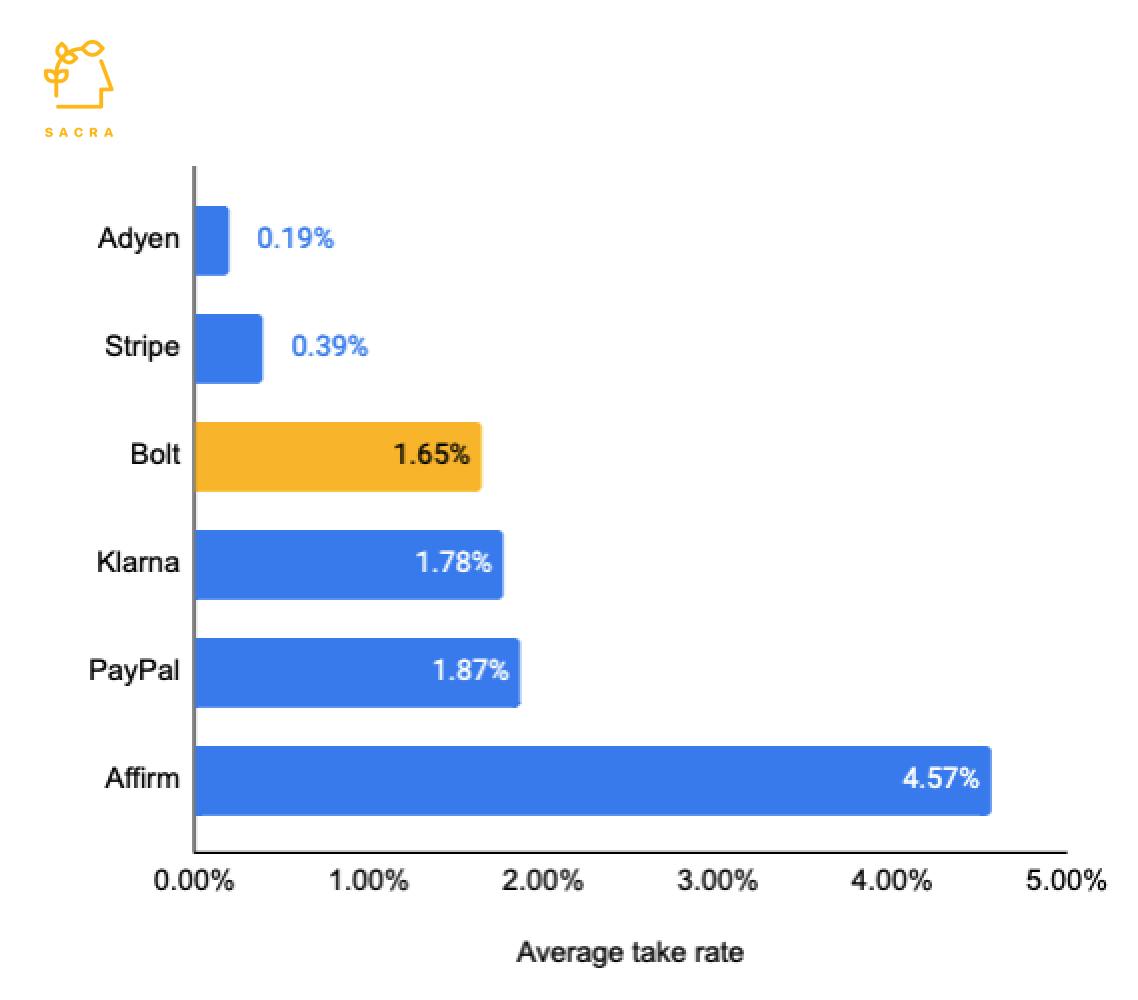

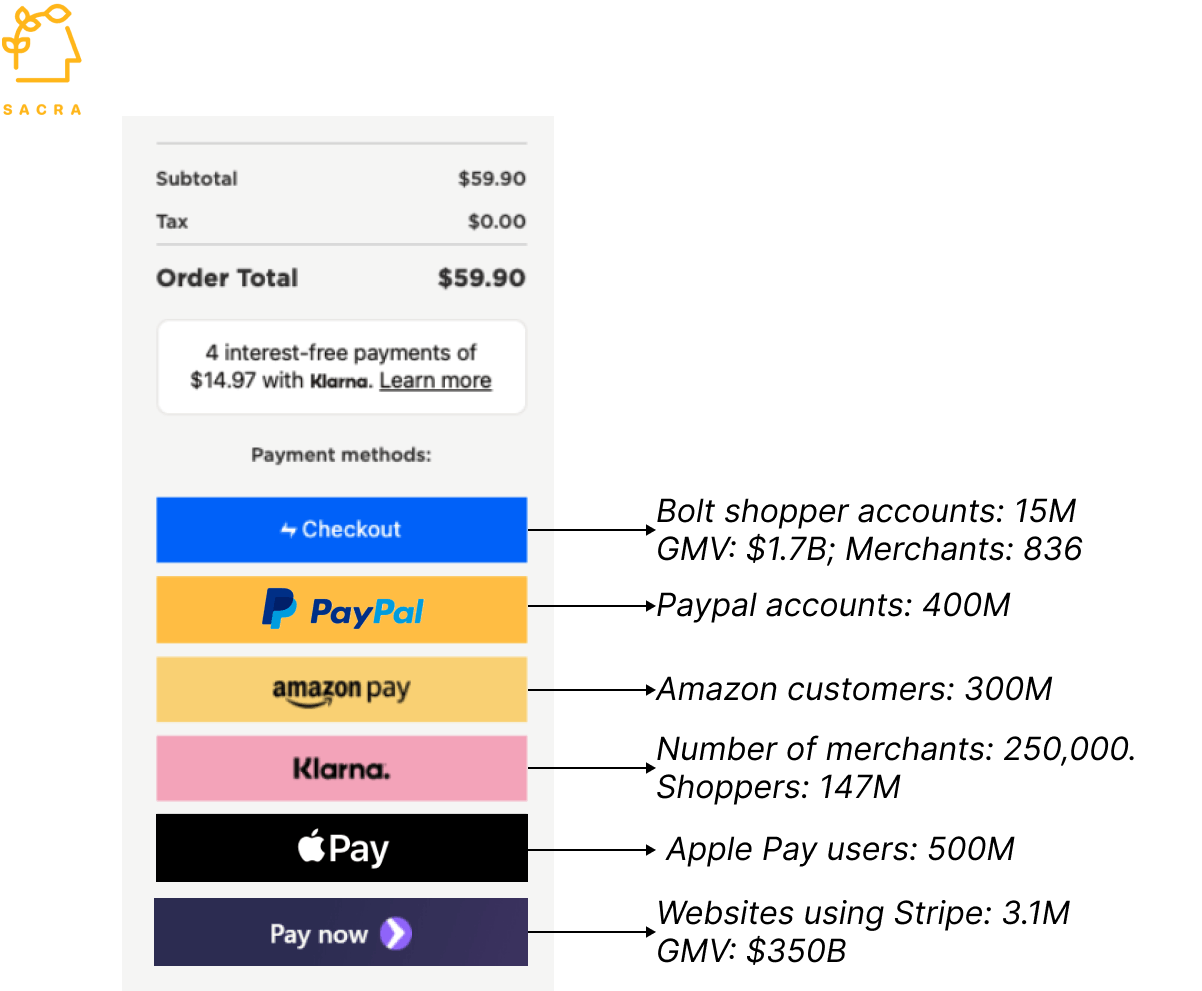

Bolt makes money by charging a cut from merchants on the transactions it processes and by selling other services such as fraud detection to them. Bolt’s average take rate of 1.6% is higher than Stripe (0.39%) and comparable to PayPal (1.87%).

Bolt's average take rate compared with other fintechs

Valuation

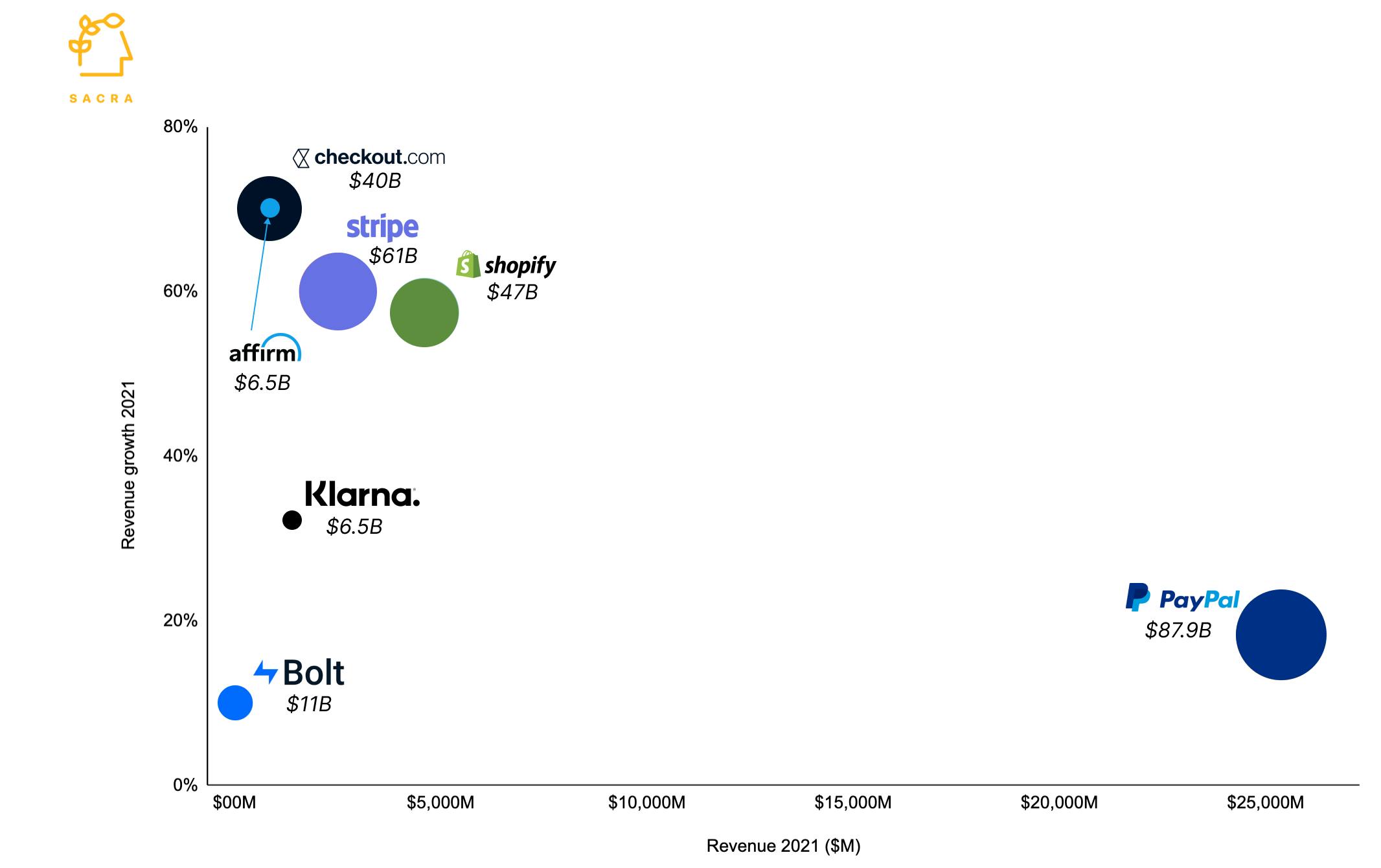

Valuation, revenue and growth rate as per publicly available information. Size of bubble indicates valuation.

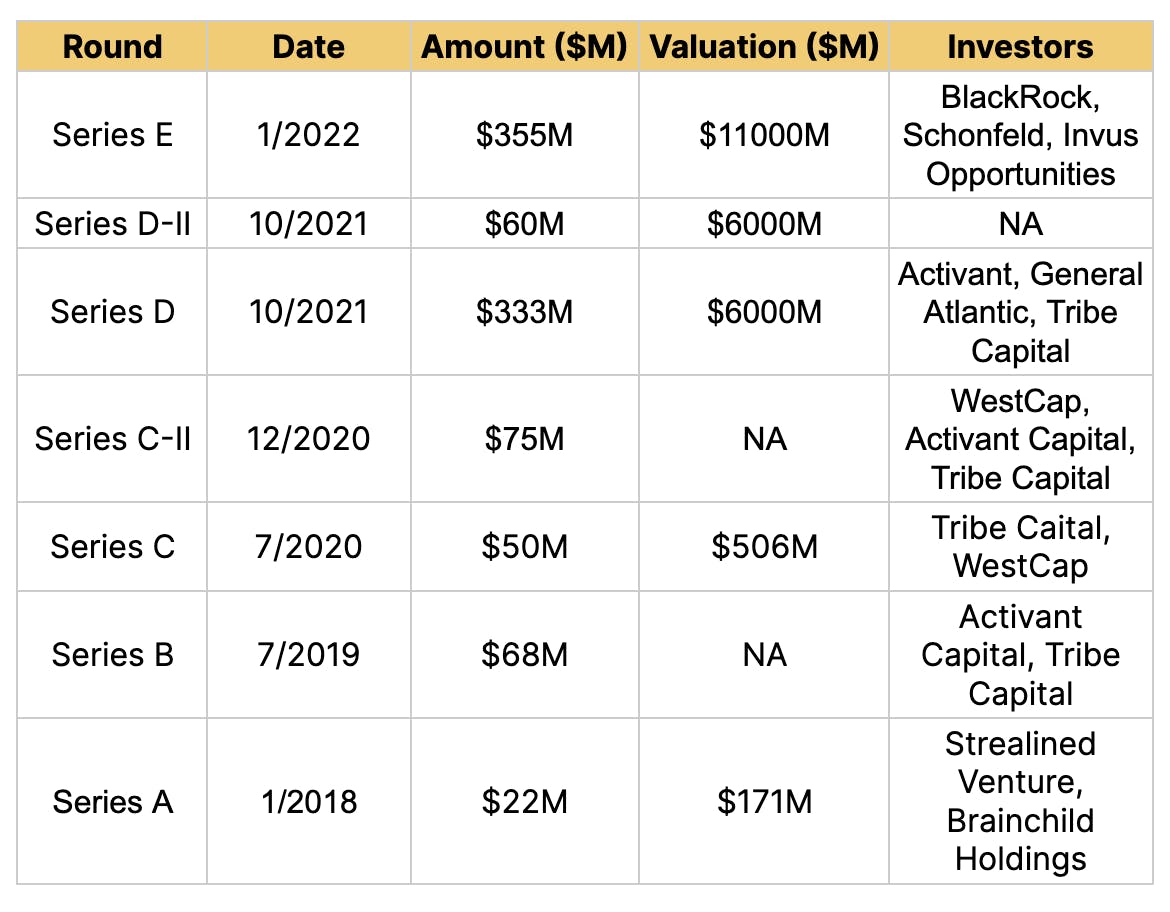

Bolt has raised $963M from investors like General Atlantic, Westcap, Activant Capital, and Tribe Capital. It was last valued at $11B for a valuation/revenue multiple of 392x. Almost all of Bolt’s competitors, private or public, have seen their valuation dip significantly in the last few months. For instance, Fidelity marked down Stripe’s valuation by 35% from a high of $95B. Similarly, PayPal and Affirm have lost 63% and 82% of their market cap, respectively. The valuation/revenue multiple is much lower for all of Bolt’s competitors with PayPal at 3.5x, Shopify at 10x, Stripe at 25x, and Checkout.com at 47x.

Business Model

Bolt signs up retailers to manage their checkout page. When shoppers make a purchase using Bolt’s checkout button, it stores their information and resurfaces it when they visit the same website or any other website that uses Bolt. It auto-fills their details and takes care of payment, discounts and tax calculations, reducing checkout friction for shoppers and retailers. Bolt charges retailers a percentage of the GMV of transactions it processes.

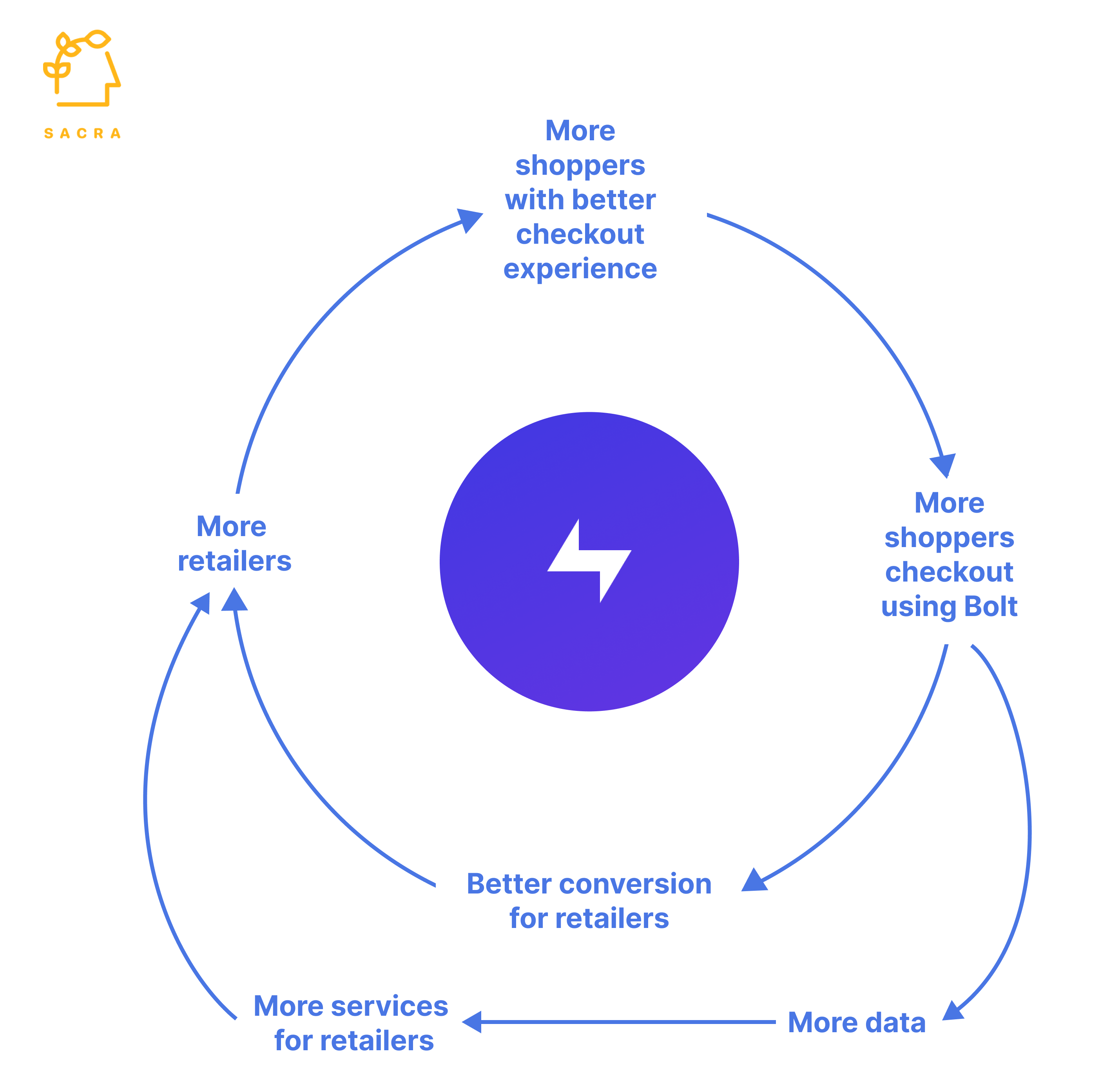

Bolt’s business model is based on two-sided network effects: a new shopper on Bolt is valuable for all its retailers, and a new retailer is valuable for its shoppers. Moreover, as Bolt processes more transactions, it becomes better at providing additional retailer services such as fraud mitigation. There’s some evidence of this network effect from Bolt, as 93% of their online retailers have had cross-network purchases with a conversion increase of 63%, and nearly 20% of all Bolt transactions are network-driven.

Eventually, Bolt wants to sign up a majority of the US shoppers so that from a checkout provider, it becomes the utility driving ecommerce transactions, much like how Google and Facebook have become utilities for signing up on websites.

Product

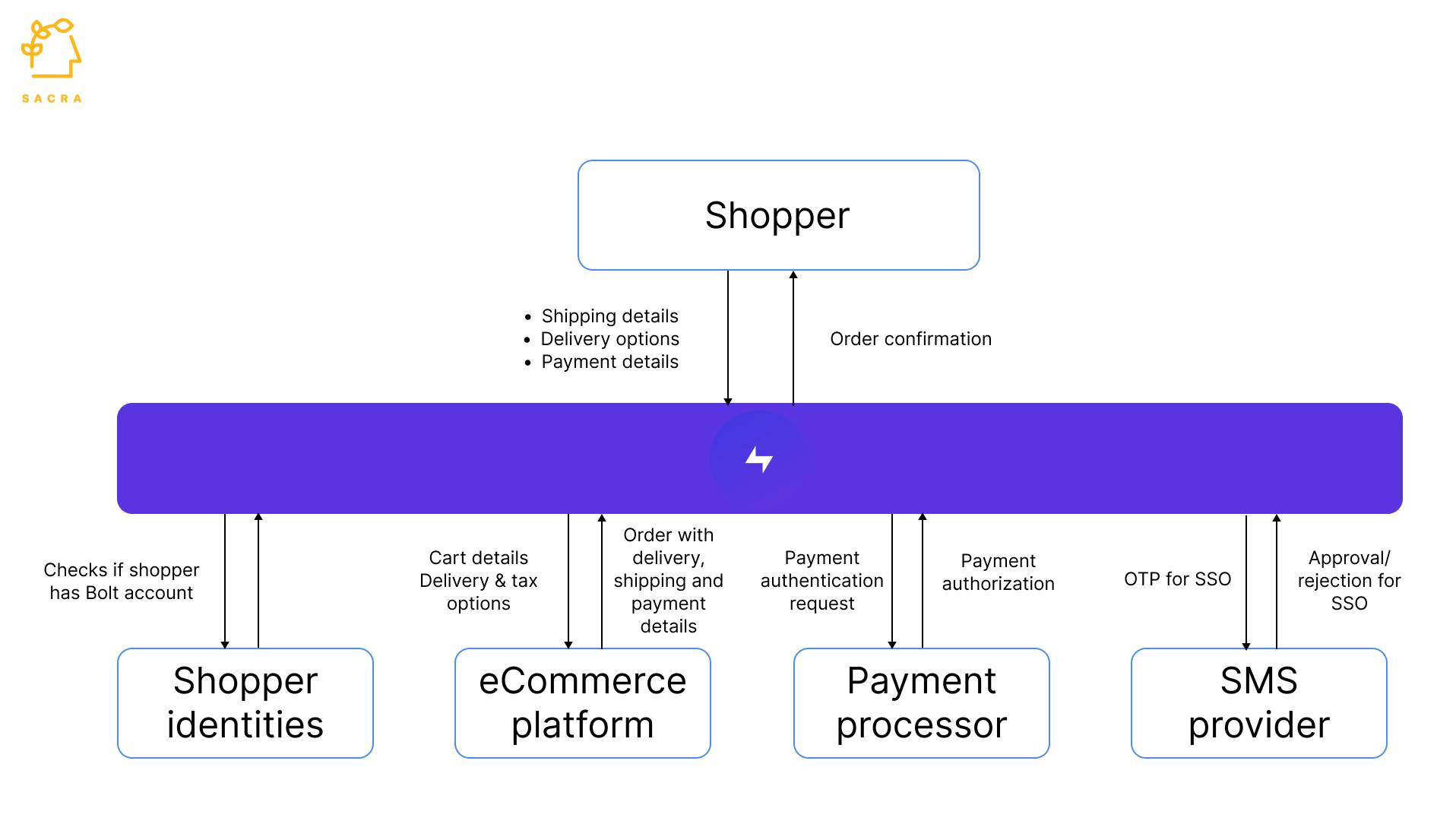

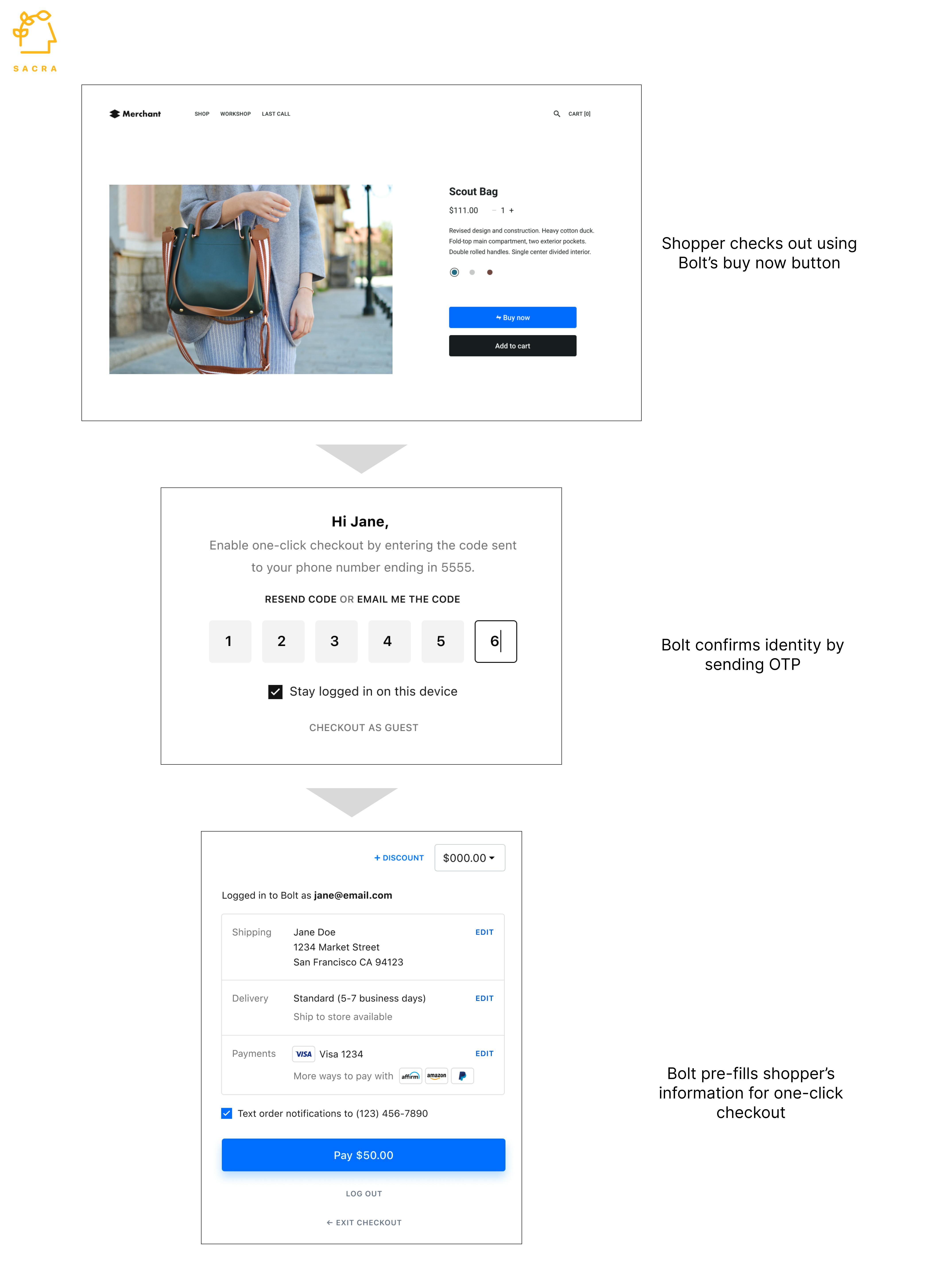

Bolt’s primary product is their wrapper around checkout that acts as a middleware between the shopping cart and downstream systems like payments. It taps into information from various systems at checkout such as shopper identities, payment gateway, payment service providers, and ecommerce platform to provide a one-click checkout experience to the shopper while enabling merchants to maintain control of the customer experience.

Bolt's one-click checkout flow

Competition

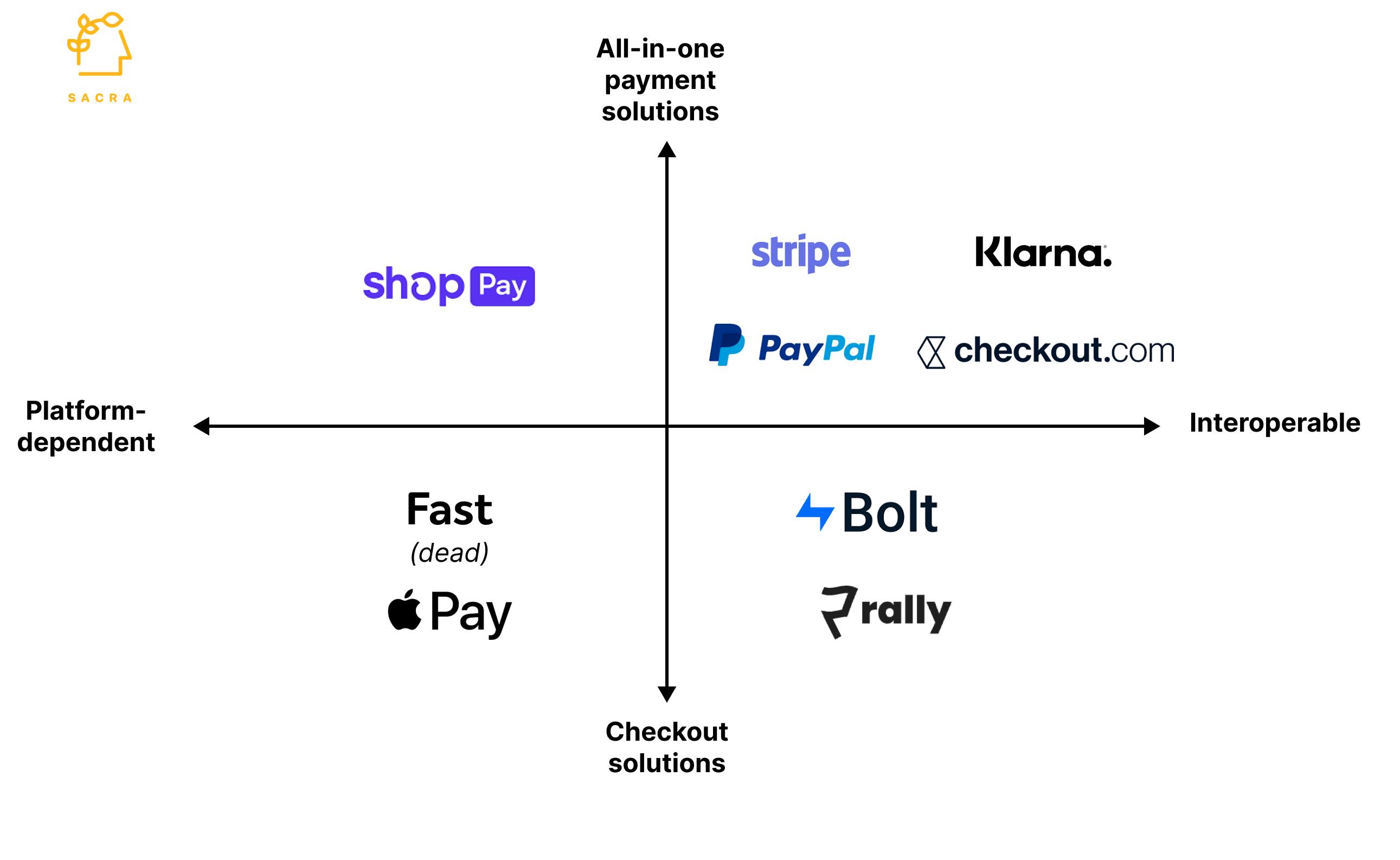

The checkout page has limited real estate for buttons, with retailers going for ones that reduce customer drop-offs and increase AOV. As checkout providers process more data, they become better at reducing drop-offs and scaling AOV with more shopper profiles, better fraud mitigation, and more backend integrations. Thus, scale is a moat. Bolt is coming from behind in this battle for the checkout button with numerous payment agrgregators, one-click checkout apps, and Buy-Now-Pay-Later fintechs having a larger scale.

Payment aggregators

Stripe and Checkout unbundled the shopping cart and checkout layers. Platforms like Shopify and BigCommerce that started as shopping carts have a good native shopping experience but a suboptimal checkout layer. Integrating numerous backend systems and collecting payment data through shopping cart platforms is particularly hard for SMBs without technical know-how or developers. Stripe uses its scale to move backward and take over the checkout layer. It makes setup easy with APIs/no-code tools and provides additional services such as fraud mitigation to reduce drop-offs/increase AOV. Currently, Stripe powers 41% of the top 65,000 ecommerce sites, more than any other checkout button.

One-click checkout

There are two types of one-click checkout buttons, closed ecosystem, and universal checkout.

Examples of a closed ecosystem are Apple Pay, available on Apple devices, and Shop Pay, which is available only on websites running Shopify. Both have large ecosystems, Apple Pay with 500M users and Shop Pay achieving 100M+ users quickly.

Amazon is the original leader in one-click checkout, and any retailer can add Amazon Pay to their website. Similarly, Bolt and Rally are building the universal one-click checkout button that can be used independently of the rest of the ecommerce stack.

Buy-Now-Pay-Later fintechs

BNPL apps like Klarna allow shoppers to split a large purchase into four equal payments without interest, signing them up at the checkout page. Once signed up, shoppers can checkout on other websites using one click. BNPL has a stronger value proposition than other one-click buttons, enabling customers to buy something they otherwise couldn’t and improving AOV and conversion rates for retailers. The largest BNPL fintech Klarna has over 147M shopper accounts today.

Checkout page of an ecommerce website

TAM expansion

Growth of headless commerce

Boltʼs indexed on a world where ecommerce brands build their modular stacks of point solutions instead of relying on a single platform as an end-to-end ecommerce solution, whether it is Shopify or Stripe. Boltʼs partnerships with BigCommerce, WooCommerce, and Magneto point to this focus. Bolt envisions a future where the extensibility and freedom of headless commerce win out over the convenience of building your entire ecommerce stack on Shopify. Headless technologies startups are showing momentum, with over $1.65B invested by VCs in 2020-21.

Value-added services to retailers

The bullish bet on Bolt is that it can move upwards from the checkout layer and leverage the data from its shoppers network to sell marketing, analytics, conversion, and engagement software into its enterprise customer base to build the Salesforce of headless commerce. Bolt is counting on two-sided network effects across its shopper base and retailers to scale its shopper base quickly and build new retailer tools on top of it.

Shopper portal

Shoppers are increasingly seeking personalized experiences integrating checkout, reward points, gift cards, and return/replacement. With 14M shopper accounts, Bolt has a place to build a portal where shoppers can track purchases, loyalty points, discounts, and offers across different retailers. Bolt can then use the behavioral data to build personalized checkout flows when they land on ecommerce websites.

Risks

Challenges in scaling-up

Bolt’s biggest risk today is reaching a critical mass of retailers without running out of money. Bolt’s business model hinges on acquiring retailers that bring millions of new shopper accounts to Bolt that it can take to other retailers to build network effects. However, Bolt's reputation is dented by the lawsuit from its largest customer, Authentic Brands Group. With Fast shutting down and Bolt having enough money only for three more years, the sustainability of universal one-click checkout companies is under a question mark. After all, no retailer wants to replace its core checkout layer every two years. Thus Bolt may find it difficult to sign-up retailers in reasonable time frames, putting a strain on the viability of its business model.

High valuation

Boltʼs last raise nearly doubled its valuation from $6 billion around the end of 2021, just as the Nasdaq 100 peaked. At $11 billion with about $28 million in ARR, that's a 392x multiple. Boltʼs high valuation has implications for new investors to generate a sizable return and Bolt's ability to recruit high-quality talent for whom Bolt may be too richly valued for any upside in their next job.

Fundraising

Funding Rounds

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.